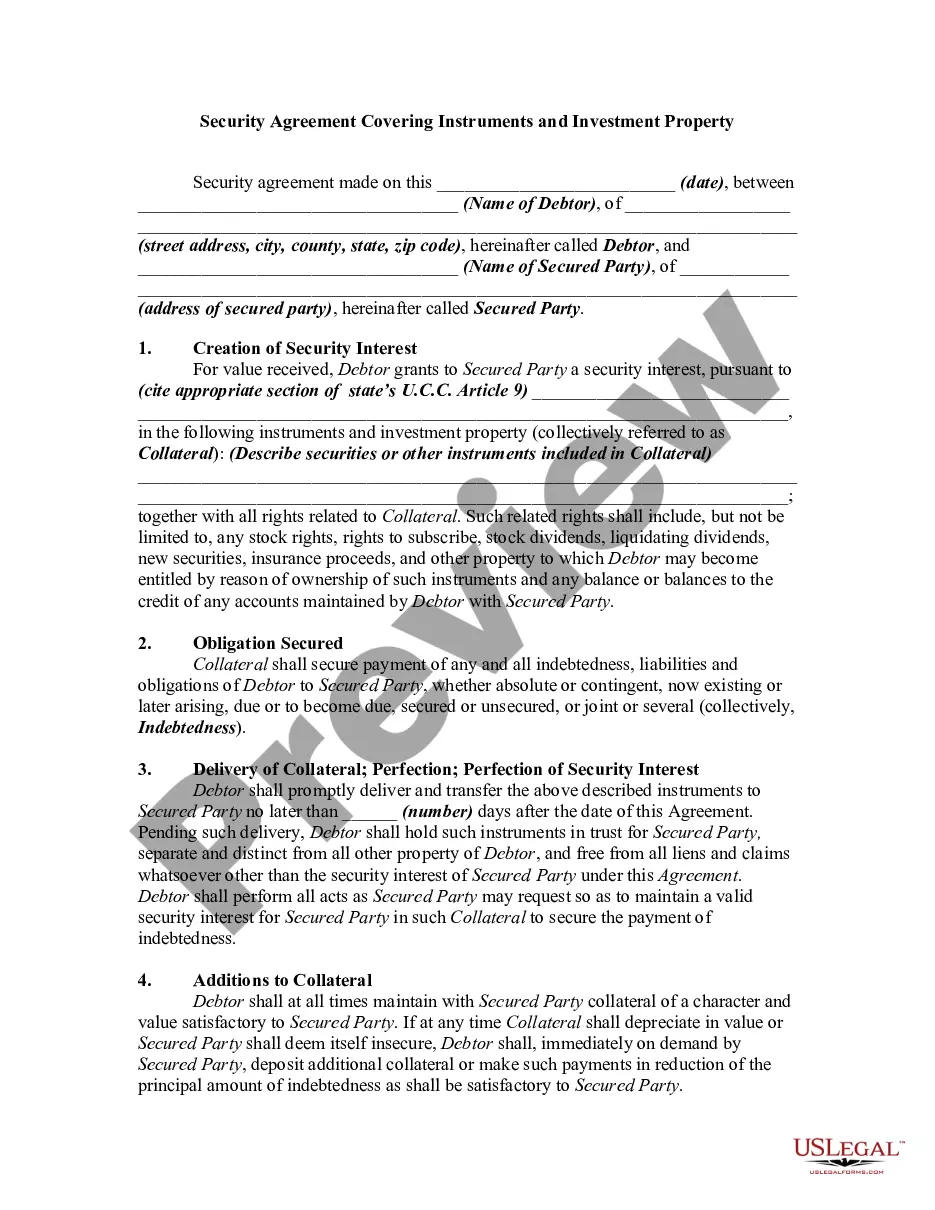

The Chicago Illinois Contract for the International Sale of Goods with Purchase Money Security Interest (PSI) is an essential legal agreement that outlines the terms and conditions for the sale of goods between parties involved in international trade. This specific contract pertains to transactions made in Chicago, Illinois, under the jurisdiction of the state's laws. Keywords: Chicago Illinois, Contract, International Sale of Goods, Purchase Money Security Interest, PSI. The Chicago Illinois Contract for the International Sale of Goods with Purchase Money Security Interest serves as a legal framework that allows for the smooth facilitation of global trade transactions in the region. It provides clarity and protection for both the buyer and seller of goods, ensuring that their rights and obligations are clearly defined and enforced. The contract includes crucial elements such as the identification of the parties involved, the description of the goods being sold, the purchase price, payment terms and conditions, shipment and delivery terms, and dispute resolution mechanisms. It also covers matters related to logistics, insurance, warranties, and risk allocation. Purchase Money Security Interest (PSI) is a significant aspect of this type of contract. It refers to a security interest or lien that provides the seller with a legal claim over the goods sold until the purchase price is paid in full. This security interest gives the seller priority in payment over other creditors if the buyer defaults on their obligations. There can be different types of the Chicago Illinois Contract for the International Sale of Goods with Purchase Money Security Interest, categorized based on various factors such as the nature of the goods being sold, the industries involved, or the specific legal requirements applicable to different types of transactions. For instance, one variant of this contract could be specific to the sale of industrial machinery or equipment, while another could be tailored for the sale of agricultural products. The use of different types of contracts with Purchase Money Security Interest allows for customization and adaptation to various industries and trade scenarios. In summary, the Chicago Illinois Contract for the International Sale of Goods with Purchase Money Security Interest is a specialized legal agreement that ensures smooth and secure international trade transactions in the region. It provides a comprehensive framework for the parties involved to protect their rights and obligations, with particular emphasis on the establishment of a Purchase Money Security Interest.

Chicago Illinois Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out Chicago Illinois Contract For The International Sale Of Goods With Purchase Money Security Interest?

Do you need to quickly draft a legally-binding Chicago Contract for the International Sale of Goods with Purchase Money Security Interest or maybe any other form to handle your personal or business affairs? You can select one of the two options: hire a legal advisor to write a legal document for you or draft it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Chicago Contract for the International Sale of Goods with Purchase Money Security Interest and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, double-check if the Chicago Contract for the International Sale of Goods with Purchase Money Security Interest is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were looking for by using the search bar in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Chicago Contract for the International Sale of Goods with Purchase Money Security Interest template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!