Fulton Georgia Along is a legal document that serves as an endorsement for transferring the ownership rights or interest in a promissory note to another party. It is commonly used in real estate transactions, especially when there is a need to assign the mortgage or note to a new lender or investor. The Fulton Georgia Along is typically attached to the original promissory note and contains important information regarding the transfer, such as the name of the current note holder, the name of the new note holder, the date of the transfer, and the amount of the note. This document ensures that the transfer of ownership is properly documented and legally recognized. There are different types of Fulton Georgia Along, each with specific purposes: 1. Blank Along: A blank along is used when the original promissory note does not have enough space to endorse additional parties. It is left blank with only the necessary details filled out when needed. 2. Specific Along: A specific along identifies the specific parties involved in the transfer and includes their names, signatures, and the exact terms of the transfer. 3. Restrictive Along: A restrictive along limits the rights of the new note holder and specifies certain conditions or limitations on the transfer. This is often used to protect the interests of the original lender or note holder. 4. Endorsement Along: An endorsement along is used to endorse the promissory note over to a new party without the need for a separate assignment document. It contains the necessary endorsement language and signatures. Fulton Georgia Along plays a crucial role in ensuring the smooth transfer of ownership and the validity of promissory notes in real estate transactions. It provides a clear record of ownership, protects the rights of all parties involved, and helps avoid any potential disputes or legal issues.

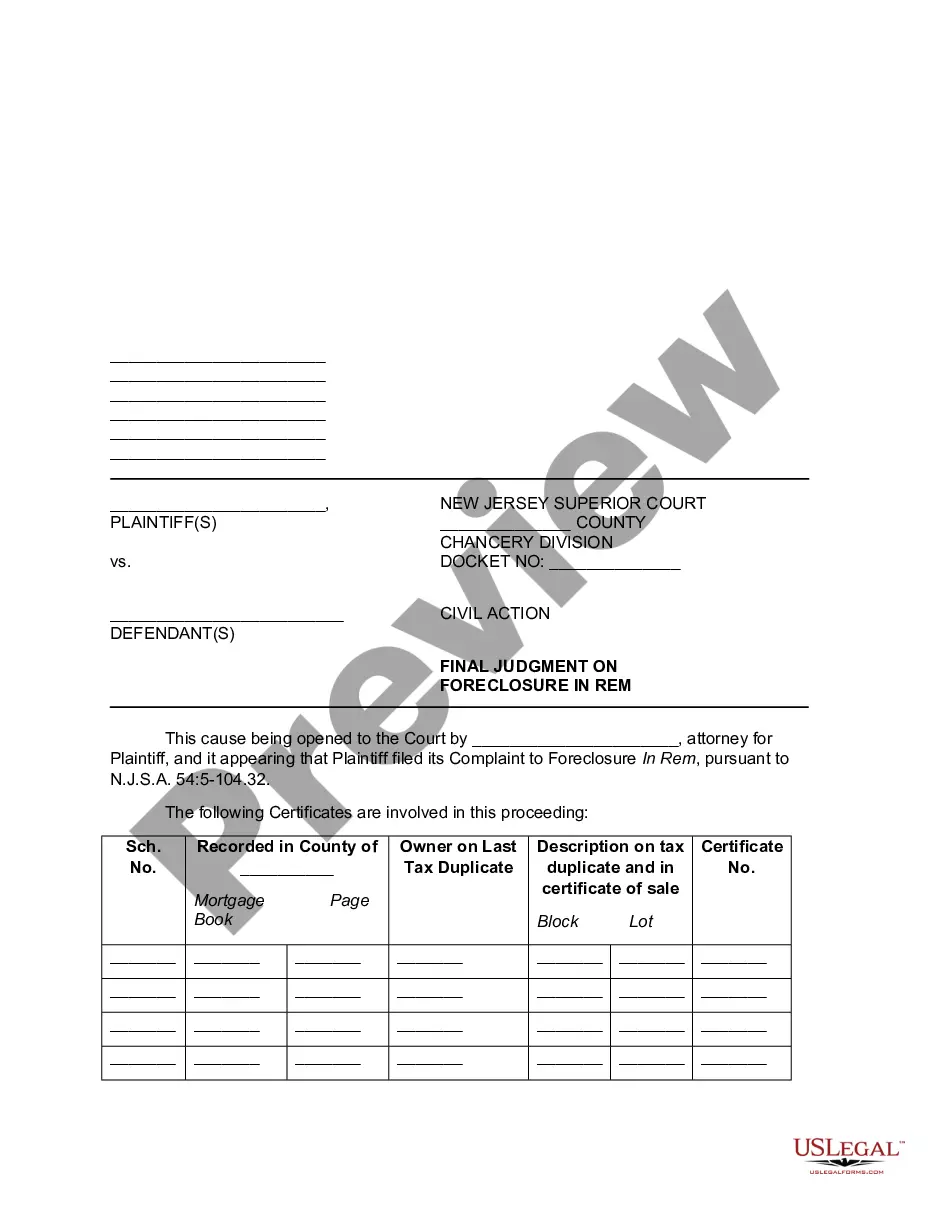

Fulton Georgia Allonge

Description

How to fill out Allonge?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Fulton Allonge, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how to find and download Fulton Allonge.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the related forms or start the search over to locate the correct file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Fulton Allonge.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Fulton Allonge, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you have to deal with an extremely challenging case, we recommend getting an attorney to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork with ease!

Form popularity

FAQ

To unlock mission 51 you must first remove your left index finger with pliers. Once completed, head to a tattoo parlor and have ''KOJIMA WAS HERE"' tattooed onto your anus. After that is complete you will need 30 feet of rope, and a tall building.

Metal Gear Solid 5 - How to Unlock the Wormhole Fulton - YouTube YouTube Start of suggested clip End of suggested clip You'll need to have already completed the other animal capture side ups but once you track down andMoreYou'll need to have already completed the other animal capture side ups but once you track down and extract this legendary pup you'll unlock the blueprint.

Yes, you can fulton them after killing or tranquilizing them.

Side Ops 113 unlocks the child Fulton. To unlock the Side Ops, you will have to complete Mission 26. Show activity on this post. You don't actually need to research the Child-Safe Fulton Device to Fulton the kids.

Metal Gear Solid 5 - How to Unlock the Wormhole Fulton - YouTube YouTube Start of suggested clip End of suggested clip Pain to unlock this excellent R&D project all you need to do is complete sign up number 50 captureMorePain to unlock this excellent R&D project all you need to do is complete sign up number 50 capture the legendary jackal which will unlock sometime after completing the end of chapter 1.

You have to get the Master Fulton certificate, which you get automatically after successfully fultoning 1000 things. That will unlock two more Capacity upgrades in R&D.

The Wormhole device can be built after completing Side Op 50: Capture the Legendary Jackal and meeting the development requirements below. Extract personnel / containers from any location (even indoors). Fulton device cannot be shot down.

Alternate Victory #1 - Fulton the Man on Fire Douse the Man on Fire with tanks and/or the water towers. Then quickly close in and attach your Fulton system. If you're using the Wormhole, he'll simply disappear. Extraction will fail but he'll be removed from the mission.

The Skulls can only be extracted via Wormhole Fulton or a Fulton Cargo upgrade. Do NOT wait until the end of the battle to extract them, otherwise they will get up and jump away before you can even approach them.

You need to fulton exactly 1,000 soldiers in order to unlock development for the F-Ballista. You need to fulton exactly 1,000 soldiers in order to unlock development for the F-Ballista.