Dear [Bank or Lending Institution], I am writing this letter to provide a detailed explanation of my bankruptcy, which occurred in Philadelphia, Pennsylvania. I understand the importance of transparency, and I aim to ensure you have a comprehensive understanding of my financial situation. Philadelphia, Pennsylvania, known as the City of Brotherly Love, is a vibrant and historically rich city located in the northeastern region of the United States. It serves as the economic and cultural hub of the state, offering a multitude of opportunities for residents and businesses alike. The city boasts a diverse population and a thriving economy with key industries such as healthcare, education, finance, tourism, and manufacturing. With respect to my bankruptcy, it is crucial to clarify the type of bankruptcy filing that was made. Bankruptcy law encompasses several chapters, each serving different purposes and addressing varied financial circumstances. Therefore, providing an accurate description of the specific type of bankruptcy filing plays a vital role in assessing the overall picture. If the bankruptcy filed is Chapter 7 bankruptcy, commonly referred to as liquidation bankruptcy, it means that most of my assets were sold to repay creditors. In exchange for the discharge of my debts, I was required to undergo a means test, ensuring my eligibility for this type of filing. This chapter is designed to provide individuals or businesses facing extreme financial distress a fresh start by eliminating eligible debts. On the other hand, if the bankruptcy filed is Chapter 13 bankruptcy, often known as reorganization bankruptcy, it signifies that I entered into a court-approved repayment plan. This plan enables individuals with steady incomes to repay a portion of their debts over a specified period, usually three to five years. Chapter 13 bankruptcy focuses on restructuring and creating an affordable repayment schedule while protecting assets from liquidation. Whichever type of bankruptcy filing occurred, rest assured that it was made in accordance with existing legislation and regulations, following the necessary legal procedures. I recognize the consequences and responsibilities that come with bankruptcy and have learned valuable financial lessons from this difficult experience. It is important to note that bankruptcy filings are not indicative of one's character or ability to manage finances. Life circumstances, unexpected medical expenses, job loss, or other unforeseen events can cause financial hardships, making bankruptcy a feasible option to regain stability. Since my bankruptcy filing, I have taken proactive measures to rebuild my financial standing. I have embraced financial literacy, attended credit counseling sessions, and developed a budgeting plan to ensure responsible financial management in the future. I understand the significance of regaining trust and credibility, which is why I am committed to making responsible financial decisions moving forward. Furthermore, I hope this detailed explanation sheds light on my bankruptcy filing and demonstrates my dedication to financial stability. Please feel free to contact me if any additional information or documentation is required. I sincerely appreciate your understanding, and thank you for considering my request. Yours sincerely, [Your Name]

Philadelphia Pennsylvania Sample Letter for Explanation of Bankruptcy

Description

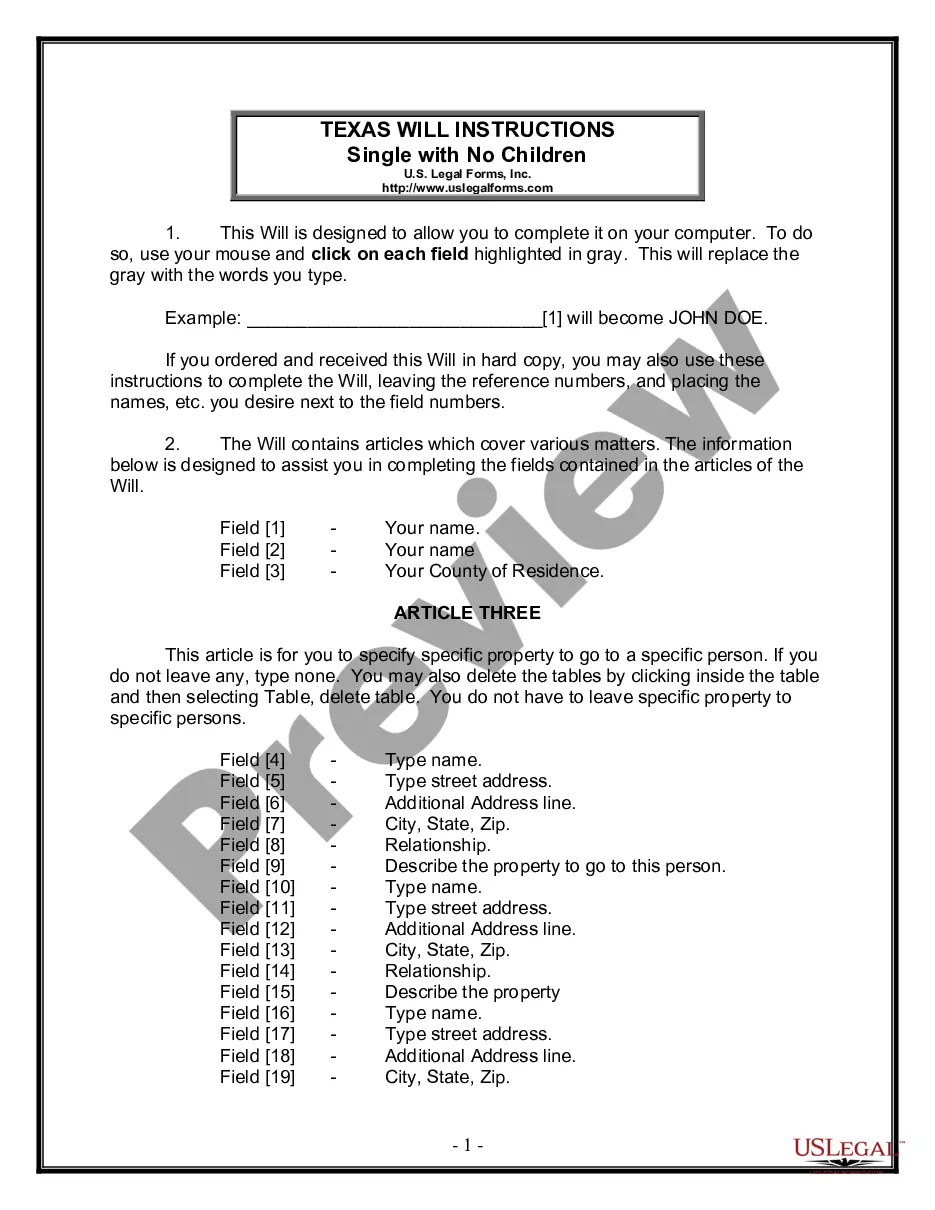

How to fill out Philadelphia Pennsylvania Sample Letter For Explanation Of Bankruptcy?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Philadelphia Sample Letter for Explanation of Bankruptcy is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Philadelphia Sample Letter for Explanation of Bankruptcy. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Sample Letter for Explanation of Bankruptcy in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!