The King Washington Assignment of Bank Account is a legal document that allows an individual or entity to transfer their rights and ownership of a bank account to another party. This assignment is commonly used in financial and business transactions such as mergers, acquisitions, or loans. When completing a King Washington Assignment of Bank Account, several important details need to be included. The document should clearly identify the parties involved, including the assignor (the current account holder) and the assignee (the individual or entity acquiring the account). The specific bank account details should also be outlined, including the bank name, account number, and any relevant account information. Additionally, the purpose or reason for the assignment should be explained in detail. This could include providing collateral for a loan, transferring ownership of funds, or consolidating accounts. It is crucial to provide a comprehensive explanation to ensure legal clarity and avoid any disputes or misunderstandings in the future. Furthermore, the King Washington Assignment of Bank Account should clearly state the effective date of the assignment. This is the date when the transfer of ownership and rights takes effect. Parties may also include any specific conditions or terms that must be met for the assignment to be valid and enforceable. It is important to note that there are no known different types of the King Washington Assignment of Bank Account. However, variations may exist in terms of specific provisions, conditions, or legal requirements based on individual jurisdictions or financial institutions. Therefore, it is recommended to consult with legal experts or a specialized attorney to ensure compliance with local laws and regulations when executing such an assignment. In conclusion, the King Washington Assignment of Bank Account is a legal instrument that facilitates the transfer of rights and ownership of a bank account from one party to another. By accurately and comprehensively completing this assignment, individuals or entities can ensure a smooth and legally binding transition of assets.

King Washington Assignment of Bank Account

Description

How to fill out King Washington Assignment Of Bank Account?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the King Assignment of Bank Account, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the King Assignment of Bank Account from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the King Assignment of Bank Account:

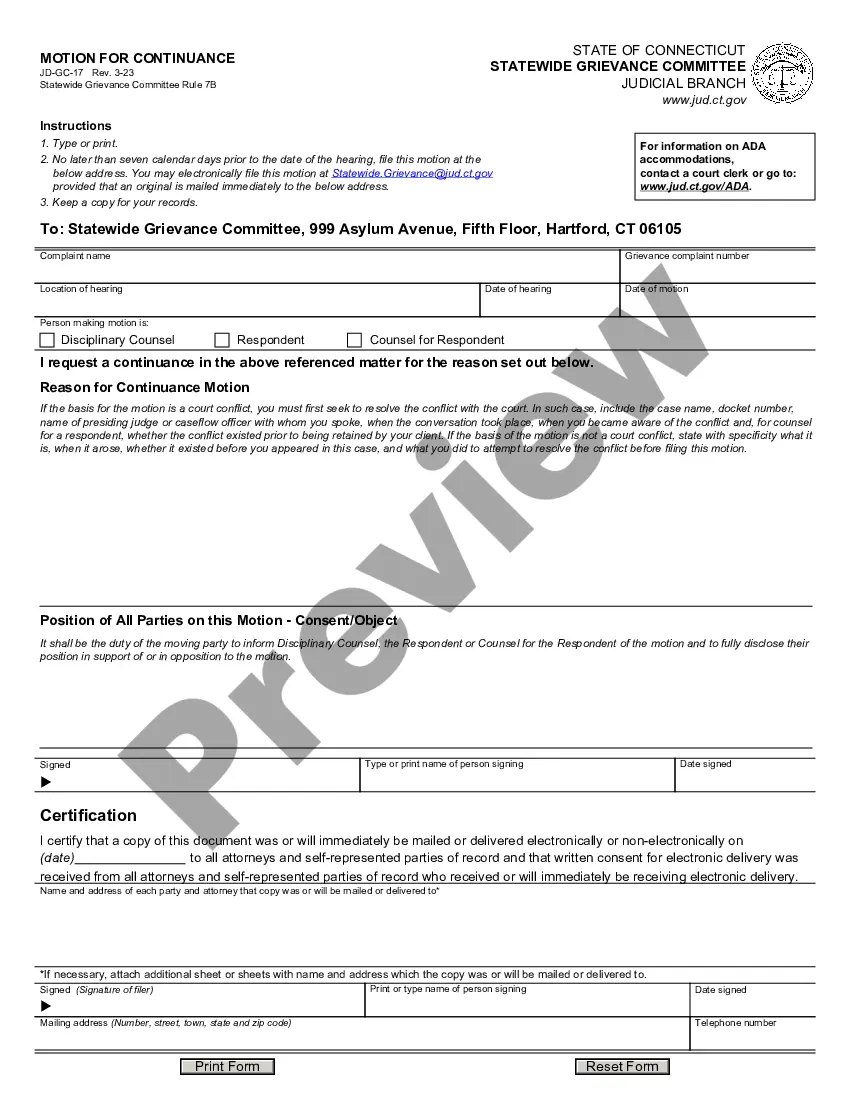

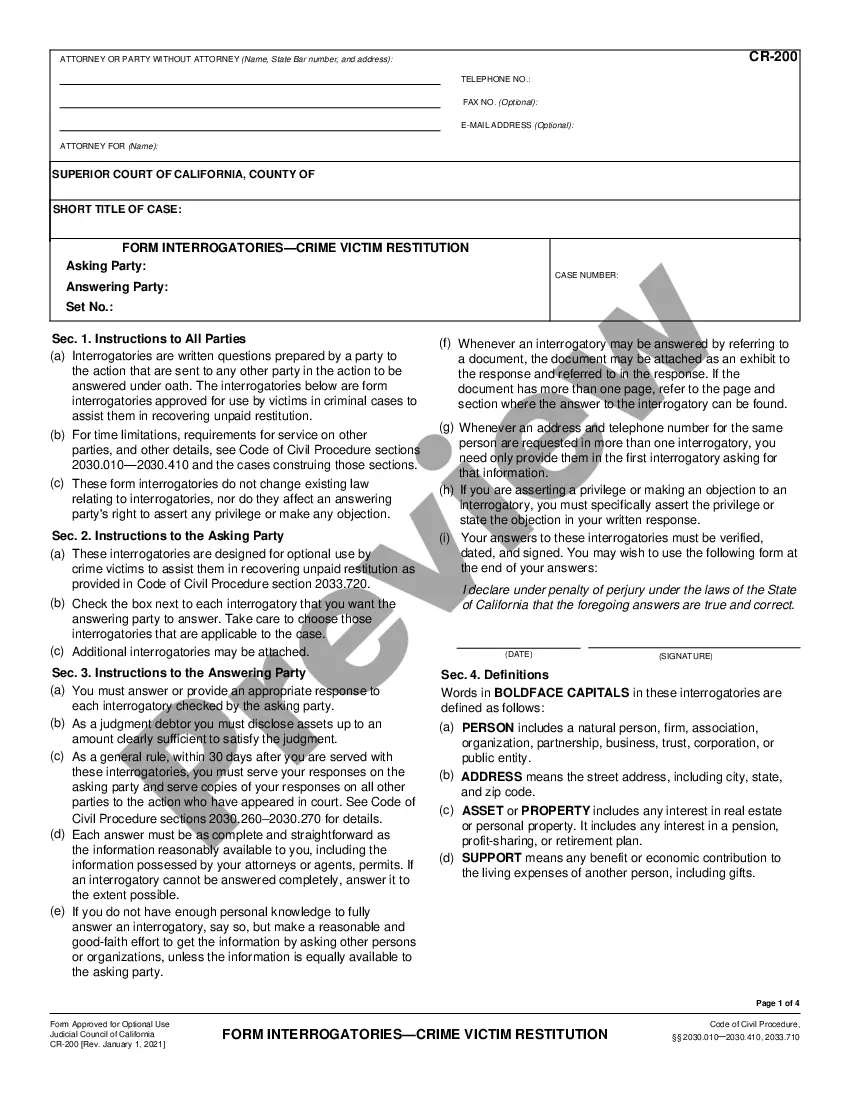

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

An assignable letter of credit can be assigned to a third party by the beneficiary of the credit. When the buyer is not able to find the real exporter, in the meantime, he opens the credit in favor of his agent or representative.

They do. And it's not just Bank of America. Most major banks recycle customers' checking account numbers. They say there aren't enough new numbers to go around and it would be too expensive to add extra digits.

Banks don't generally require or usually even request holders of checking accounts to name a beneficiary. As a result, many checking accounts and savings accounts may not have a beneficiary. However, there are good reasons to consider naming a bank account beneficiary, and the process is fairly simple.

What Is an Assignment of Proceeds? An assignment of proceeds occurs when a beneficiary transfers all or part of the proceeds from a letter of credit to a third-party beneficiary.

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, etc. to another entity through a written agreement. For example, a payee assigns rights for collecting note payments to a bank.

Assigned Bank Account shall be any account of the Company held at any of the Lenders, or another bank which has signed a Deposit Account Control Agreement, and which account is subject to a perfected first priority lien in favor of the Agent.

An assignment of letter of credit proceeds is an assignment (or transfer) of future debt payable under a letter of credit from the beneficiary to another person (ie, the assignee). It enables the assignee, instead of the beneficiary, to receive payment under the letter of credit.

A type of secured transaction whereby an account receivable is pledged to a bank, factor, or other lender to secure the repayment of a loan.

An assignee is a person or a company that buys your loan. For example, an auto dealer that extends credit to individuals may sell their loans to a bank. In this case, the bank is the assignee and the auto dealer is the assignor. If your loan has been sold, you owe money to whoever owns your loan.