The Franklin Ohio Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legally binding document that helps protect and manage assets for the long-term benefit of your loved ones. This trust agreement is specific to residents of Franklin, Ohio, and is designed to provide a solid financial foundation for the beneficiaries. The primary purpose of this trust agreement is to ensure that the spouse, children, and grandchildren of the person establishing the trust (known as the granter) are well taken care of. By creating an irrevocable trust, the granter ensures that the assets placed into the trust cannot be altered, modified, or revoked without the consent of all parties involved. Within the Franklin Ohio Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren, there may be different variations or types to suit individual needs. These can include: 1. Spousal Trust: This type of trust focuses on providing financial security and support for the surviving spouse after the granter's passing. It may include provisions for living expenses, healthcare, and other necessary costs. 2. Children's Trust: The children's trust component allows the granter to designate assets to be distributed to their children at specific ages or life milestones. This helps ensure financial stability for the children in case of any unexpected circumstances. 3. Grandchildren's Trust: Some granters choose to set aside a portion of the trust specifically for their grandchildren. This can help with educational expenses, extracurricular activities, or even future homeownership. 4. Educational Trust: With this type of trust, the granter can establish a separate fund within the trust agreement to provide financial support specifically for the education of their children and grandchildren. This may cover tuition fees, books, and other related educational expenses. 5. Charitable Trust: For those individuals who value philanthropy, this type of trust can be established to benefit charitable organizations or causes, alongside providing for the spouse, children, and grandchildren. This allows the granter to leave a lasting impact and support causes they care about deeply. The Franklin Ohio Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a powerful tool that enables individuals to protect and carefully distribute their assets to provide for the financial well-being of their loved ones. By utilizing this trust agreement, families can have peace of mind knowing that their assets will be managed according to their wishes and that their beneficiaries will receive the support they need.

Franklin Ohio Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description

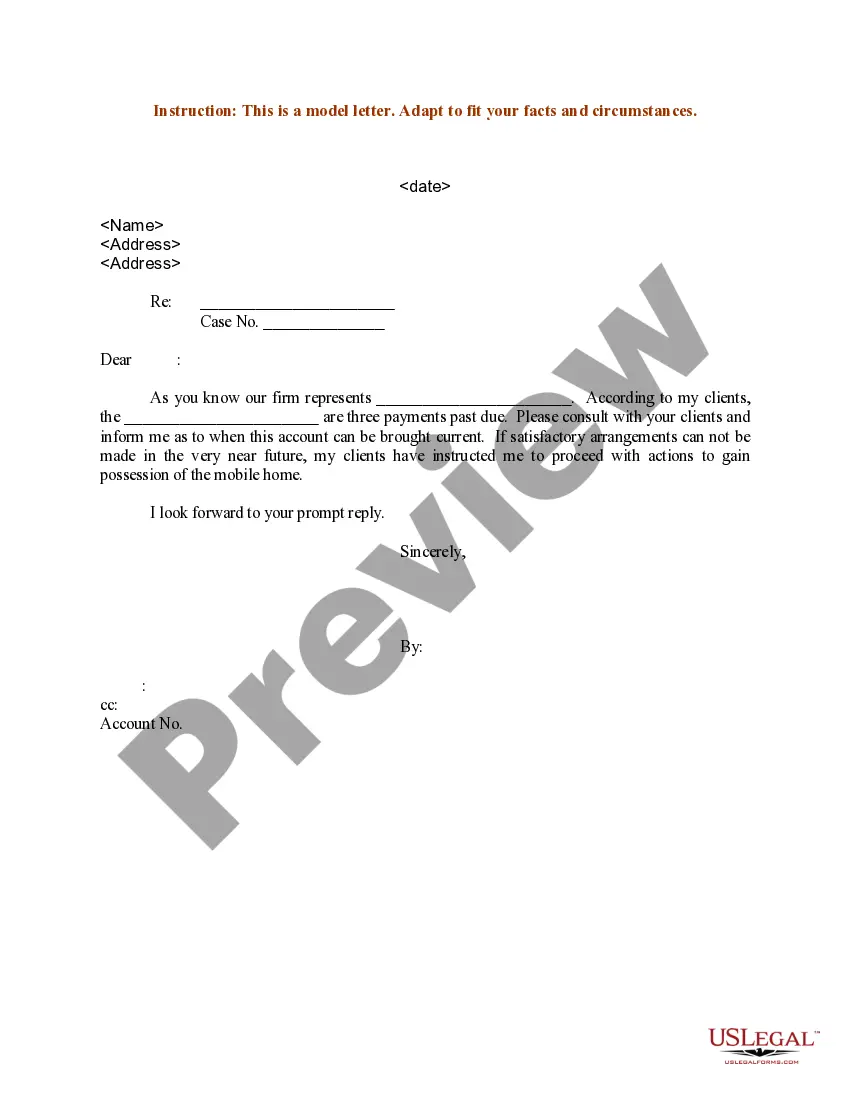

How to fill out Franklin Ohio Irrevocable Trust Agreement For The Benefit Of Spouse, Children And Grandchildren?

If you need to get a trustworthy legal form provider to get the Franklin Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it easy to get and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Franklin Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Franklin Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less costly and more affordable. Set up your first business, organize your advance care planning, create a real estate agreement, or complete the Franklin Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren - all from the convenience of your home.

Sign up for US Legal Forms now!