A Dallas Texas Assignment Creditor's Claim Against Estate refers to a legal process that occurs when a creditor files a claim against an estate to recover debts owed to them by the deceased individual. This claim can arise from various types of outstanding debts, such as credit card bills, mortgages, medical bills, or personal loans. When someone passes away, their assets and liabilities are typically resolved through a legal procedure known as probate. In Dallas, Texas, the probate process involves multiple steps that ensure the deceased's debts are paid off before their remaining assets are distributed among the beneficiaries or heirs. The assignment creditor's claim against the estate is one of the crucial aspects of this process. It allows creditors to assert their rights and seek repayment from the deceased person's estate. There are several types of claims that can be filed as part of an assignment creditor's claim against the estate in Dallas, Texas. These may include: 1. Secured Claims: These are debts that are backed by collateral, such as a mortgage on a property or a car loan. In the event of default, the creditor can claim the specific asset securing the debt. 2. Unsecured Claims: Unlike secured claims, these debts are not supported by specific collateral. They typically include credit card debts, medical bills, personal loans, and other forms of consumer debt. 3. Priority Claims: These claims have higher precedence over other unsecured claims due to their specific nature. Examples include unpaid taxes, child support arrears, and certain types of government debts. 4. Contingent Claims: These claims are uncertain in nature and are dependent on some future event. For instance, a pending lawsuit against the deceased person can result in a contingent claim. In Dallas, Texas, creditors must carefully follow the probate process to file a valid assignment creditor's claim against the estate. They must adhere to specific timelines and provide supporting documentation for their claim. The probate court will review these claims, and if validated, the estate's assets will be used to satisfy the debts owed. It is essential for creditors to consult with an attorney experienced in probate and estate law in Dallas, Texas, to navigate the assignment creditor's claim process smoothly. This legal professional can guide them through the necessary documentation, deadlines, and legal procedures to increase the chances of a successful claim. Ultimately, obtaining legal representation can help creditors recover the debts owed to them by the deceased individual's estate in Dallas, Texas.

Dallas Texas Assignment Creditor's Claim Against Estate

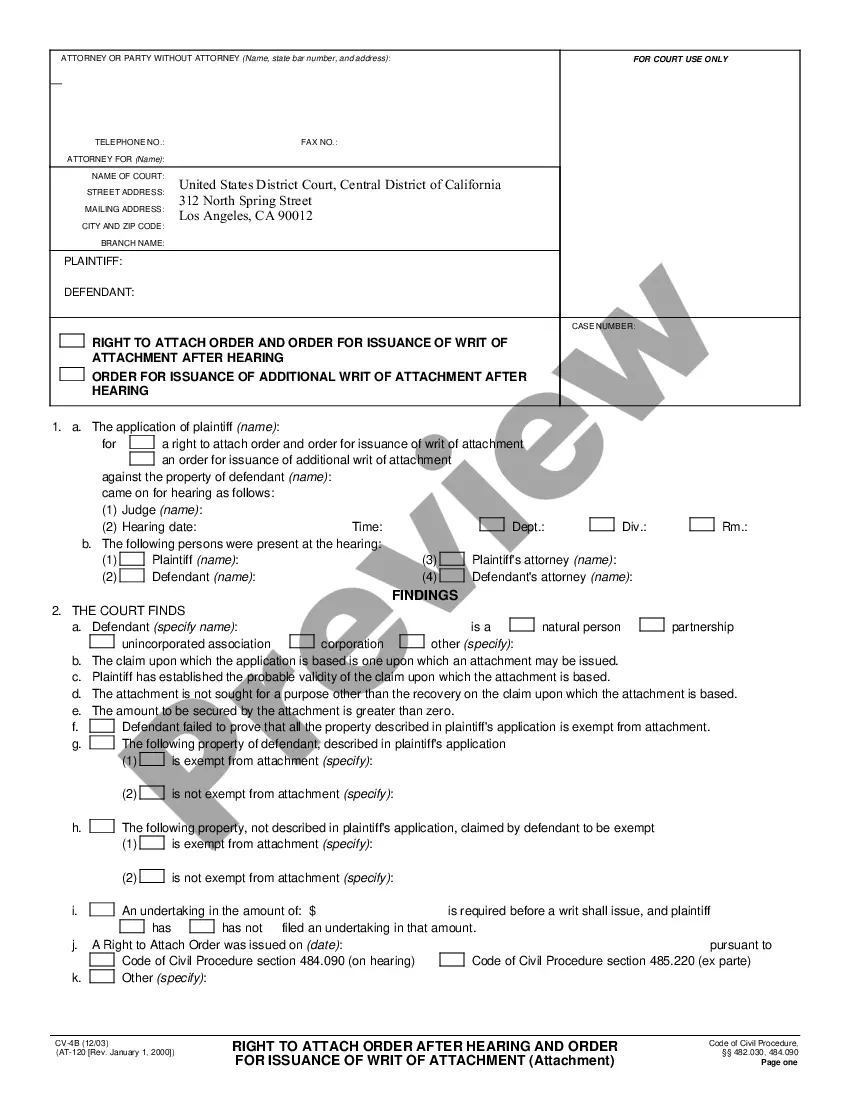

Description

How to fill out Dallas Texas Assignment Creditor's Claim Against Estate?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Dallas Assignment Creditor's Claim Against Estate is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Dallas Assignment Creditor's Claim Against Estate. Follow the guide below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Assignment Creditor's Claim Against Estate in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!