Allegheny Pennsylvania Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren is a legal document that allows individuals residing in Allegheny, Pennsylvania, to establish a trust to safeguard their assets for the financial security and well-being of their spouse, children, and grandchildren. This type of trust is designed to provide long-term protection and can have various subtypes depending on specific needs and circumstances. 1. Allegheny Pennsylvania Irrevocable Trust Agreement for the Benefit of Spouse: This subtype focuses on providing financial security to the surviving spouse after the granter's passing. It ensures that the surviving spouse has access to income and assets from the trust while preserving the principal for the children and grandchildren. 2. Allegheny Pennsylvania Irrevocable Trust Agreement for the Benefit of Children and Grandchildren: This variation concentrates on preserving and managing wealth for the children and grandchildren. It safeguards assets from potential creditors, taxation, and mismanagement while allowing distribution or access to income as specified in the trust agreement. 3. Allegheny Pennsylvania Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren: This comprehensive version encompasses the financial well-being of the entire family. It provides for the surviving spouse during their lifetime, ensures support and asset distribution to children, and secures a portion of the trust for the future generations (grandchildren). An Allegheny Pennsylvania Irrevocable Trust Agreement helps individuals protect and manage their assets while facilitating seamless wealth transfer to their loved ones. By legally binding the terms of trust and appointing a trustee responsible for managing the trust assets, individuals can have peace of mind knowing their family's financial future is secure. Allegheny Pennsylvania, being home to numerous families seeking asset protection and succession planning, encourages the use of irrevocable trusts. These trust agreements help minimize estate taxes, protect assets from potential lawsuits or creditors, and provide a structured plan for wealth distribution. Whether individuals choose to establish a trust for the benefit of their spouse, children, or grandchildren, or opt for a comprehensive agreement encompassing all, the Allegheny Pennsylvania Irrevocable Trust Agreement offers a powerful tool to safeguard their family's financial future, promote family harmony, and preserve wealth for generations to come.

Allegheny Pennsylvania Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description

How to fill out Allegheny Pennsylvania Irrevocable Trust Agreement For The Benefit Of Spouse, Children And Grandchildren?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Allegheny Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Allegheny Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Allegheny Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren:

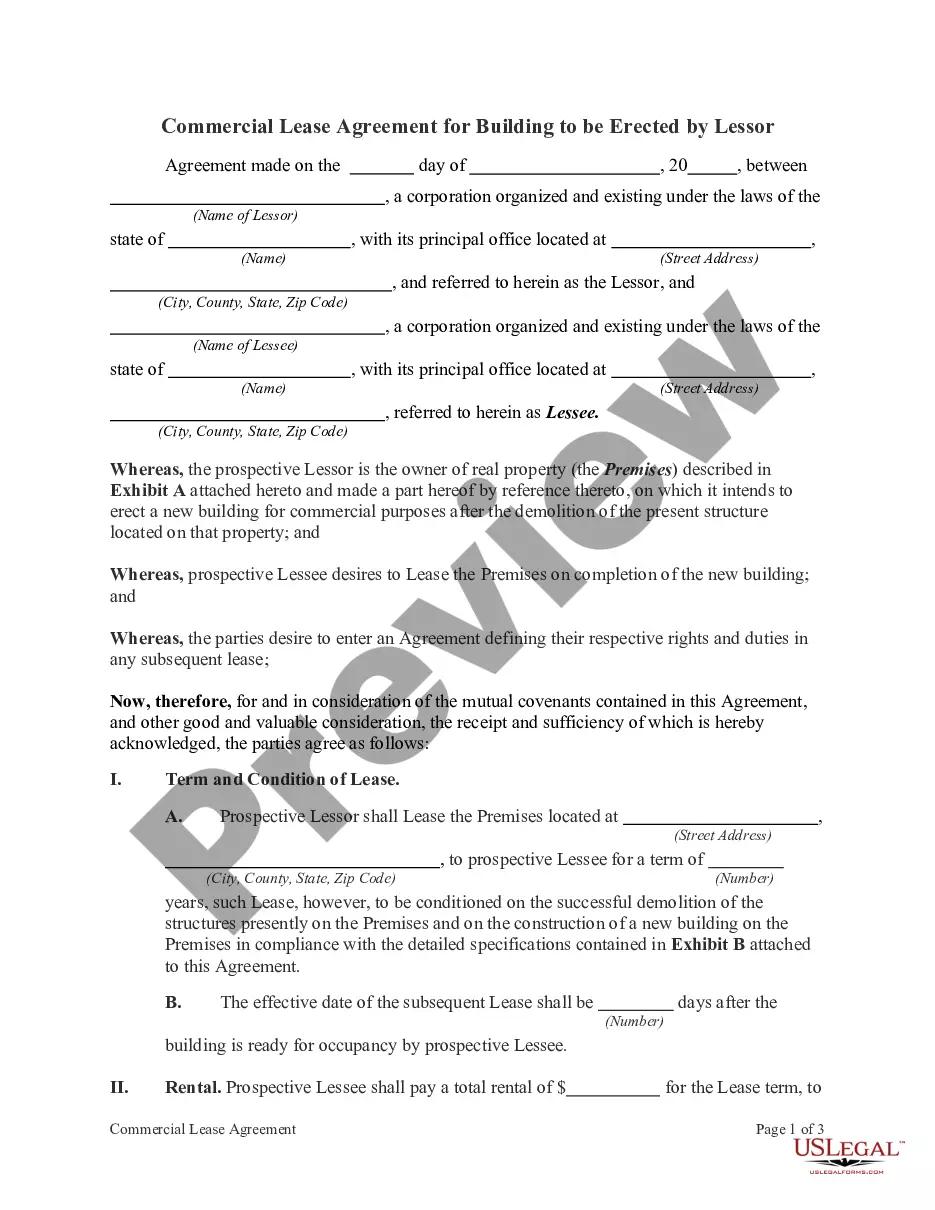

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!