Description: Philadelphia, Pennsylvania is a vibrant city situated in the northeastern region of the United States. With its rich history, diverse culture, and thriving economy, Philadelphia is a popular destination for tourists and a great place to live and work. The city serves as the economic and cultural hub of the state and boasts numerous attractions, universities, and historical landmarks. One important legal document often used in Philadelphia, Pennsylvania is the General Form of Assignment as Collateral for Note. This document plays a crucial role in financial transactions, particularly when a borrower uses an asset as collateral for a loan or note. The General Form of Assignment as Collateral for Note outlines the terms and conditions of the collateral agreement, protecting the interests of both the borrower and lender. This form of assignment can be utilized for various types of collateral in Philadelphia, Pennsylvania. Some examples of specific types of collateral that may be used in this arrangement include real estate properties, vehicles, inventory, accounts receivable, stocks, and bonds. The General Form of Assignment as Collateral for Note helps establish a legal framework to ensure that the collateral is protected and properly valued. In Philadelphia, Pennsylvania, individuals and businesses frequently engage in financial transactions that require collateral to secure loans or notes. Whether it is a small business owner using their inventory as collateral to obtain funding or an individual leveraging their property to secure a personal loan, the General Form of Assignment as Collateral for Note serves as a crucial legal instrument. By using relevant keywords such as Philadelphia Pennsylvania, General Form of Assignment, Collateral for Note, and different types of collateral, this content provides a comprehensive overview of the city's importance, the purpose of the General Form of Assignment, and the diverse assets that can be used as collateral in Philadelphia.

Philadelphia Pennsylvania General Form of Assignment as Collateral for Note

Description

How to fill out Philadelphia Pennsylvania General Form Of Assignment As Collateral For Note?

If you need to find a reliable legal document supplier to find the Philadelphia General Form of Assignment as Collateral for Note, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it simple to find and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Philadelphia General Form of Assignment as Collateral for Note, either by a keyword or by the state/county the form is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

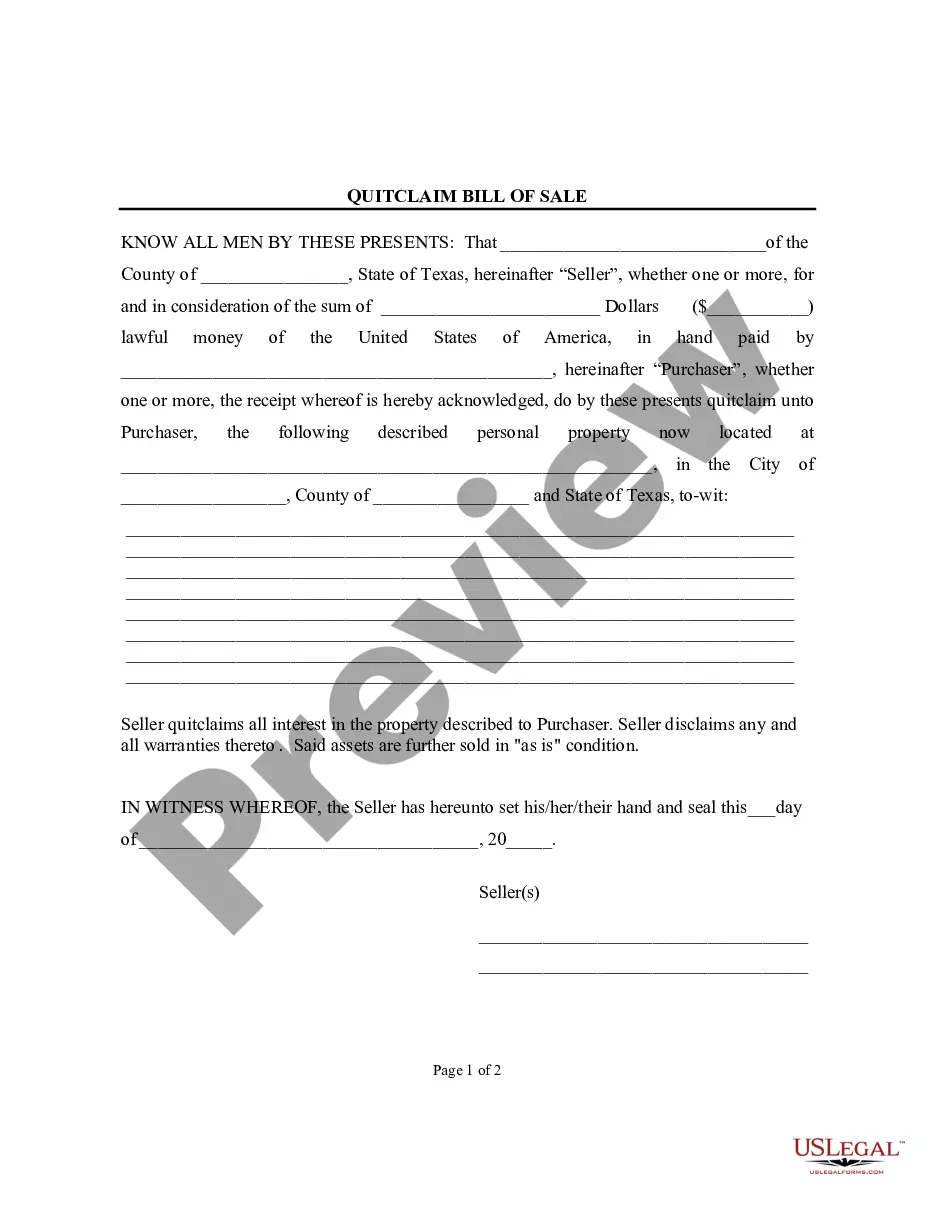

Don't have an account? It's simple to start! Simply locate the Philadelphia General Form of Assignment as Collateral for Note template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Philadelphia General Form of Assignment as Collateral for Note - all from the comfort of your sofa.

Sign up for US Legal Forms now!