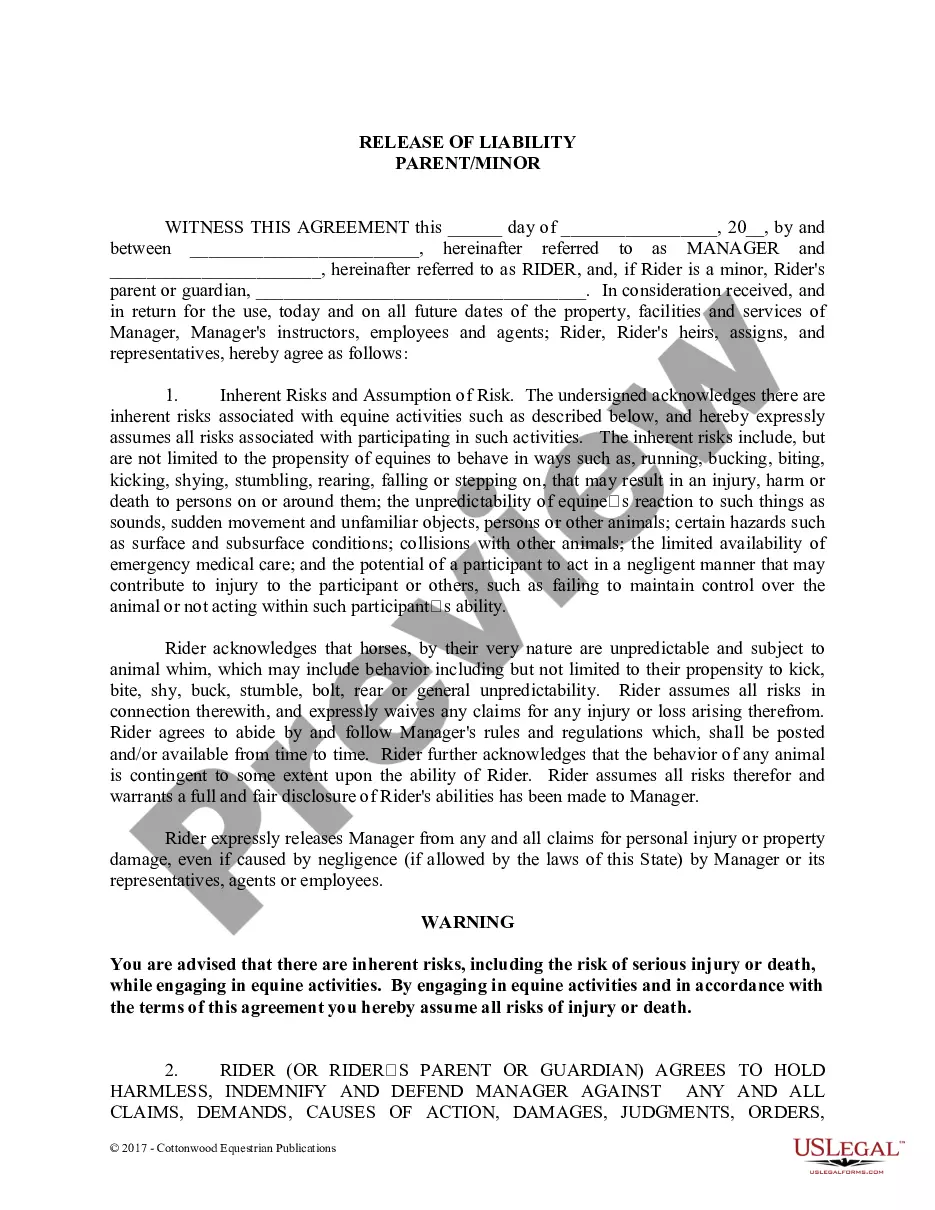

A Nassau New York Subscription Receipt refers to a financial instrument typically issued by a company to raise capital from investors. It acts as an interim security, representing an investor's commitment to subscribe for shares or units in a specific offering or investment fund based in Nassau, New York. Nassau New York Subscription Receipts are commonly associated with private placements, initial public offerings (IPOs), or special purpose acquisition companies (SPACs) where investors commit capital before the offering is completed. The purpose of this instrument is to allow companies to raise funds while finalizing certain regulatory or legal processes. There are different types of Nassau New York Subscription Receipts, including: 1. Private Placement Subscription Receipts: These are issued by privately held companies to raise capital from specific investors, usually institutions or high net worth individuals. Investors purchase these receipts with the expectation that the offering will be completed, and the receipts will be converted into shares or units of the company. 2. Initial Public Offering (IPO) Subscription Receipts: These receipts are used by companies planning to go public. In this case, investors subscribe to the offering by purchasing subscription receipts. Once the IPO is completed, the receipts are automatically converted into common shares, giving investors ownership in the newly listed company. 3. Special Purpose Acquisition Companies (SPAC) Subscription Receipts: SPACs are companies formed solely to acquire other companies and take them public. Investors purchase subscription receipts issued by SPACs, enabling them to fund the future acquisition. Once the acquisition is completed, the receipt converts into shares of the acquired company. Nassau New York Subscription Receipts provide flexibility and convenience to both companies and investors. They allow companies to secure capital upfront and investors to participate in future offerings without immediately committing to a specific investment. However, it's important for investors to carefully evaluate the terms and conditions associated with these receipts, as the conversion ratio and future performance of the investment may vary. Overall, Nassau New York Subscription Receipts play a vital role in capital formation for various types of offerings, providing a bridge between the initial commitment of investors and the completion of a transaction or fundraising event.

Nassau New York Subscription Receipt

Description

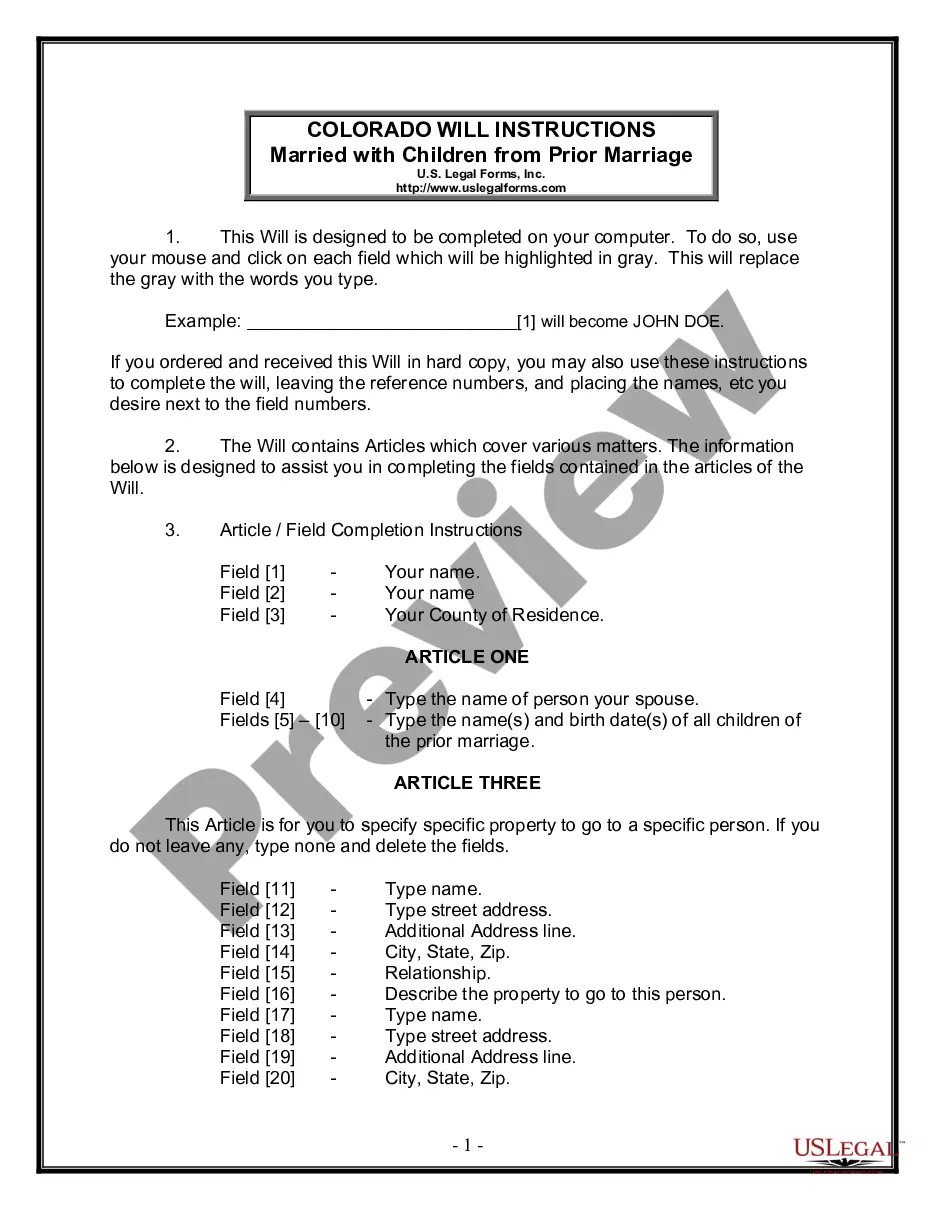

How to fill out Nassau New York Subscription Receipt?

Preparing paperwork for the business or individual needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Nassau Subscription Receipt without expert help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Nassau Subscription Receipt on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Nassau Subscription Receipt:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a few clicks!