Chicago Illinois Allonge

Description

How to fill out Allonge?

A paperwork routine consistently accompanies any judicial activity you undertake.

Establishing a business, submitting or accepting a job proposal, transferring ownership, and many other life situations necessitate you to prepare official documentation that varies across the nation.

This is why having everything organized in a single location is incredibly advantageous.

US Legal Forms is the most comprehensive online repository of current federal and state-specific legal documents.

This is the easiest and most dependable method to acquire legal documents. All templates accessible in our library are expertly drafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters effectively with US Legal Forms!

- Here, you can conveniently locate and obtain a document for any individual or business need utilized in your jurisdiction, including the Chicago Allonge.

- Finding samples on the platform is remarkably straightforward.

- If you already possess a subscription to our service, Log In to your account, search for the sample using the search bar, and click Download to store it on your device.

- Afterward, the Chicago Allonge will be available for future use in the My documents section of your account.

- If you are engaging with US Legal Forms for the first time, follow this easy guide to obtain the Chicago Allonge.

- Make sure you have accessed the appropriate page with your localized form.

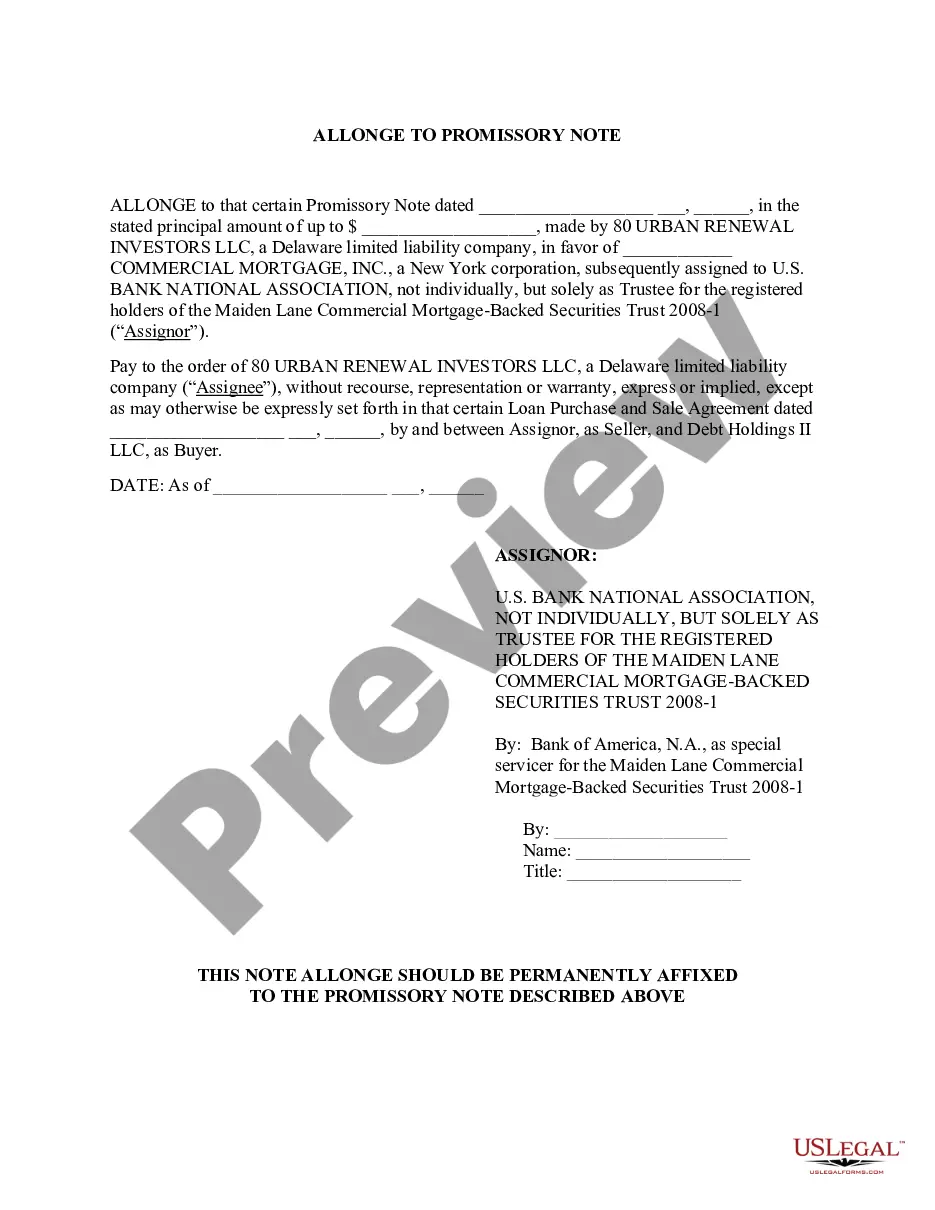

- Use the Preview mode (if available) to review the template.

- Examine the description (if any) to confirm the form meets your needs.

- Search for an alternative document using the search feature if the sample does not suit you.

- Hit Buy Now once you find the required template.

- Choose the suitable subscription plan, then Log In or establish an account.

- Select the preferred payment option (via credit card or PayPal) to proceed.

- Choose the file format and download the Chicago Allonge to your device.

- Utilize it as necessary: print or complete it electronically, sign it, and dispatch it where required.

Form popularity

FAQ

Typically, the individual or entity holding the note signs the allonge. This signature indicates consent to transfer the rights associated with the note. If you are dealing with a Chicago Illinois Allonge, verifying that the signer maintains the proper legal authority is essential. Additionally, platforms like uslegalforms can provide you with valuable insights and templates required for proper execution.

Fannie Mae requires that an allonge be properly executed to maintain the enforceability of the note. Specifically, it must clearly identify the note it is attached to and contain the signature of the appropriate party. In the context of a Chicago Illinois Allonge, adhering to these standards ensures that your documentation aligns with federal guidelines. Utilizing resources from uslegalforms might simplify the preparation of such documents.

In most cases, the original lender or holder of the note signs the allonge to a note. This signature verifies the transfer of rights associated with the note. When dealing with a Chicago Illinois Allonge, it is crucial to ensure that the signatory has the authority to make such transfers. You may find that platforms like uslegalforms can help clarify these processes and provide templates tailored to your specific needs.

To fill out an allonge to a note, begin by titling the document as 'Allonge'. Include the reference information of the main note, such as the date and parties involved. It is crucial to add explanations for any changes, and provide space for necessary signatures. Our platform can assist you in creating a well-formulated Chicago Illinois Allonge, making this process straightforward.

Typically, the parties involved in the original note sign the allonge. The original lender may need to sign it to acknowledge the changes or additions made on the allonge. Also, if there are any new parties involved—such as an assignee—they should also provide their signatures. Our service simplifies this process to help you craft a compliant Chicago Illinois Allonge.

Filling out an allonge to a note involves a few important steps. First, clearly label the allonge as an 'Allonge' at the top of the document. Next, include the details of the original note, such as the date, principal amount, and parties involved. Finally, provide sufficient space for signatures and any additional terms that apply. By using our platform, you can ensure that your Chicago Illinois Allonge is filled out correctly and meets all legal requirements.

In Chicago, Illinois, an allonge typically does not need to be notarized to be legally valid. However, having it notarized can add an extra layer of authenticity and may be beneficial in certain transactions. It’s always wise to consult with a legal professional or use platforms like US Legal Forms for guidance on specific needs.

No, an allonge is not the same as an assignment. While an allonge specifically provides additional endorsements attached to a document, an assignment fully transfers rights or interests in a property or contract. Understanding this distinction is vital for anyone dealing with legal documents in Chicago, Illinois.

Typically, the parties involved in the transaction sign the allonge. This often includes the original payee and the new holder if there is a transfer of rights. In Chicago, Illinois, gathering all necessary signatures on the allonge is crucial for ensuring that the endorsement is valid and legally binding.

The purpose of an allonge is to allow for additional endorsements or declarations on legal documents when space is limited. This tool is particularly useful for individuals working with financial instruments in Chicago, Illinois, offering a clear way to document transfers. It ensures that all necessary signatures are included without cluttering the original document.