Sample Letter for Revised Promissory Note in Wake, North Carolina: Understanding the Basics, Types, and Key Elements A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In some cases, revisions may be required to modify specific terms or address changes in circumstances. This article will delve into the details of Wake, North Carolina's sample letter for a revised promissory note, highlighting its different types and essential components. Types of Wake, North Carolina Sample Letters for Revised Promissory Notes: 1. Modification Request Letter: This type of letter is typically written by the borrower to request changes in the promissory note. It should clearly state the reasons for the modifications and propose the revised terms that align with the borrower's new circumstances. 2. Consent to Amendment Letter: This letter is prepared by the lender to grant consent to the borrower's requested amendments. It documents the lender's agreement to modify specific terms of the original promissory note and sets forth the revised provisions. Key Elements to Include in Wake, North Carolina Sample Letters for Revised Promissory Notes: 1. Date and Parties' Information: Begin the letter by mentioning the current date and providing the accurate details of both the borrower and lender, including their legal names, addresses, contact numbers, and email addresses. 2. Original Loan Details: Clearly state the original loan details, including the loan amount, interest rate, repayment period or schedule, and any other relevant terms from the original promissory note. 3. Explanation of Requested Changes: Elaborate on the reasons why revisions are necessary, such as changes in financial circumstances, delays in payment, or adjustments to the interest rate structure. Provide a thorough explanation of each modification and its impact on the overall loan agreement. 4. Revised Terms: Propose the revised terms and conditions that should be incorporated into the promissory note. These may include altering the interest rate, repayment schedule, payment amount, due dates, and any other relevant provisions. 5. Confirmation Statements: Include statements to confirm that the other terms of the original promissory note remain unchanged, apart from the specifically requested modifications. This reaffirms the original intentions of both parties. 6. Signature and Notarization: Ensure both the borrower and lender sign and date the letter. It is crucial to have the signature notarized to authenticate the document's validity and enforceability in legal proceedings. Conclusion: When seeking modifications to a promissory note in Wake, North Carolina, utilizing a sample letter for a revised promissory note can help streamline the process. Whether you are drafting a modification request letter or a consent to amendment letter, make sure to include the essential elements such as the parties' information, original loan details, requested changes, revised terms, confirmation statements, and proper signatures. By adhering to these guidelines, you can maintain transparency, clarity, and effectiveness throughout the process of revising a promissory note in Wake, North Carolina.

Wake North Carolina Sample Letter for Revised Promissory Note

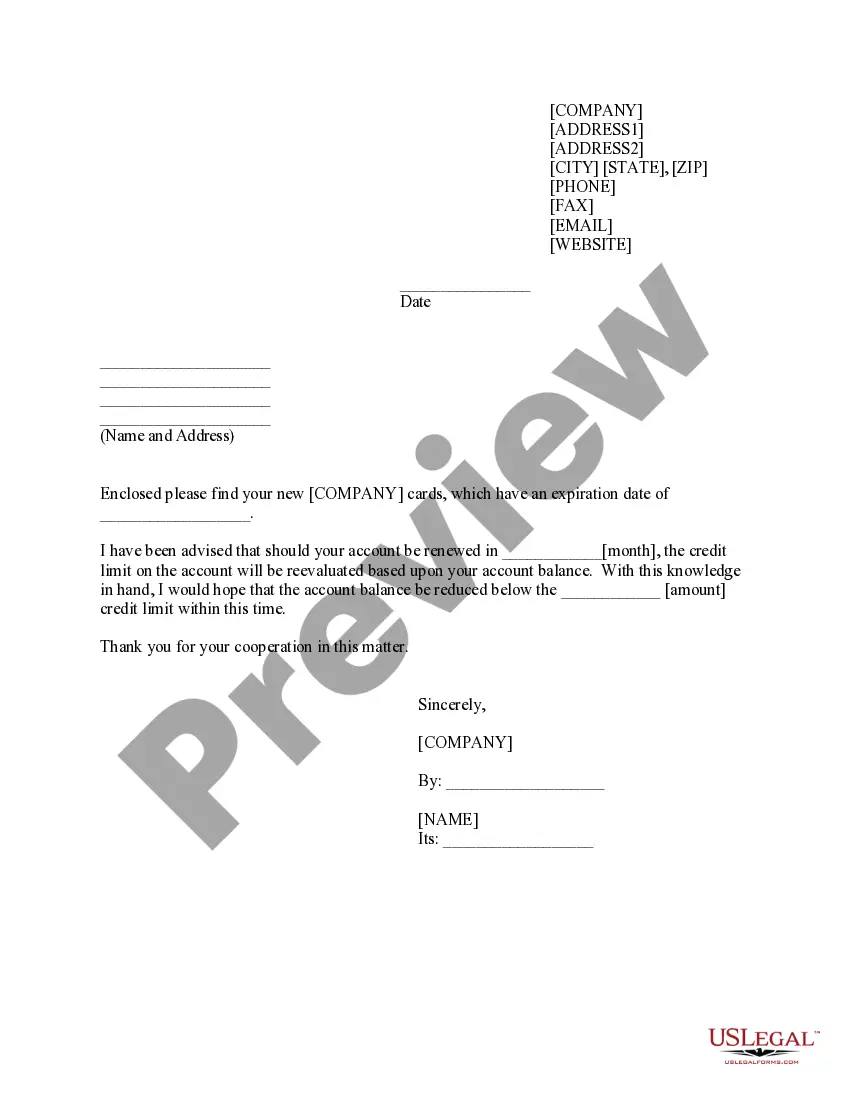

Description

How to fill out Wake North Carolina Sample Letter For Revised Promissory Note?

Preparing paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Wake Sample Letter for Revised Promissory Note without expert assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Wake Sample Letter for Revised Promissory Note on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Wake Sample Letter for Revised Promissory Note:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!