Dear [Insurance Company], I am writing to request a mobile home insurance policy for my property located in Maricopa, Arizona. Maricopa is a vibrant city nestled in the Sonoran Desert, known for its beautiful landscapes, warm climate, and friendly community. As a mobile homeowner in this vibrant area, I am seeking comprehensive insurance coverage to protect my valuable investment. Maricopa, Arizona Mobile Home Insurance Policies: 1. Basic Mobile Home Insurance: This policy provides essential coverage for the structure of my mobile home, protecting it against perils such as fire, lightning, windstorms, and vandalism. It typically includes liability coverage as well, safeguarding me against any potential lawsuits related to my property. 2. Comprehensive Mobile Home Insurance: This policy offers a wider range of coverage options compared to the basic policy. In addition to covering structure and liability, it also includes protection against accidental damage, theft, falling objects, and water-related incidents, such as burst pipes. This policy is ideal for those looking for higher levels of security and peace of mind. 3. Replacement Cost Mobile Home Insurance: This specialized policy ensures that I am reimbursed with the full replacement value of my mobile home in case of a total loss event. It takes into account the current cost of materials and labor, allowing me to rebuild my home to its previous quality without any depreciation deductions. 4. Personal Property Coverage: As a mobile homeowner, I understand the importance of protecting my personal belongings. This additional coverage ensures that my valuables, such as furniture, electronics, and appliances, are protected against perils such as theft, fire, and damage caused by accidents. 5. Flood Insurance: Maricopa, Arizona, is situated near the Gila River, making it essential to consider flood insurance coverage. This policy protects my mobile home and personal belongings in the event of a flood caused by heavy rainfall or significant river overflow. 6. Umbrella Liability Insurance: In addition to standard liability coverage, an umbrella policy offers an additional layer of protection. It provides coverage beyond the limits of my primary mobile home insurance policy, safeguarding me against lawsuits and claims that may exceed my existing coverage. I kindly request your assistance in evaluating my insurance needs and providing me with a customized mobile home insurance policy for my property in Maricopa, Arizona. As a responsible homeowner, I believe it is crucial to have adequate coverage that protects my investment and provides peace of mind. Thank you for your prompt attention to this matter. Sincerely, [Your Name]

Maricopa Arizona Sample Letter for Mobile Home Insurance Policy

Description

How to fill out Maricopa Arizona Sample Letter For Mobile Home Insurance Policy?

Preparing paperwork for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Maricopa Sample Letter for Mobile Home Insurance Policy without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Maricopa Sample Letter for Mobile Home Insurance Policy by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Maricopa Sample Letter for Mobile Home Insurance Policy:

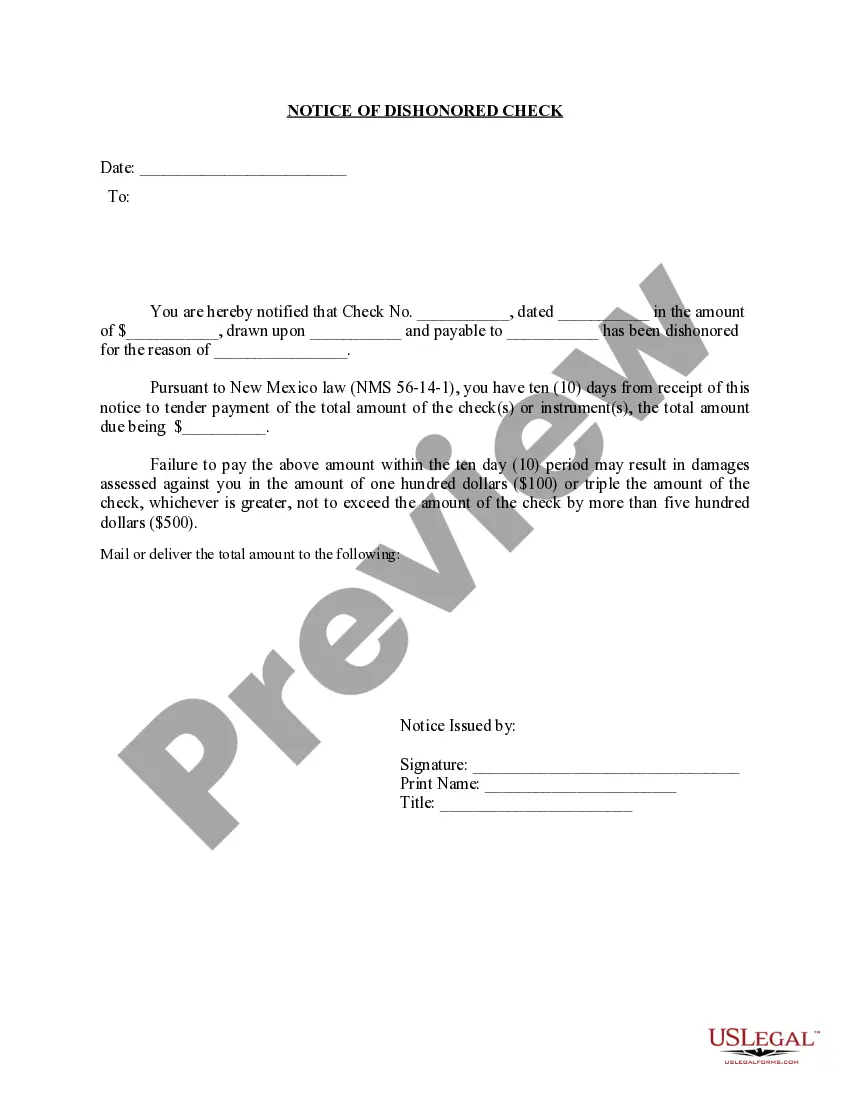

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a few clicks!