The Limited Liability Partnership (LLP) is an alternative to the limited liability company (LLC). As with the limited liability company, the limited liability partnership provides a method of insulating partners from personal liability for acts of other partners.

A limited liability partnership is a general partnership that elects to be treated as an LLP by registering with the Secretary of State. Many attorneys and accountants choose the LLP structure since it shields the partners from vicarious liability, can operate more informally and flexibly than a corporation, and is accorded full partnership tax treatment. In a general partnership, individual partners are liable for the partnership's debts and obligations whereas the partners in a limited liability partnership are statutorily provided full-shield protection from partnership liabilities, debts and obligations. It allows the members of the LLP to take an active role in the business of the partnership, without exposing them to personal liability for others' acts except to the extent of their investment in the LLP. Many law and accounting firms now operate as LLPs. In some states, with certain exceptions, the LLP is only available to attorneys and accountants.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

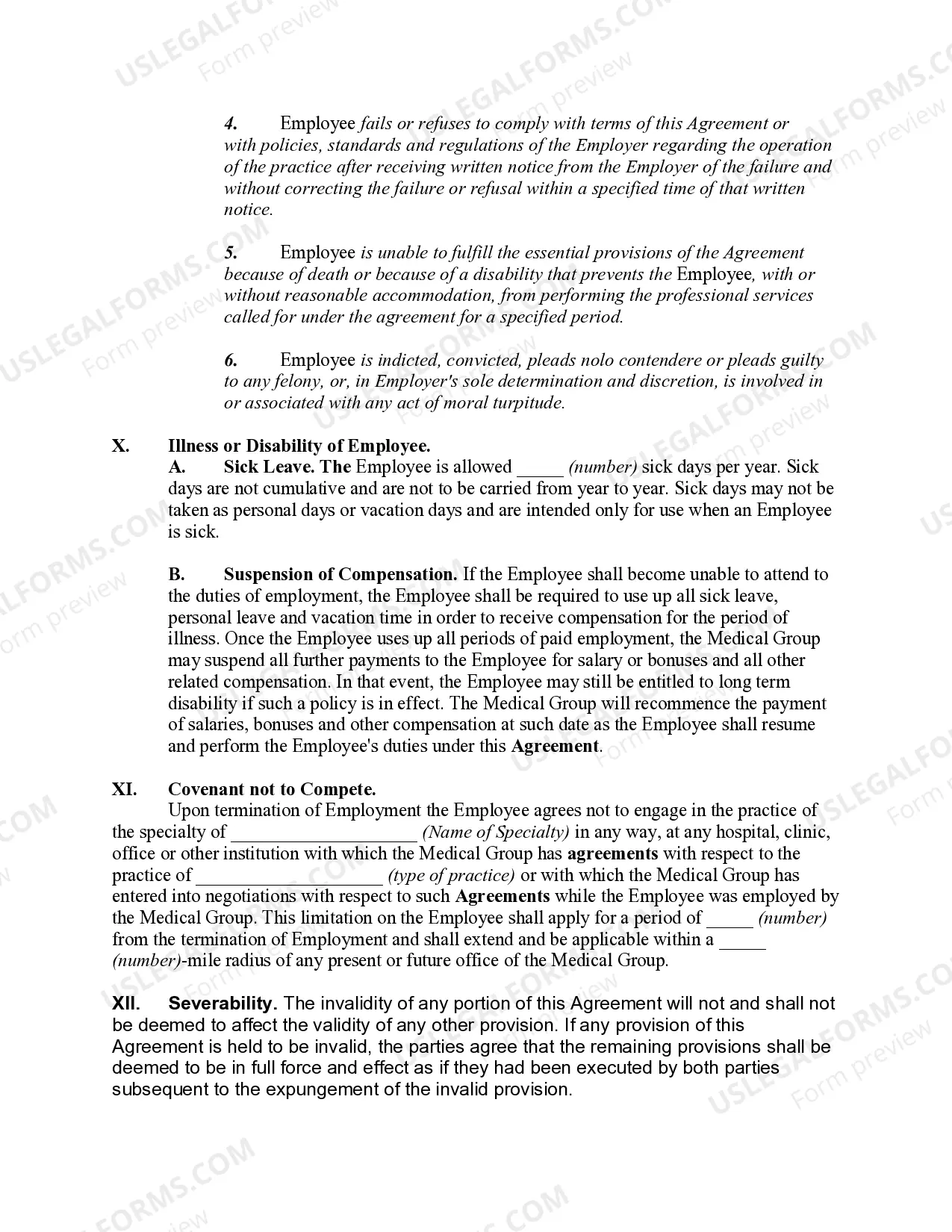

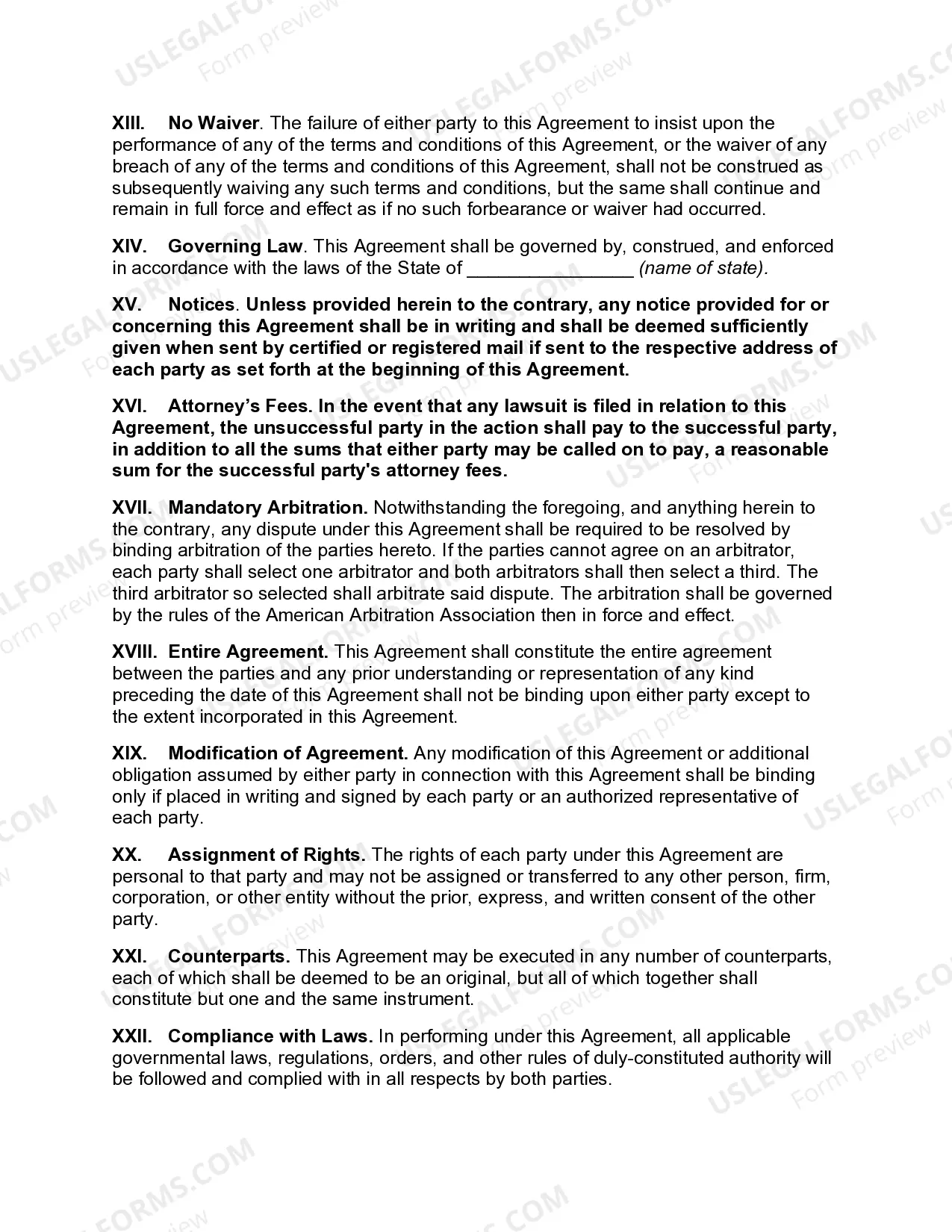

San Diego California Employment Agreement and Non-Competition Agreement between Physician and Medical Practice Providing Services as a Limited Liability Partnership is a legally binding contract that outlines the terms and conditions of employment for physicians in the healthcare industry in San Diego, California. This agreement is designed to protect the interests of both parties involved and ensure a smooth working relationship. The San Diego California Employment Agreement covers various aspects such as job responsibilities, work schedule, compensation, benefits, and termination clauses. It details the physician's role, including their specialized duties and any additional responsibilities they may need to fulfill. The agreement also provides clarity on the working hours, whether full-time or part-time, and the corresponding salary or payment structure. Compensation aspects within the agreement can include base salary, bonuses, incentives, and benefits such as health insurance, retirement plans, and paid time off. It may also address reimbursement for travel expenses or continuing education programs that are relevant to the physician's job. The Non-Competition Agreement, included as part of the employment agreement, restricts the physician from joining or starting a competing medical practice in a specific geographic region and within a defined time frame, typically after the termination of employment. This clause aims to protect the medical practice's patient base, trade secrets, confidential information, and competitive advantage. Different types of San Diego California Employment Agreement and Non-Competition Agreement between Physician and Medical Practice Providing Services as a Limited Liability Partnership may include: 1. Full-time Employment Agreement: This agreement is applicable when a physician is hired for full-time employment, typically working 40 hours or more per week. 2. Part-time Employment Agreement: In cases where a physician is hired to work less than full-time hours, a part-time agreement is used. It outlines the specific work schedule and salary or payment structure adjusted accordingly. 3. Independent Contractor Agreement: This type of agreement may be used when the physician is engaged as an independent contractor rather than an employee. It includes provisions specific to the contractor relationship, such as payment terms and allowances for flexibility in working arrangements. 4. Associate Agreement: An associate agreement is commonly used when a physician is joining an established medical practice as an associate, with the potential for partnership or ownership in the future. It may include provisions related to partnership track, buy-in options, and other relevant details. It is worth noting that the content and provisions of these agreements may vary depending on the specific needs and requirements of the physician and the medical practice providing services as a limited liability partnership. Furthermore, it is crucial for both parties to seek legal counsel to ensure their rights and interests are adequately protected.San Diego California Employment Agreement and Non-Competition Agreement between Physician and Medical Practice Providing Services as a Limited Liability Partnership is a legally binding contract that outlines the terms and conditions of employment for physicians in the healthcare industry in San Diego, California. This agreement is designed to protect the interests of both parties involved and ensure a smooth working relationship. The San Diego California Employment Agreement covers various aspects such as job responsibilities, work schedule, compensation, benefits, and termination clauses. It details the physician's role, including their specialized duties and any additional responsibilities they may need to fulfill. The agreement also provides clarity on the working hours, whether full-time or part-time, and the corresponding salary or payment structure. Compensation aspects within the agreement can include base salary, bonuses, incentives, and benefits such as health insurance, retirement plans, and paid time off. It may also address reimbursement for travel expenses or continuing education programs that are relevant to the physician's job. The Non-Competition Agreement, included as part of the employment agreement, restricts the physician from joining or starting a competing medical practice in a specific geographic region and within a defined time frame, typically after the termination of employment. This clause aims to protect the medical practice's patient base, trade secrets, confidential information, and competitive advantage. Different types of San Diego California Employment Agreement and Non-Competition Agreement between Physician and Medical Practice Providing Services as a Limited Liability Partnership may include: 1. Full-time Employment Agreement: This agreement is applicable when a physician is hired for full-time employment, typically working 40 hours or more per week. 2. Part-time Employment Agreement: In cases where a physician is hired to work less than full-time hours, a part-time agreement is used. It outlines the specific work schedule and salary or payment structure adjusted accordingly. 3. Independent Contractor Agreement: This type of agreement may be used when the physician is engaged as an independent contractor rather than an employee. It includes provisions specific to the contractor relationship, such as payment terms and allowances for flexibility in working arrangements. 4. Associate Agreement: An associate agreement is commonly used when a physician is joining an established medical practice as an associate, with the potential for partnership or ownership in the future. It may include provisions related to partnership track, buy-in options, and other relevant details. It is worth noting that the content and provisions of these agreements may vary depending on the specific needs and requirements of the physician and the medical practice providing services as a limited liability partnership. Furthermore, it is crucial for both parties to seek legal counsel to ensure their rights and interests are adequately protected.