Philadelphia Pennsylvania Along is a legal document typically associated with promissory notes and mortgages. It serves as an attachment to these financial agreements and is used to endorse the transfer of these debts from one party to another. This mechanism enables the new holder of the note to enforce the debt and collect payments. The Philadelphia Pennsylvania Along is valid and enforceable under the laws and regulations of the state of Pennsylvania and more specifically of the city of Philadelphia. It functions as an essential tool for parties involved in financial transactions involving promissory notes or mortgages within this jurisdiction. There are a few different types of Philadelphia Pennsylvania Alleges that may be encountered depending on the specific circumstances and requirements involved in the transfer of the debt. Some of these types include: 1. Blank Along: This is an along left blank, without any endorsements or transfer details. It provides flexibility for future transfers as it can be endorsed by successive holders. 2. Special Along: This type of along contains specific endorsements and transfer details, including the name of the transferee, date, and any necessary signatures. It explicitly designates the transferee as the new holder of the note. 3. Multiple Alleges: In some cases, multiple alleges may be attached to a single promissory note or mortgage. Each along represents a separate transfer of the debt, and the order in which they are attached indicates the chronological sequence of these transfers. 4. Restrictive Along: This type of along includes specific restrictions or conditions on the transfer of the note. It may require the consent of the transferee before any further endorsements or transfers can occur. When executing a Philadelphia Pennsylvania Along, it is crucial to ensure strict compliance with the local legal requirements and adhere to the appropriate procedures to validate the transfer of the debt. It is advisable to consult with legal professionals familiar with the specific laws in Philadelphia and Pennsylvania to ensure proper documentation and smooth transactions.

Philadelphia Pennsylvania Allonge

Description

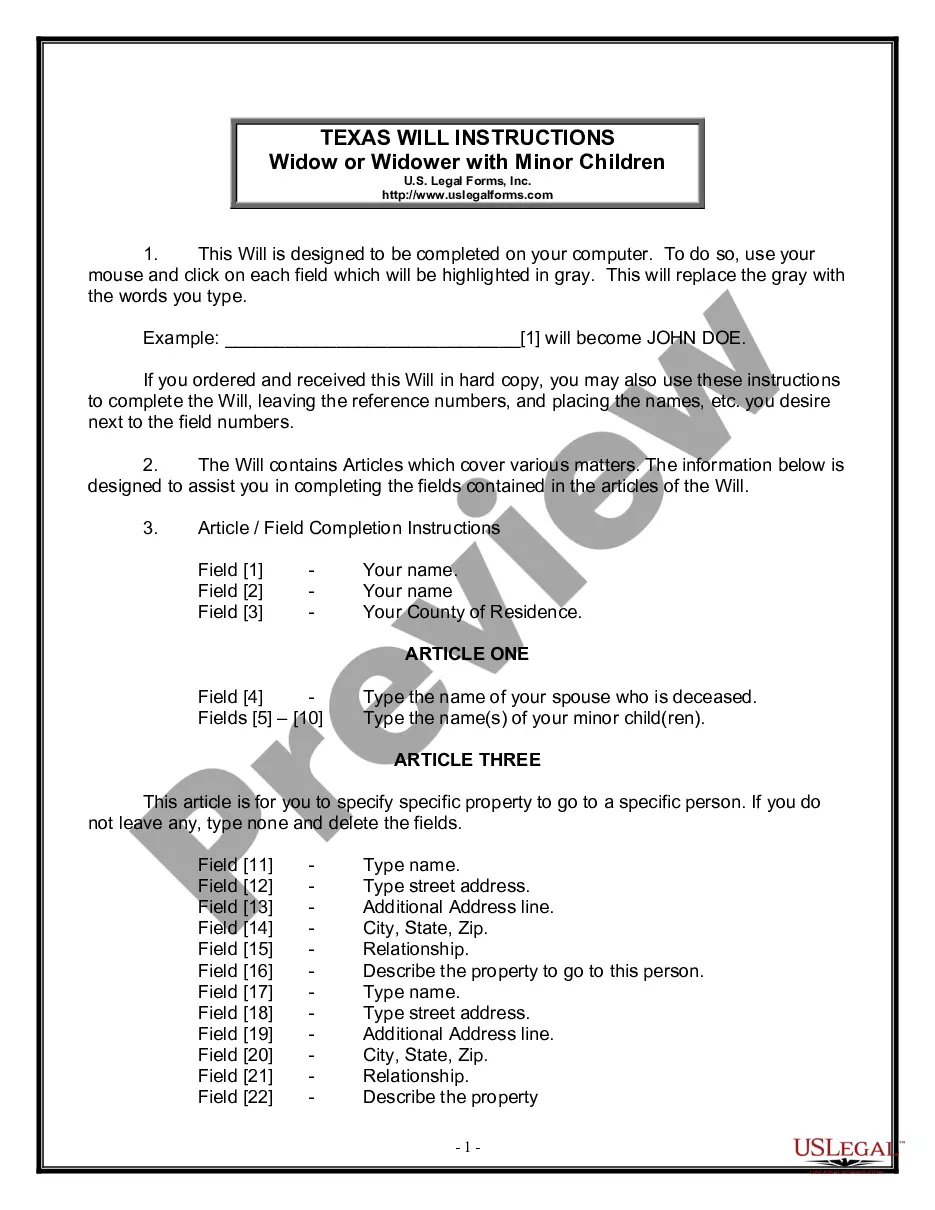

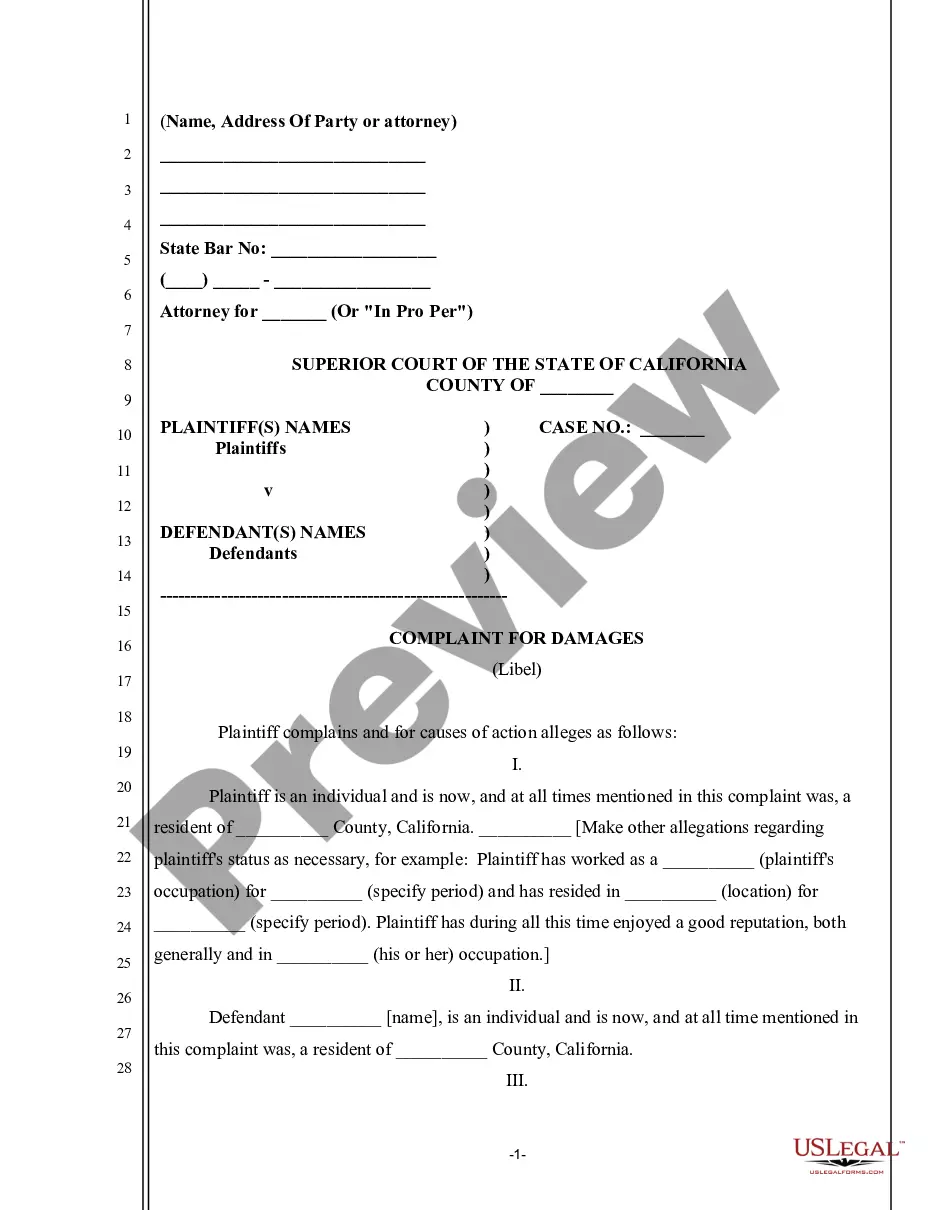

How to fill out Philadelphia Pennsylvania Allonge?

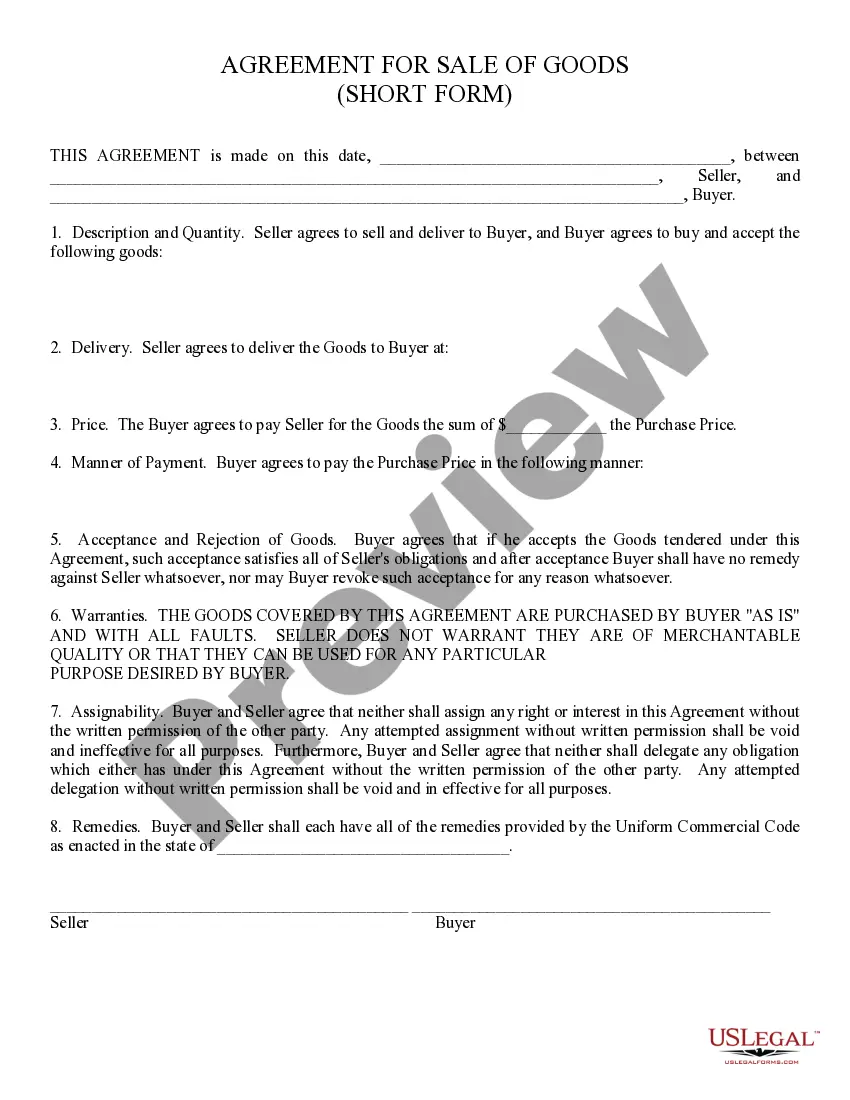

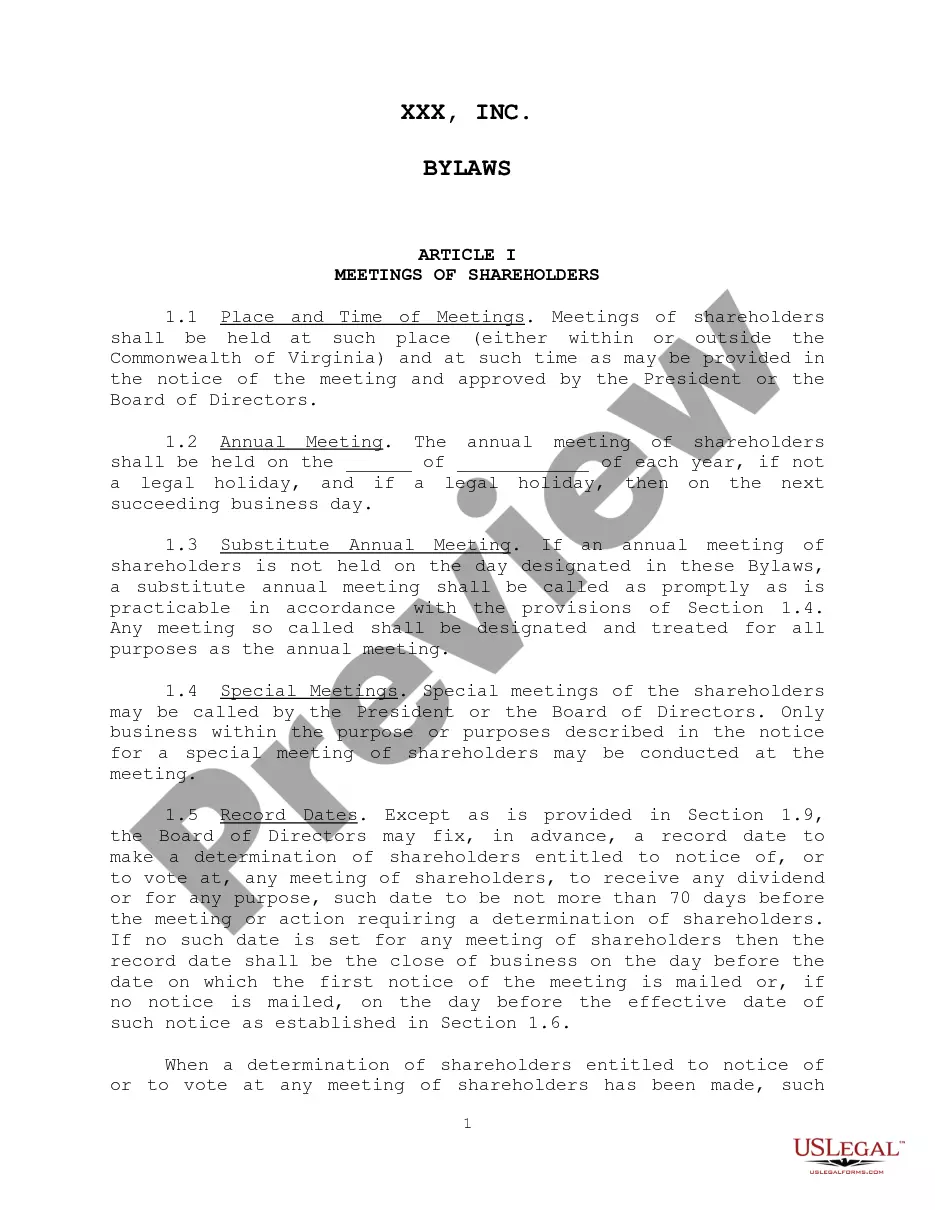

If you need to find a trustworthy legal paperwork provider to find the Philadelphia Allonge, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support team make it simple to get and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Philadelphia Allonge, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Philadelphia Allonge template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate agreement, or complete the Philadelphia Allonge - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows ?

How to pay Mail the application form to: Philadelphia Dept. of Revenue. 1401 John F. Kennedy Blvd.File returns and send quarterly payments to: Philadelphia Dept. of Revenue. P.O. Box 1648. Philadelphia, PA 1910520101648.File and pay the annual reconciliation by mailing it to: Philadelphia Dept. of Revenue. P.O. Box 1648.

How to pay File a return by mail. Mail your return to: Philadelphia Dept. of Revenue. P.O. Box 1660.Pay by mail. Mail all payments with a payment coupon to: Philadelphia Dept. of Revenue. P.O. Box 1393.Request a refund by email. Mail your return and refund request to: Philadelphia Dept. of Revenue. P.O. Box 1137.

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax. Effective July 1, 2021, the rate for residents is 3.8398 percent, and the rate for non-residents is 3.4481 percent.

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must fb01le a Business Income & Receipts Tax (BIRT) return.

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

An individual is considered a resident rather than a part- year resident if that person was physically present in PA for at least 184 days (or parts of 184 days) and maintained a permanent place of abode in PA at any time during the tax year.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).