Clark Nevada Subscription Receipts are financial instruments designed to facilitate the raising of capital for Clark Nevada companies. These receipts represent an agreement to purchase a specified number of Clark Nevada shares at a predetermined price. They provide investors with the option to convert their investment into common shares of Clark Nevada Corporation. The Clark Nevada Subscription Receipts are typically offered to investors during a private placement or initial public offering (IPO). They serve as a temporary placeholder for shares until certain conditions, usually regulatory or contractual, are met. Once the conditions are fulfilled, the subscription receipts can be converted into common shares of Clark Nevada Corporation on a one-to-one basis, allowing investors to fully participate in potential future gains. There are different types of Clark Nevada Subscription Receipts, including: 1. Base Clark Nevada Subscription Receipts: These are the standard subscription receipts issued during the fundraising process. They represent the basic agreement between the investor and the Clark Nevada Corporation. 2. Convertible Clark Nevada Subscription Receipts: These receipts offer additional flexibility to investors by allowing them to convert their investment into a different class of shares, such as preferred shares, if specified conditions are met. 3. Limited Clark Nevada Subscription Receipts: These receipts have certain restrictions on their conversion. They may have a specific expiry date or limit the number of shares that can be converted, providing more control to Clark Nevada Corporation over the capitalization process. 4. Es crowed Clark Nevada Subscription Receipts: These receipts are held in escrow until specific milestones are achieved. Once the milestones are met, typically related to completing a merger or acquisition, the receipt holders can convert them into Clark Nevada shares. Investing in Clark Nevada Subscription Receipts can be an attractive option for investors looking to participate in the growth potential of a Clark Nevada Corporation. These financial instruments offer the opportunity to secure a stake in the company before it goes public or undergoes significant expansion, potentially leading to substantial returns on investment. It is essential for potential investors to thoroughly analyze the terms and conditions of the Clark Nevada Subscription Receipts and understand the specific risks and rewards associated with their investment. Consulting with a financial advisor or conducting thorough due diligence is recommended to make informed investment decisions.

Clark Nevada Subscription Receipt

Description

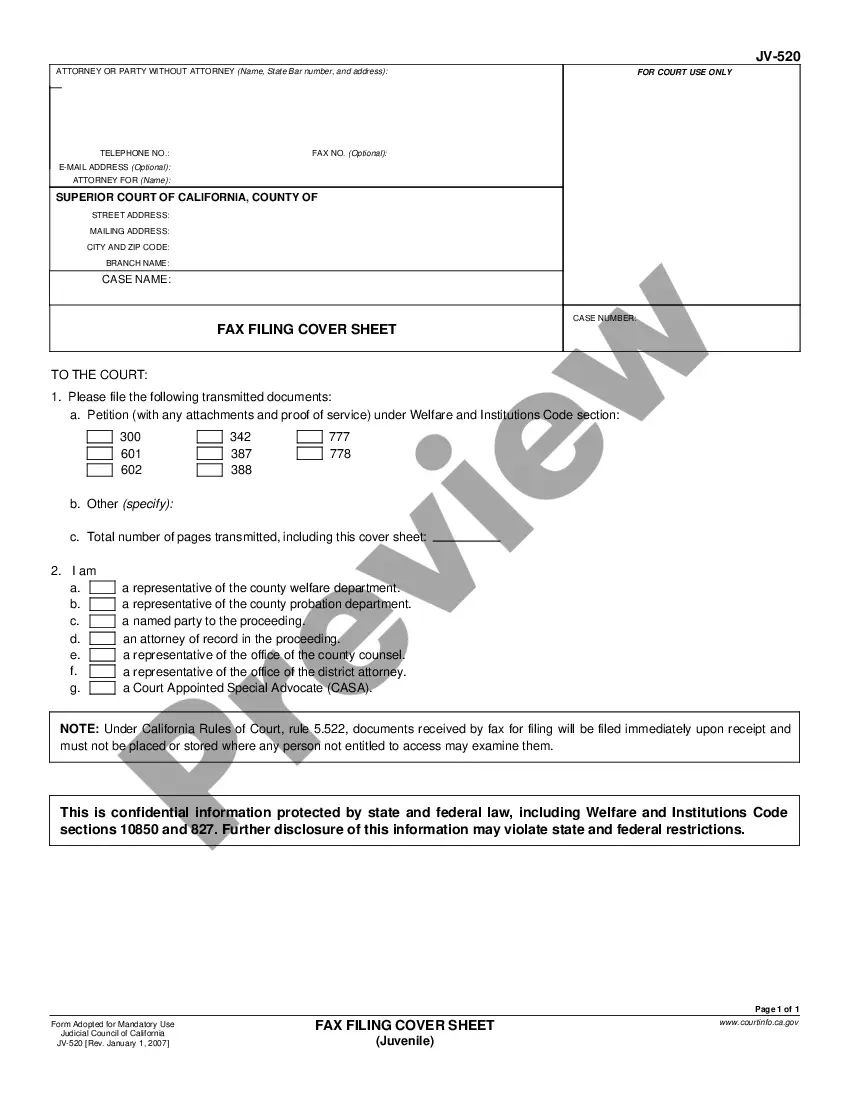

How to fill out Clark Nevada Subscription Receipt?

Draftwing forms, like Clark Subscription Receipt, to take care of your legal matters is a challenging and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for a variety of scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Clark Subscription Receipt template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Clark Subscription Receipt:

- Ensure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Clark Subscription Receipt isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start utilizing our website and download the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!