A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

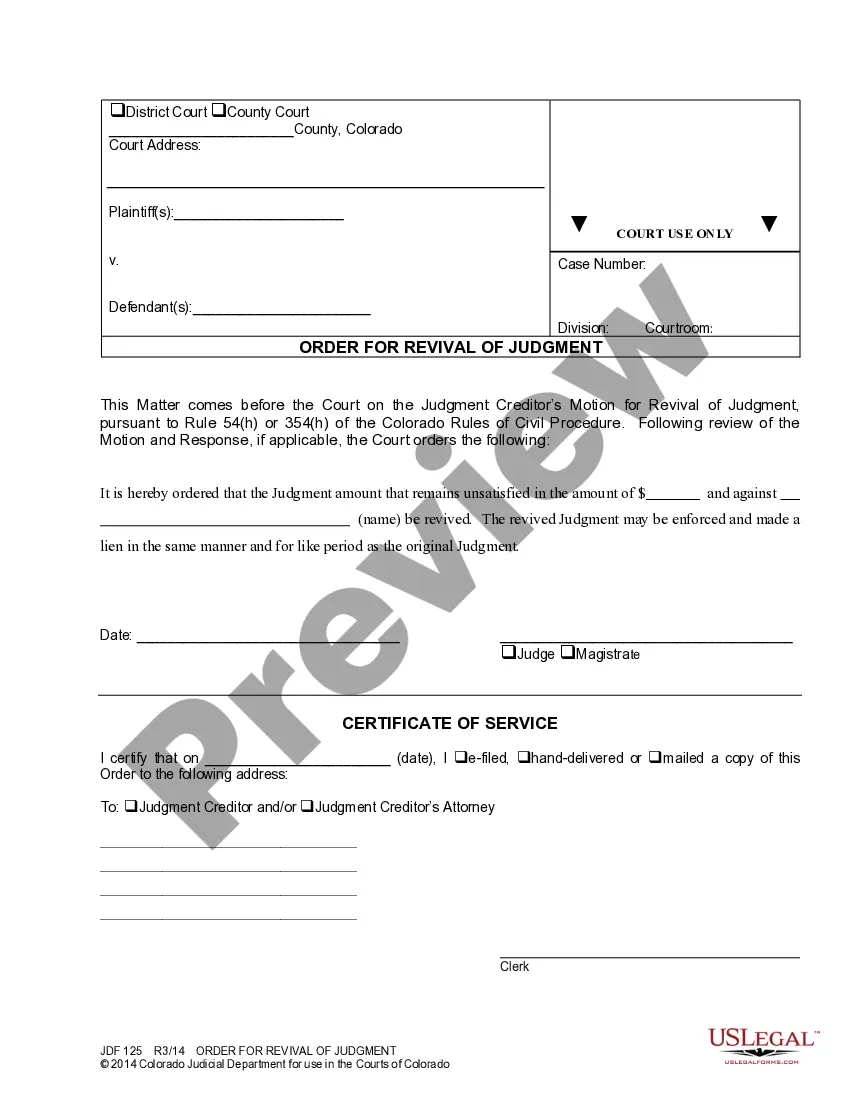

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Bexar Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legal document designed to protect and manage assets for the benefit of beneficiaries in Bexar County, Texas. This trust agreement is irrevocable, meaning it cannot be changed or modified once it is established, providing stability and long-term planning for the designated beneficiaries. The primary purpose of this trust agreement is to ensure that the assets placed in the trust are preserved and distributed according to the granter's wishes, even after their passing. By creating this trust, individuals can safeguard their wealth while providing financial security to their spouse, children, and grandchildren. There are various types of Bexar Texas Irrevocable Trust Agreements for the Benefit of Spouse, Children, and Grandchildren, each tailored to the granter's specific goals and preferences. Here are some examples of these trust agreements: 1. Spousal Support Trust: This type of trust aims to provide financial assistance for the surviving spouse during their lifetime. The trust assets are managed by a trustee who makes distributions according to the terms outlined in the trust agreement. This trust ensures that the surviving spouse has a stable income source and is well cared for. 2. Education Trust: This trust focuses on providing funds for the education of the granter's children and grandchildren. It can cover various educational expenses, including school fees, tuition, books, and other related costs. The trust enables the beneficiaries to pursue their academic goals without financial constraints. 3. Asset Protection Trust: This trust is designed to shield the assets from potential creditors and legal judgments, ensuring their long-term preservation for the benefit of the beneficiaries. By placing assets in this trust, individuals can safeguard them from potential risks and preserve their value for future generations. 4. Charitable Remainder Trust: This type of trust allows the granter to donate their assets to a charitable organization while providing income to their spouse, children, or grandchildren beneficiaries during their lifetime. After the trust term ends, the remaining assets are distributed to the designated charity, enabling both philanthropy and family support. 5. Generation-Skipping Trust: A generation-skipping trust allows the granter to transfer assets directly to their grandchildren, bypassing their children as beneficiaries. This trust can provide tax advantages and secure the financial future of subsequent generations, ensuring the efficient transfer of wealth. It is important for individuals considering the establishment of a Bexar Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren to consult with an experienced estate planning attorney who can provide expert guidance tailored to their specific circumstances and goals.