Dallas, Texas, Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws In Dallas, Texas, the sale of assets of a corporation without the requirement to comply with bulk sales laws presents a unique opportunity for both buyers and sellers. This transaction allows for a streamlined process, ensuring efficient and hassle-free exchanges of assets, all while bypassing the typical legal requirements associated with bulk sales laws. In this context, there are different types of Dallas, Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws. Here are a few examples: 1. Traditional Asset Sale: This type of transaction involves the sale of tangible and intangible assets of a corporation, such as property, equipment, inventories, trademarks, and intellectual property rights. It allows buyers to acquire specific assets without the burden of assuming the corporation's liabilities. 2. Intellectual Property Sale: This type of sale focuses primarily on the transfer of intellectual property assets, which may include patents, copyrights, trademarks, trade secrets, and licenses. Buyers can acquire exclusive rights to these assets without concerns regarding potential undisclosed liabilities. 3. Real Estate Asset Sale: This variant of the sale of assets specifically involves the transfer of real estate properties owned by a corporation. Buyers can acquire commercial, residential, or industrial properties in Dallas, Texas, with the assurance of a seamless process exempt from bulk sales laws. 4. Equipment Asset Sale: This type of sale primarily revolves around the transfer of machinery, vehicles, tools, or other equipment owned by a corporation. Buyers can expand their business operations in Dallas, Texas, by acquiring necessary equipment without being encumbered by bulk sales law requirements. 5. Inventory Asset Sale: In this specific type of transaction, buyers have the opportunity to acquire a corporation's inventory, including finished goods, raw materials, and supplies. This can be beneficial for businesses looking to stock up on inventory quickly and efficiently. The beauty of the Dallas, Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws lies in its flexibility, allowing buyers to choose the specific assets they are interested in purchasing while mitigating the legal complexities typically associated with bulk sales. It ensures a smooth transfer of assets, providing both buyers and sellers the freedom and ease to engage in transactions that align with their respective business strategies and objectives.

Dallas Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

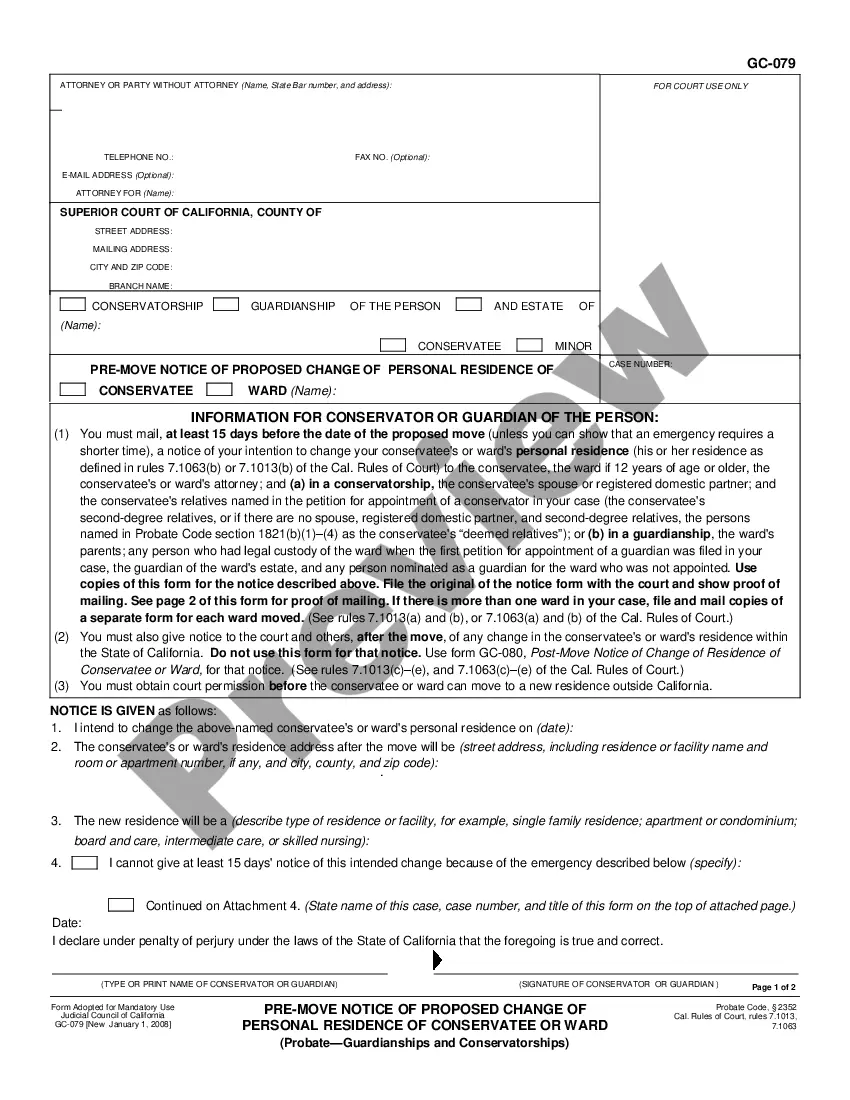

How to fill out Dallas Texas Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Dallas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Apart from the Dallas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Dallas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws:

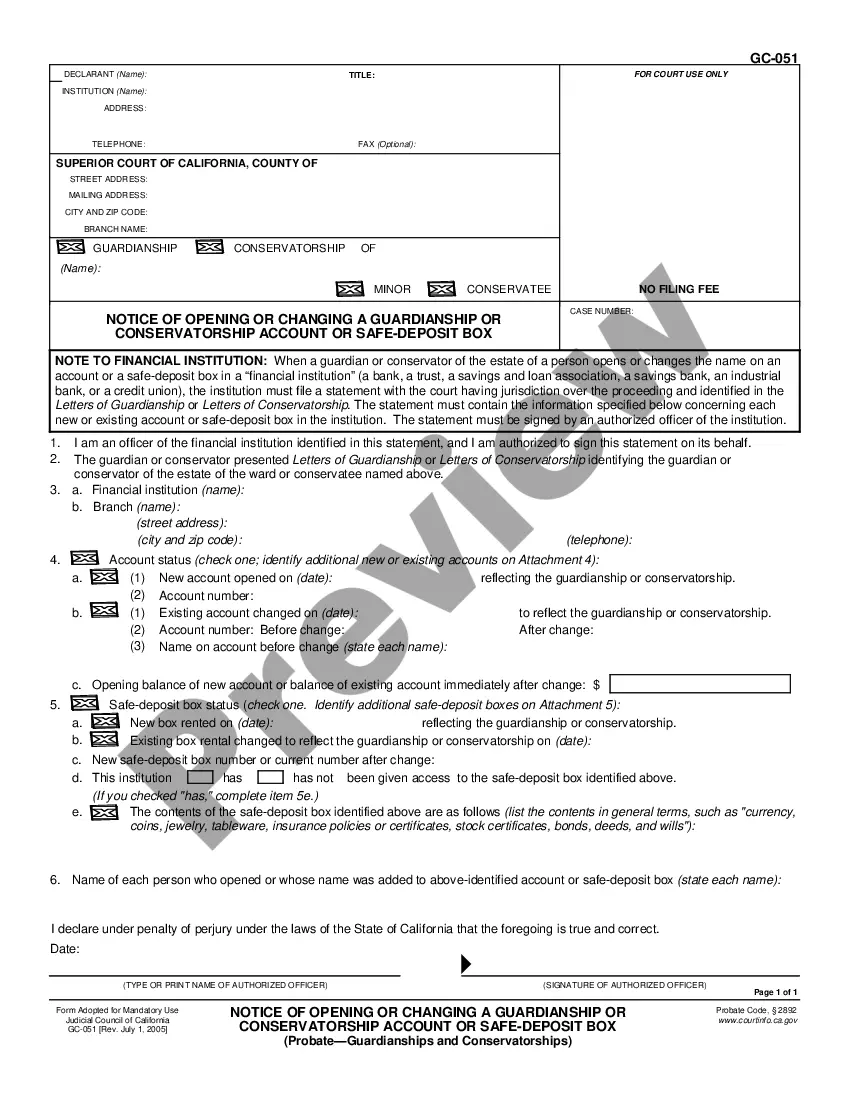

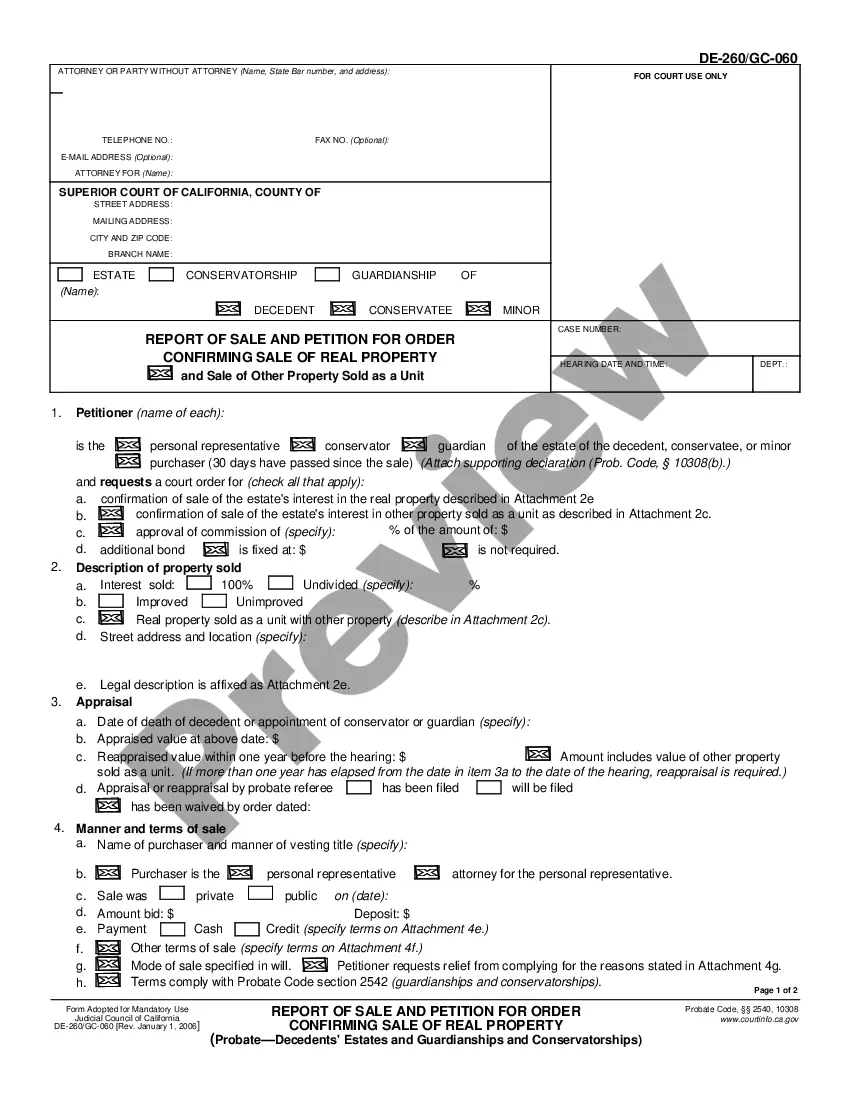

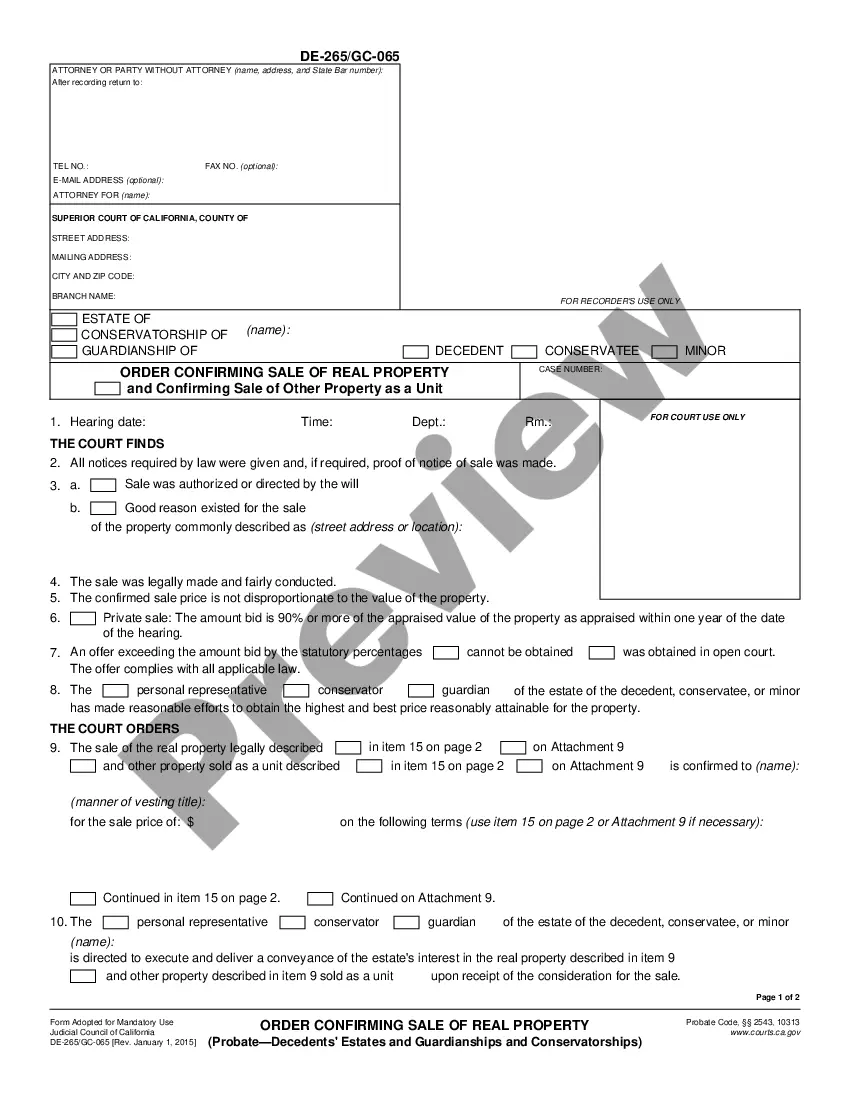

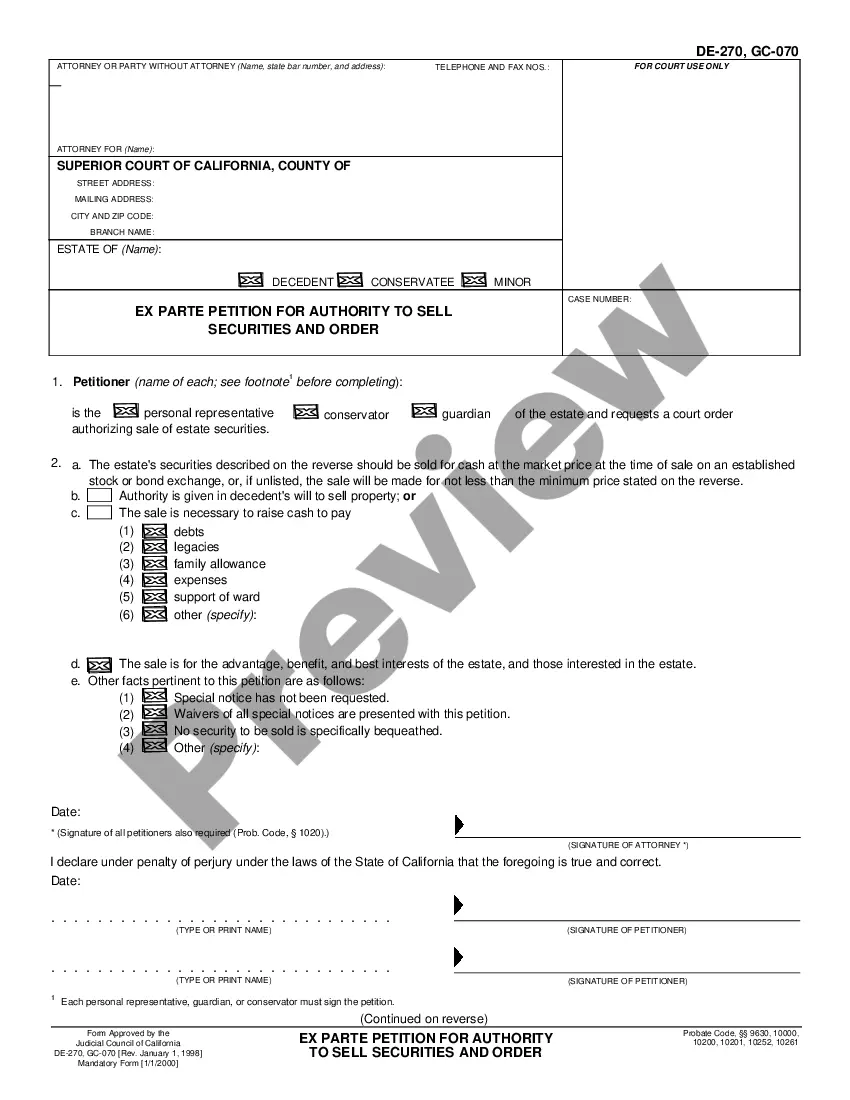

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Dallas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!