Clark Nevada is a legal term that refers to a specific type of sale of assets of a corporation. In this context, "Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws" implies that the transaction does not need to adhere to bulk sales laws. Bulk sales laws are regulations that govern the sale of a significant portion or all of a business's assets outside the ordinary course of business. These laws aim to protect creditors and ensure they are paid before the business's assets are transferred. However, in a Clark Nevada sale of assets, the transaction is exempt from complying with bulk sales laws. This exemption may occur due to specific circumstances or legislative provisions, allowing the assets of a corporation to be sold without the typical requirements of bulk sales laws. There can be different types of Clark Nevada Sales of Assets of Corporations with No Necessity to Comply with Bulk Sales Laws, including: 1. Distressed Business Sales: When a corporation is facing financial distress or bankruptcy, it may be necessary to sell its assets quickly and efficiently to satisfy creditors. A Clark Nevada sale can provide a means to bypass bulk sales laws, streamlining the process. 2. Mergers and Acquisitions: In some cases, when one corporation acquires another, certain assets may be sold without the need for compliance with bulk sales laws. This can help expedite the transaction and reduce administrative burdens. 3. Internal Restructuring: Large corporations often undergo internal restructuring to optimize their operations or streamline their businesses. During such restructurings, the sale of certain assets may not require compliance with bulk sales laws, allowing for ease and flexibility in the process. 4. State-Specific Exceptions: Specific states may have legal provisions that permit certain sales of assets without needing to comply with bulk sales laws. These exceptions can vary, necessitating the need for a Clark Nevada sale in those particular jurisdictions. In summary, a Clark Nevada Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws refers to a specific type of asset sale exempt from adhering to bulk sales regulations. Various situations can warrant such a sale, including distressed businesses, mergers and acquisitions, internal restructuring, or state-specific exceptions.

Clark Nevada Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Clark Nevada Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Clark Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Clark Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Clark Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws:

- Make sure you have opened the right page with your regional form.

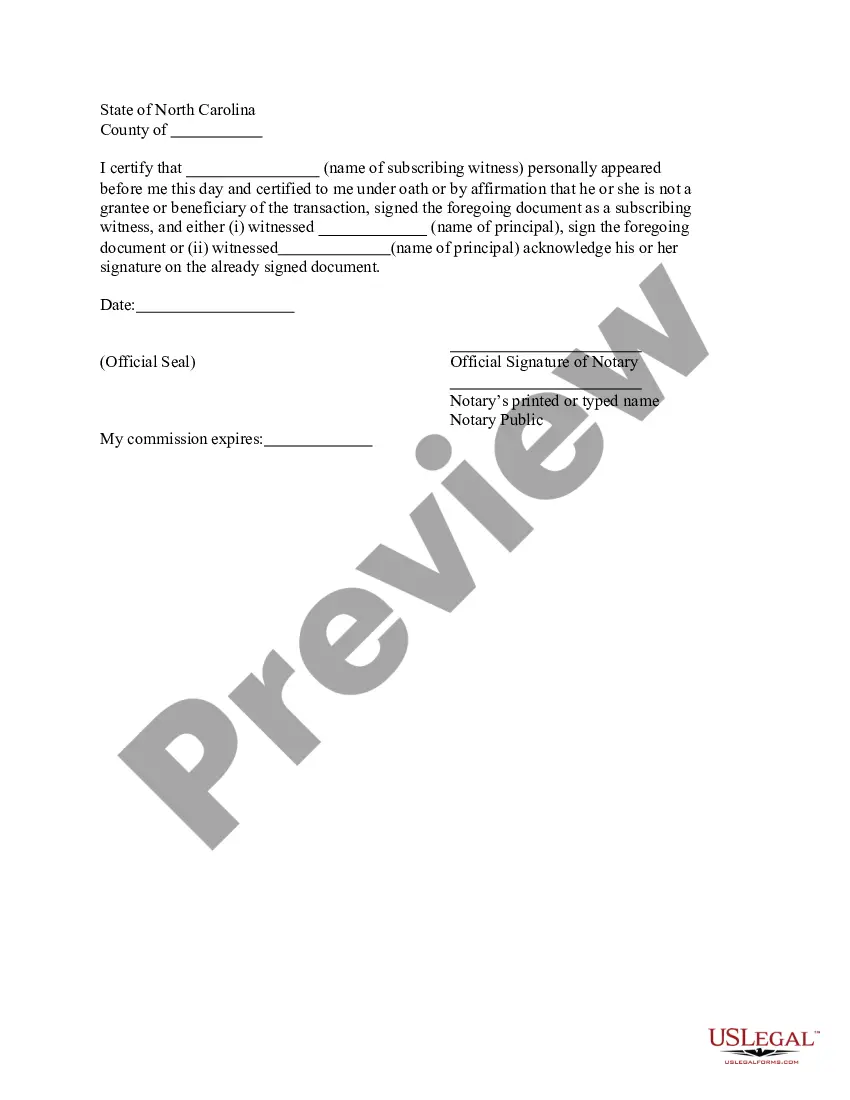

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Clark Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!