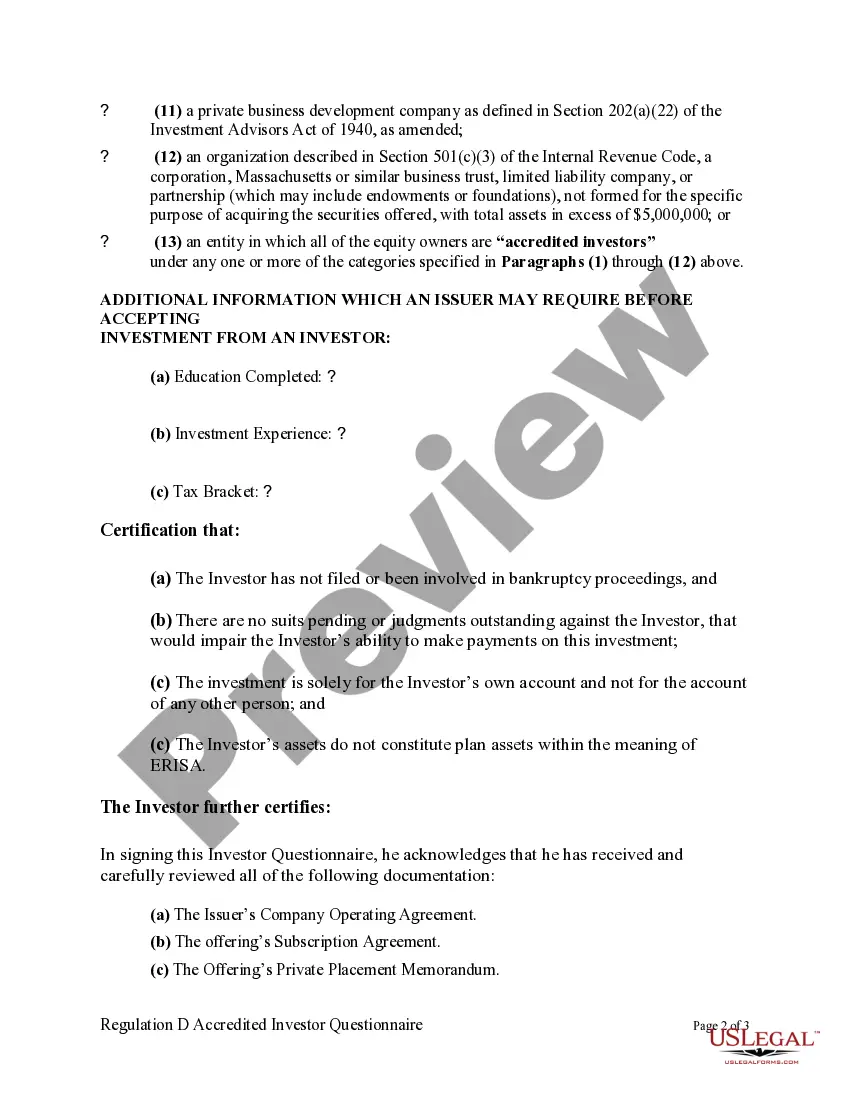

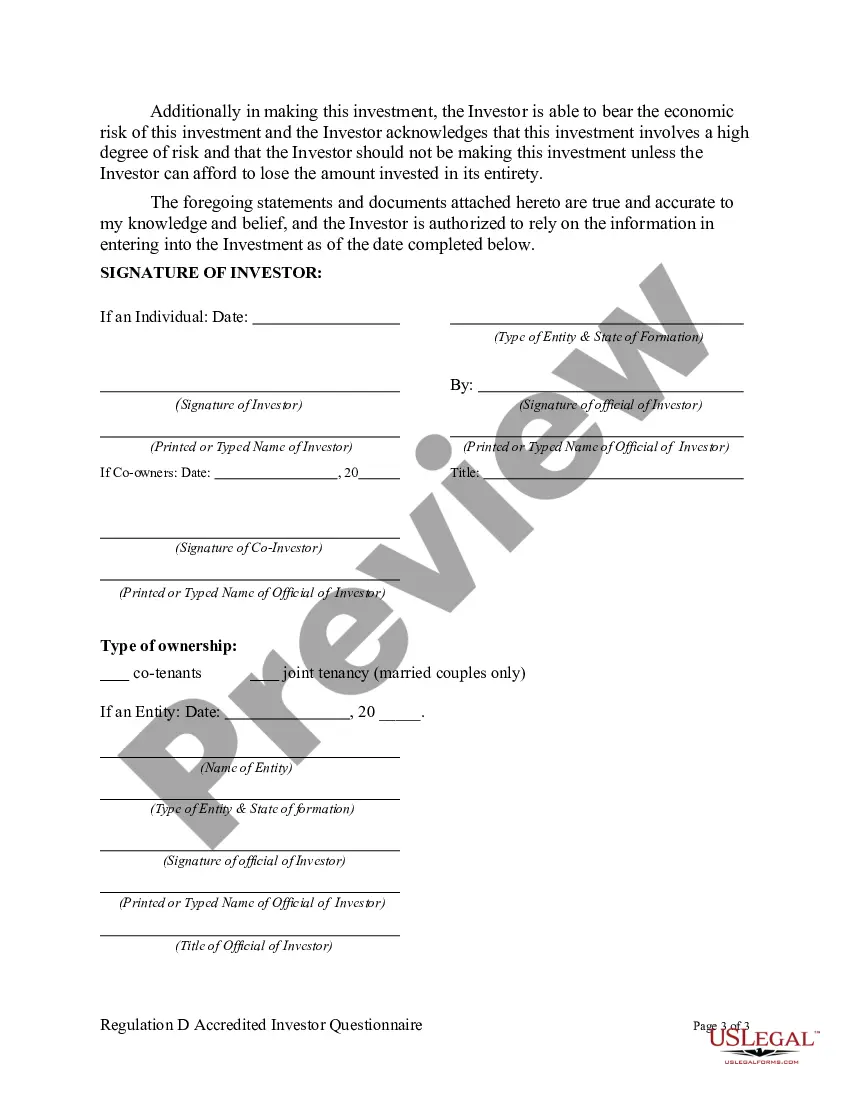

The information contained in this Questionnaire is being furnished by a potential investor in order to determine whether the prospective investor qualifies as an accredited investor as defined in Regulation D of the Securities Act of 1933.

Regulation D creates an exemption that permits sales of securities without registration with the U.S. Security and Exchange Commission. However, Sellers are required to file a Form D informational statement about the sale. The definition of accredited investor is important regarding this exemption as far as a limitation on the number of shareholders allowed (i.e., 35). Accredited investors do not have to be counted as far as the 35 limitation is concerned. An accredited investor includes any investor who at the time of the sale falls into any of the following categories: " a private business development firm; " directors, officers, and general partners of issuer; " banks; " purchasers of $150,000 or more of the securities; " natural persons with a net worth greater than $1,000,000; or " persons with an income of greater than or equal to $200,000 per year.

The Hillsborough Florida Regulation D Accredited Investor Questionnaire is a crucial document used in the financial industry to determine an individual's eligibility as an accredited investor under Regulation D. This comprehensive questionnaire helps investment firms and financial institutions establish whether an investor meets the criteria set forth by the U.S. Securities and Exchange Commission (SEC) for participation in certain private investment opportunities. Hillsborough County, located in Florida, adheres to the Regulation D guidelines outlined by the SEC. Accredited investors are classified as individuals or entities that satisfy certain income, net worth, and professional experience requirements, allowing them to access private placements and other investment opportunities not available to the public. The Hillsborough Florida Regulation D Accredited Investor Questionnaire covers various aspects to evaluate an individual's eligibility. It begins by collecting general personal information, such as name, address, contact details, and employment details. The questionnaire also delves into an investor's financial standing, including net worth, income, and assets. Furthermore, the questionnaire inquires about an investor's professional experience and expertise in managing financial matters. This information is important as certain exemptions within Regulation D may apply to investors based on their professional qualifications or affiliations. For instance, lawyers, accountants, and other professionals with specific financial knowledge may be eligible for certain exemptions. Different types or variations of the Hillsborough Florida Regulation D Accredited Investor Questionnaire may exist, depending on the specific investment firm or financial institution. These variations might tailor the questionnaire to include additional fields or questions based on the firm's internal policies or requirements. However, the fundamental purpose remains the same: determining an investor's accredited status under Regulation D guidelines. In summary, the Hillsborough Florida Regulation D Accredited Investor Questionnaire is an essential tool used in the financial sector to verify an individual's eligibility as an accredited investor. It covers personal details, financial information, and professional experience to assess compliance with Regulation D guidelines. Complying with these guidelines ensures that accredited investors can access exclusive investment opportunities while protecting the interests of both investors and issuers.The Hillsborough Florida Regulation D Accredited Investor Questionnaire is a crucial document used in the financial industry to determine an individual's eligibility as an accredited investor under Regulation D. This comprehensive questionnaire helps investment firms and financial institutions establish whether an investor meets the criteria set forth by the U.S. Securities and Exchange Commission (SEC) for participation in certain private investment opportunities. Hillsborough County, located in Florida, adheres to the Regulation D guidelines outlined by the SEC. Accredited investors are classified as individuals or entities that satisfy certain income, net worth, and professional experience requirements, allowing them to access private placements and other investment opportunities not available to the public. The Hillsborough Florida Regulation D Accredited Investor Questionnaire covers various aspects to evaluate an individual's eligibility. It begins by collecting general personal information, such as name, address, contact details, and employment details. The questionnaire also delves into an investor's financial standing, including net worth, income, and assets. Furthermore, the questionnaire inquires about an investor's professional experience and expertise in managing financial matters. This information is important as certain exemptions within Regulation D may apply to investors based on their professional qualifications or affiliations. For instance, lawyers, accountants, and other professionals with specific financial knowledge may be eligible for certain exemptions. Different types or variations of the Hillsborough Florida Regulation D Accredited Investor Questionnaire may exist, depending on the specific investment firm or financial institution. These variations might tailor the questionnaire to include additional fields or questions based on the firm's internal policies or requirements. However, the fundamental purpose remains the same: determining an investor's accredited status under Regulation D guidelines. In summary, the Hillsborough Florida Regulation D Accredited Investor Questionnaire is an essential tool used in the financial sector to verify an individual's eligibility as an accredited investor. It covers personal details, financial information, and professional experience to assess compliance with Regulation D guidelines. Complying with these guidelines ensures that accredited investors can access exclusive investment opportunities while protecting the interests of both investors and issuers.