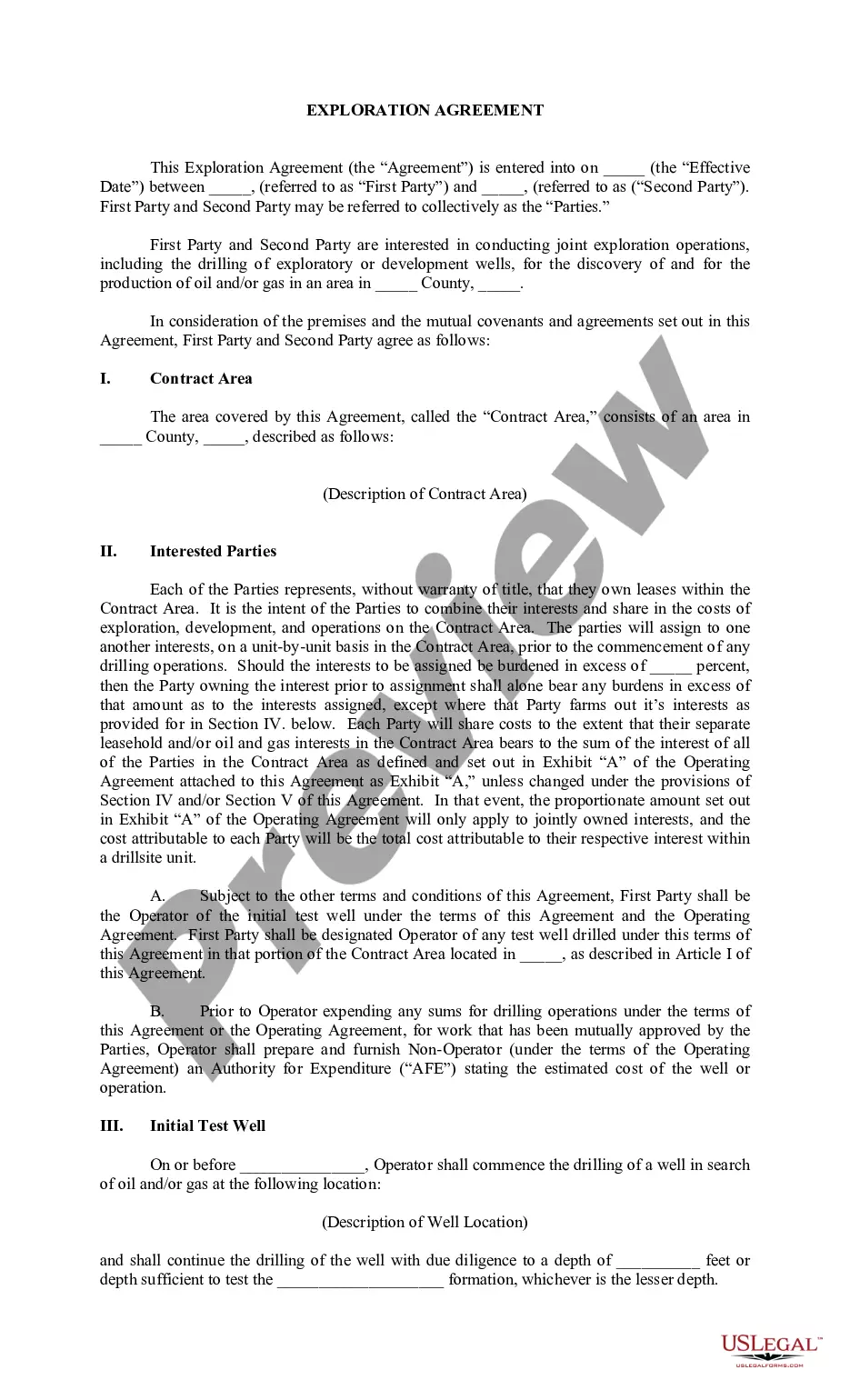

Cook Illinois Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws refers to a transaction where a corporation located in Cook County, Illinois, sells its assets without the need to adhere to the regulations set forth by bulk sales laws. This type of sale enables corporations to conduct asset transfers smoothly and efficiently, without the need for extensive legal processes. Cook Illinois Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws can include various types, such as: 1. Voluntary Asset Sale: This type of sale occurs when a corporation willingly decides to sell its assets, either to streamline operations, liquidate assets, or transition into a different business structure. The absence of adhering to bulk sales laws simplifies the process and allows for a quicker and more straightforward transaction. 2. Bankruptcy Asset Sale: In cases where a corporation files for bankruptcy, it may be required to sell its assets to repay creditors or dissolve the company. Cook Illinois Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws can offer a more efficient way to handle asset transfers, taking into account the unique circumstances of bankruptcy proceedings. 3. Merger or Acquisition: When a corporation merges with or is acquired by another entity, a sale of assets often takes place. The exemption from bulk sales laws ensures that the merging or acquiring company can seamlessly integrate the purchased assets into its operations without additional legal barriers. 4. Restructuring or Reorganization: Corporations undergoing internal restructuring or reorganization may opt to sell certain assets to optimize their operations or address financial challenges. Cook Illinois Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws provides a valuable framework for conducting these asset transfers quickly and efficiently. By eliminating the need to comply with bulk sales laws, Cook Illinois Sale of Assets of Corporation streamlines the asset transfer process, reducing legal and administrative burdens. This allows corporations to efficiently sell their assets, whether voluntarily or as part of larger business changes such as bankruptcy, merger, acquisition, restructuring, or reorganization.

Cook Illinois Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Cook Illinois Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Cook Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws suiting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. In addition to the Cook Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Cook Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Cook Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!