Sample Letter for Mobile Home Insurance Policy in Collin, Texas Dear [Insurer], I am writing to inquire about mobile home insurance policies available in Collin, Texas. As a resident of this vibrant county, I understand the importance of protecting my mobile home from potential risks and uncertainties. After conducting thorough research, I believe that your insurance company can provide the coverage and peace of mind I seek. Collin, Texas is an ever-growing county located in the northeastern part of the state. Known for its bustling urban areas, stunning natural beauty, and warm community spirit, Collin County is a desirable place to live, work, and raise a family. With its diverse landscape, ranging from picturesque suburbs to rural communities, mobile home living has become increasingly popular within the region. Mobile homes, also known as manufactured homes, come in various sizes and designs, accommodating a wide range of residents' needs. Whether someone is residing in a cozy single-section mobile home or a spacious multi-section mobile home, they understand the importance of protecting their investment. This is where mobile home insurance policies play a crucial role. Mobile home insurance policies are designed to cover potential risks such as fire, theft, vandalism, extreme weather conditions, and liability. It provides financial protection for both the structure and contents of a mobile home, ensuring that residents can rebuild or repair their homes in the event of an unexpected event. Some specific types of mobile home insurance policies available in Collin, Texas may include: 1. Dwelling coverage: This insurance policy covers the physical structure of the mobile home, including walls, roof, and any attached structures like porches or sheds. It ensures that policyholders can rebuild or repair their home in case of covered damages. 2. Personal property coverage: This type of insurance policy protects the belongings inside the mobile home, such as furniture, appliances, electronics, and clothing. It helps residents replace or repair their possessions if they are damaged, destroyed, or stolen. 3. Liability coverage: Liability coverage is crucial in protecting mobile home residents from potential legal claims if someone gets injured on their property. It covers medical expenses, legal fees, and damages awarded if the resident is found responsible for the accident. 4. Additional living expenses coverage: In case a mobile home becomes uninhabitable due to a covered peril, this insurance policy covers temporary living expenses, such as hotel bills or rental costs, while repairs or reconstruction take place. When choosing a mobile home insurance policy in Collin, Texas, it's important to consider the specific risks associated with the area, such as hailstorms, tornadoes, and other severe weather events. Look for comprehensive policies that provide coverage against these perils to ensure maximum protection. In conclusion, as a resident of Collin, Texas, I understand the value of having a reliable mobile home insurance policy. The county's unique blend of urban and rural areas requires insurance coverage tailored to the specific needs of mobile home residents. With careful consideration of the available policies, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage, I am confident that I can find the perfect insurance policy to safeguard my mobile home investment. Thank you for your attention to this matter, and I look forward to hearing more about the mobile home insurance policies your company offers. Sincerely, [Your Name]

Collin Texas Sample Letter for Mobile Home Insurance Policy

Description

How to fill out Collin Texas Sample Letter For Mobile Home Insurance Policy?

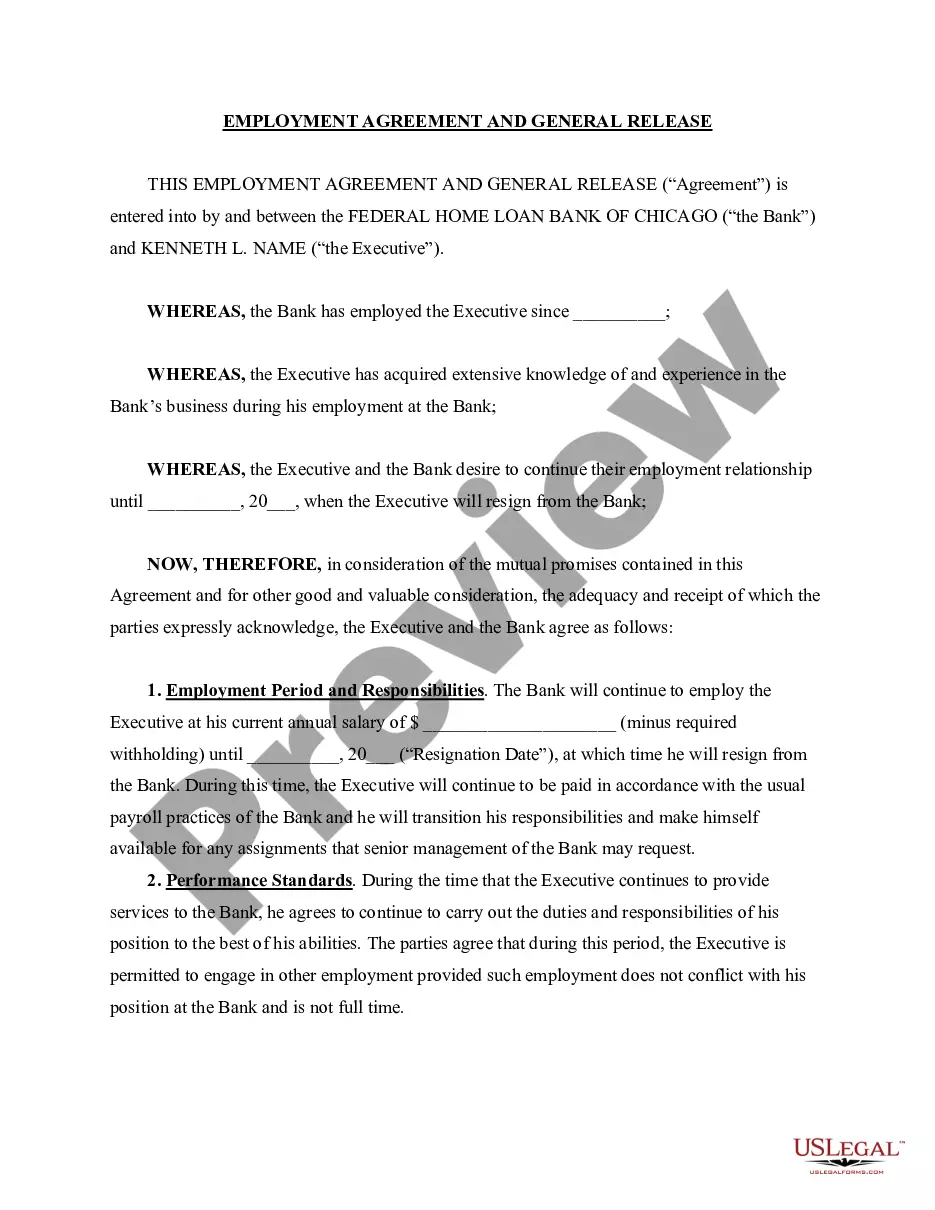

If you need to find a trustworthy legal paperwork provider to find the Collin Sample Letter for Mobile Home Insurance Policy, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Collin Sample Letter for Mobile Home Insurance Policy, either by a keyword or by the state/county the document is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Collin Sample Letter for Mobile Home Insurance Policy template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Collin Sample Letter for Mobile Home Insurance Policy - all from the comfort of your sofa.

Sign up for US Legal Forms now!