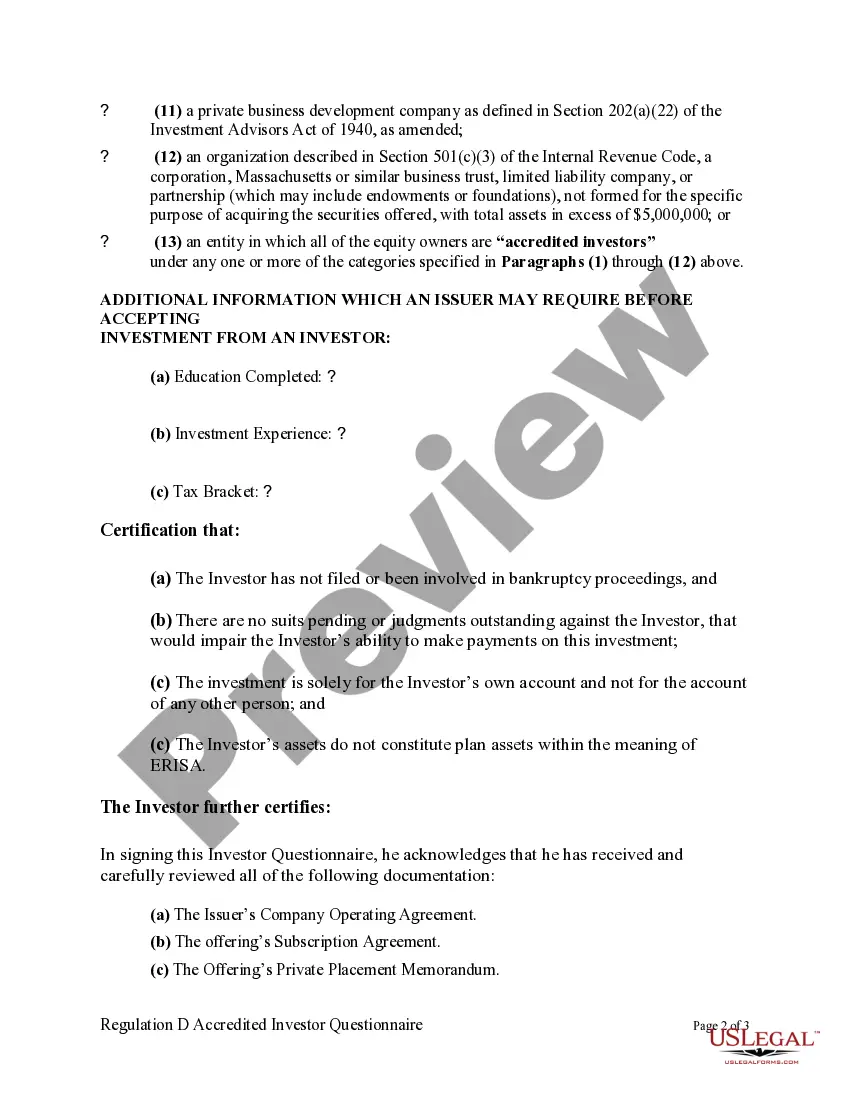

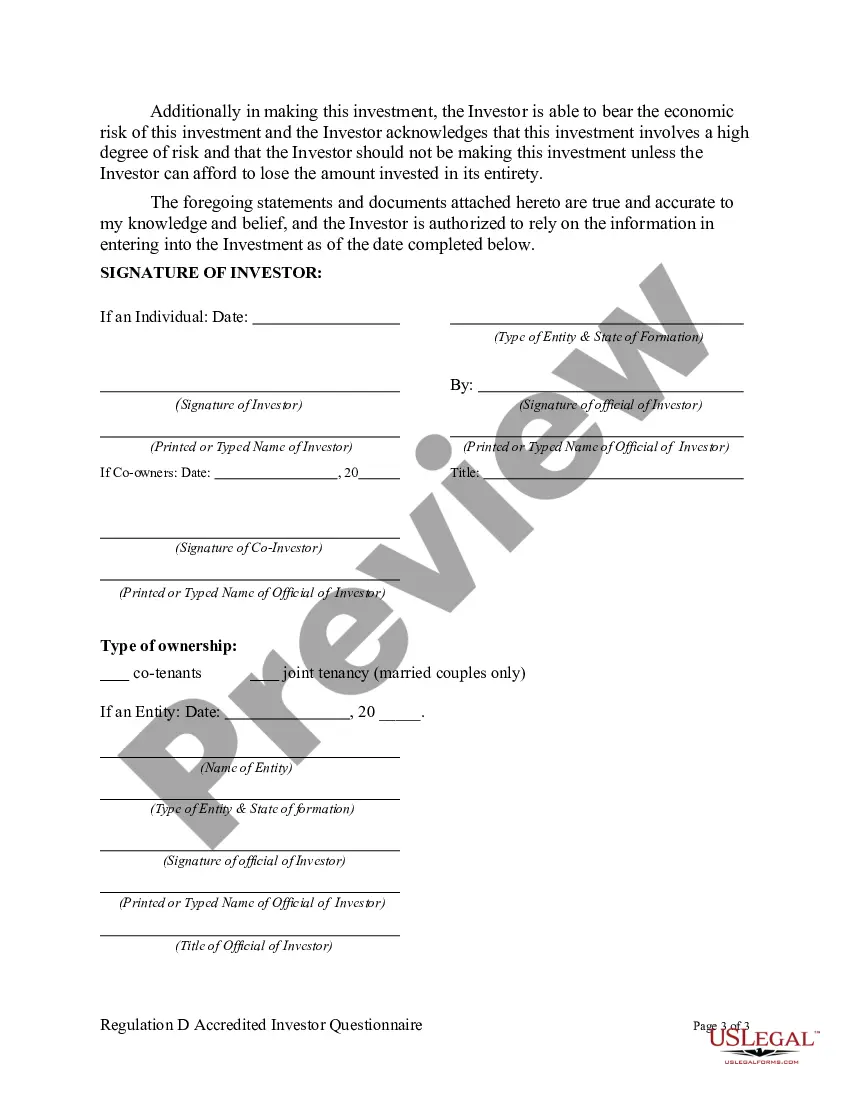

The information contained in this Questionnaire is being furnished by a potential investor in order to determine whether the prospective investor qualifies as an accredited investor as defined in Regulation D of the Securities Act of 1933.

Regulation D creates an exemption that permits sales of securities without registration with the U.S. Security and Exchange Commission. However, Sellers are required to file a Form D informational statement about the sale. The definition of accredited investor is important regarding this exemption as far as a limitation on the number of shareholders allowed (i.e., 35). Accredited investors do not have to be counted as far as the 35 limitation is concerned. An accredited investor includes any investor who at the time of the sale falls into any of the following categories: " a private business development firm; " directors, officers, and general partners of issuer; " banks; " purchasers of $150,000 or more of the securities; " natural persons with a net worth greater than $1,000,000; or " persons with an income of greater than or equal to $200,000 per year.

The Suffolk New York Regulation D Accredited Investor Questionnaire is a comprehensive document that plays a vital role in determining an individual's eligibility as an accredited investor. This questionnaire adheres to the regulatory guidelines put forth by the Securities and Exchange Commission (SEC). By thoroughly evaluating an individual's financial status, investment experience, and overall sophistication, this questionnaire serves as a crucial tool for ensuring compliance with Regulation D under the Securities Act of 1933. The Suffolk New York Regulation D Accredited Investor Questionnaire is specifically tailored to the Suffolk County area in New York, encompassing the towns and cities within this jurisdiction. It takes into account the specific regulatory framework and investor requirements within this geographical area. Different types of Suffolk New York Regulation D Accredited Investor Questionnaires may include variations based on unique investor categorizations or preferences. For instance, there could be questionnaires designed for individual investors, institutional investors, or entities such as corporations, partnerships, or limited liability companies seeking accredited investor status. The Suffolk New York Regulation D Accredited Investor Questionnaire covers a wide range of relevant topics, capturing crucial information through detailed questions and statements. Some pertinent areas covered in this questionnaire include: 1. Income Verification: Requesting disclosure of income sources, levels, and consistency to assess the financial capacity and stability of the investor. 2. Net Worth Evaluation: Gathering information about the investor's total assets, liabilities, and net worth to determine their financial standing. 3. Investment Experience and Knowledge: Inquiring about the investor's familiarity with various investment types, such as stocks, bonds, private placements, or real estate ventures, to assess their understanding of investment risks and opportunities. 4. Professional Designations: Seeking information regarding any professional certifications or designations the investor holds, which could demonstrate their proficiency in financial matters. 5. Business Affiliations: Identifying any business or professional relationships the investor may have, as these relationships might present potential conflicts of interest or additional investment opportunities. 6. Investment Goals: Evaluating the investor's investment objectives, time horizons, and risk tolerance to ensure alignment with Regulation D requirements. 7. Restrictions and Eligibility Requirements: Verifying that the investor meets the eligibility criteria outlined in Regulation D, which may include net worth or income thresholds, or specific qualifications based on expertise or involvement in the financial industry. As the Suffolk New York Regulation D Accredited Investor Questionnaire goes through a meticulous evaluation process, it assists both investors and regulatory bodies in ensuring compliance with the rules and regulations governing accredited investor status. By gathering comprehensive information, this questionnaire provides a standardized and transparent method to determine an individual or entity's suitability for participating in certain investment opportunities available to accredited investors.The Suffolk New York Regulation D Accredited Investor Questionnaire is a comprehensive document that plays a vital role in determining an individual's eligibility as an accredited investor. This questionnaire adheres to the regulatory guidelines put forth by the Securities and Exchange Commission (SEC). By thoroughly evaluating an individual's financial status, investment experience, and overall sophistication, this questionnaire serves as a crucial tool for ensuring compliance with Regulation D under the Securities Act of 1933. The Suffolk New York Regulation D Accredited Investor Questionnaire is specifically tailored to the Suffolk County area in New York, encompassing the towns and cities within this jurisdiction. It takes into account the specific regulatory framework and investor requirements within this geographical area. Different types of Suffolk New York Regulation D Accredited Investor Questionnaires may include variations based on unique investor categorizations or preferences. For instance, there could be questionnaires designed for individual investors, institutional investors, or entities such as corporations, partnerships, or limited liability companies seeking accredited investor status. The Suffolk New York Regulation D Accredited Investor Questionnaire covers a wide range of relevant topics, capturing crucial information through detailed questions and statements. Some pertinent areas covered in this questionnaire include: 1. Income Verification: Requesting disclosure of income sources, levels, and consistency to assess the financial capacity and stability of the investor. 2. Net Worth Evaluation: Gathering information about the investor's total assets, liabilities, and net worth to determine their financial standing. 3. Investment Experience and Knowledge: Inquiring about the investor's familiarity with various investment types, such as stocks, bonds, private placements, or real estate ventures, to assess their understanding of investment risks and opportunities. 4. Professional Designations: Seeking information regarding any professional certifications or designations the investor holds, which could demonstrate their proficiency in financial matters. 5. Business Affiliations: Identifying any business or professional relationships the investor may have, as these relationships might present potential conflicts of interest or additional investment opportunities. 6. Investment Goals: Evaluating the investor's investment objectives, time horizons, and risk tolerance to ensure alignment with Regulation D requirements. 7. Restrictions and Eligibility Requirements: Verifying that the investor meets the eligibility criteria outlined in Regulation D, which may include net worth or income thresholds, or specific qualifications based on expertise or involvement in the financial industry. As the Suffolk New York Regulation D Accredited Investor Questionnaire goes through a meticulous evaluation process, it assists both investors and regulatory bodies in ensuring compliance with the rules and regulations governing accredited investor status. By gathering comprehensive information, this questionnaire provides a standardized and transparent method to determine an individual or entity's suitability for participating in certain investment opportunities available to accredited investors.