Houston Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws is a legal process wherein a corporation or business entity in Houston, Texas, sells its assets without needing to comply with bulk sales laws. This type of transaction allows for a streamlined and efficient way of transferring assets and can be particularly advantageous in certain situations. One key aspect of Houston Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws is that it eliminates the need for the seller to adhere to the traditional legal requirements associated with bulk sales. Bulk sales laws typically require sellers to provide advance notice of the sale to creditors and follow specific procedures to protect the rights of creditors. However, in this case, the sale can proceed without having to comply with these obligations. This type of sale can be particularly beneficial in situations where a company wants to liquidate its assets quickly, such as in bankruptcy proceedings or when a business wants to restructure its operations. By bypassing the usual requirements, the corporation can expedite the sale process and potentially achieve higher returns on its assets. There may be different types or scenarios where Houston Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws are applicable. Some examples include: 1. Bankruptcy Sales: When a corporation is going through bankruptcy proceedings, it may opt for a sale of assets to generate funds to pay off creditors. By utilizing this method, the corporation can avoid the complexities associated with bulk sales laws and accelerate the liquidation process. 2. Business Restructuring: In situations where a corporation wants to restructure its operations, it may choose to sell off certain assets to streamline its core business. By utilizing Houston Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, the corporation can conveniently divest its non-essential assets without being hindered by bulk sales regulations. 3. Mergers and Acquisitions: In some cases, during a merger or acquisition, a corporation may choose to sell specific assets that are not aligned with the new entity's strategic objectives. Using this approach, the corporation can swiftly dispose of these assets without the cumbersome requirements associated with bulk sales laws. In summary, Houston Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws offers corporations and businesses in Houston, Texas, a flexible and efficient means of selling their assets without having to comply with the usual obligations imposed by bulk sales laws. This streamlined process benefits corporations in bankruptcy, those undergoing restructuring, and during mergers and acquisitions, enabling quicker asset liquidation and business optimization.

Houston Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Houston Texas Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

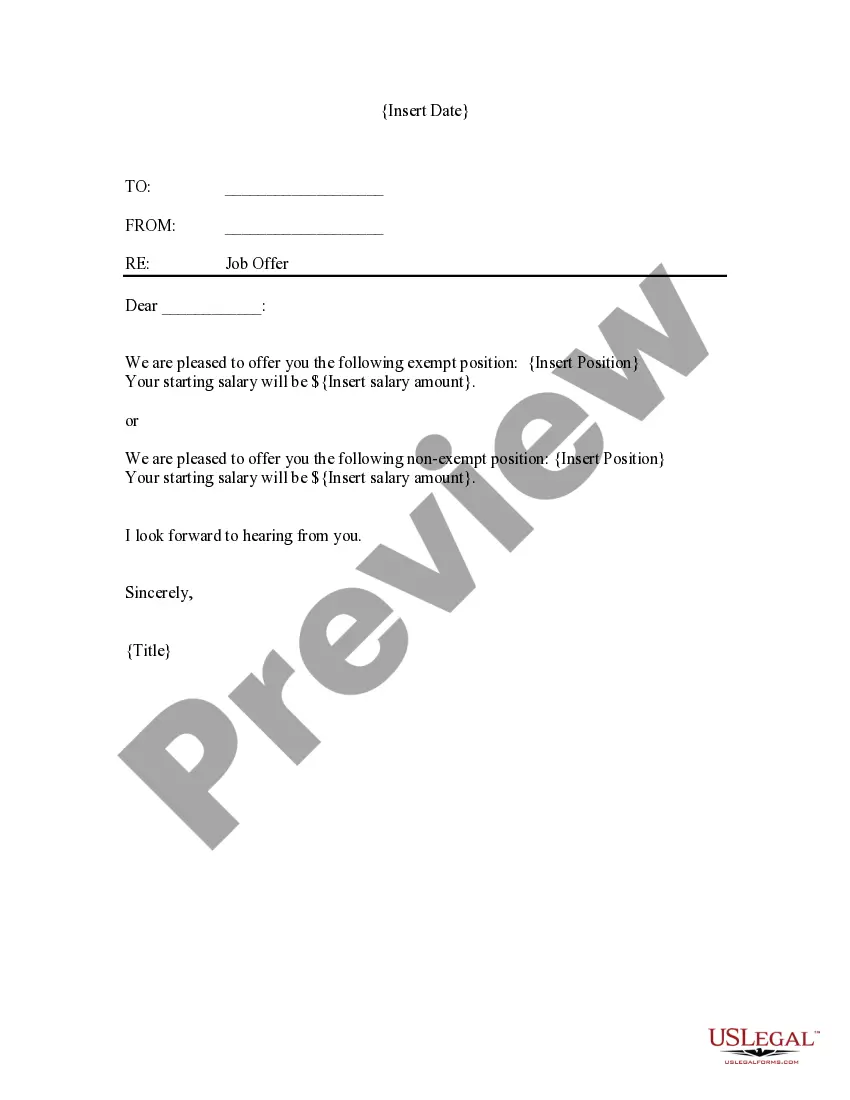

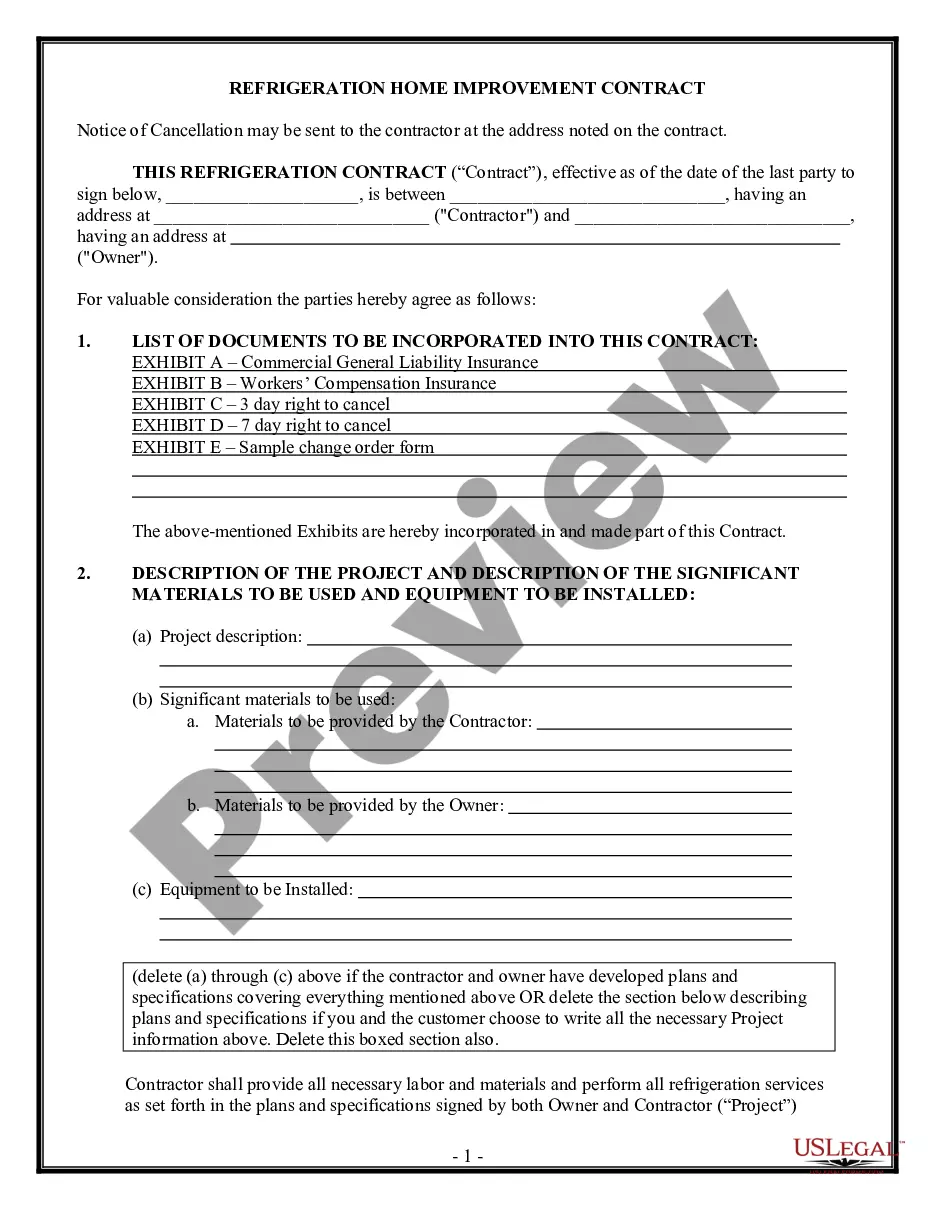

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Houston Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information resources and tutorials on the website to make any activities associated with document execution straightforward.

Here's how you can purchase and download Houston Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Check the related forms or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and buy Houston Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Houston Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you need to deal with an exceptionally complicated situation, we recommend using the services of a lawyer to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents with ease!

Form popularity

FAQ

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

The BSA was enacted in 1917, and was intended to protect unpaid trade creditors (i.e. the people a seller is indebted to for goods, money or services furnished for the purpose of enabling the seller to carry on his or her business) from ?bulk sales? by a seller of all or substantially all of its assets over a short

What is bulk selling? Bulk selling is the selling of goods or merchandise in large quantities to retailers, other bulk sellers, or to other business users in the industrial, commercial, or institutional sectors.

While the rules and laws for bulk sales may change from state to state, a bulk sales transaction is a sale or transfer that takes place outside of the normal course of business and involves more than 51% of a business's assets.

Except in the case of tax-paid deliveries into the fuel supply tanks of motor vehicles, it shall be unlawful to make bulk sales of special fuels to any user or dealer who is not licensed as such, when the supplier knows, or reasonably should know the purchaser is not a licensed user or dealer.

Sec. 11. Any person violating any provision of this Act shall, upon conviction thereof, be punished by imprisonment for not less than six months, nor more than five years, or fined in a sum not exceeding five thousand pesos, or by both such imprisonment and fine, in the discretion of the court.

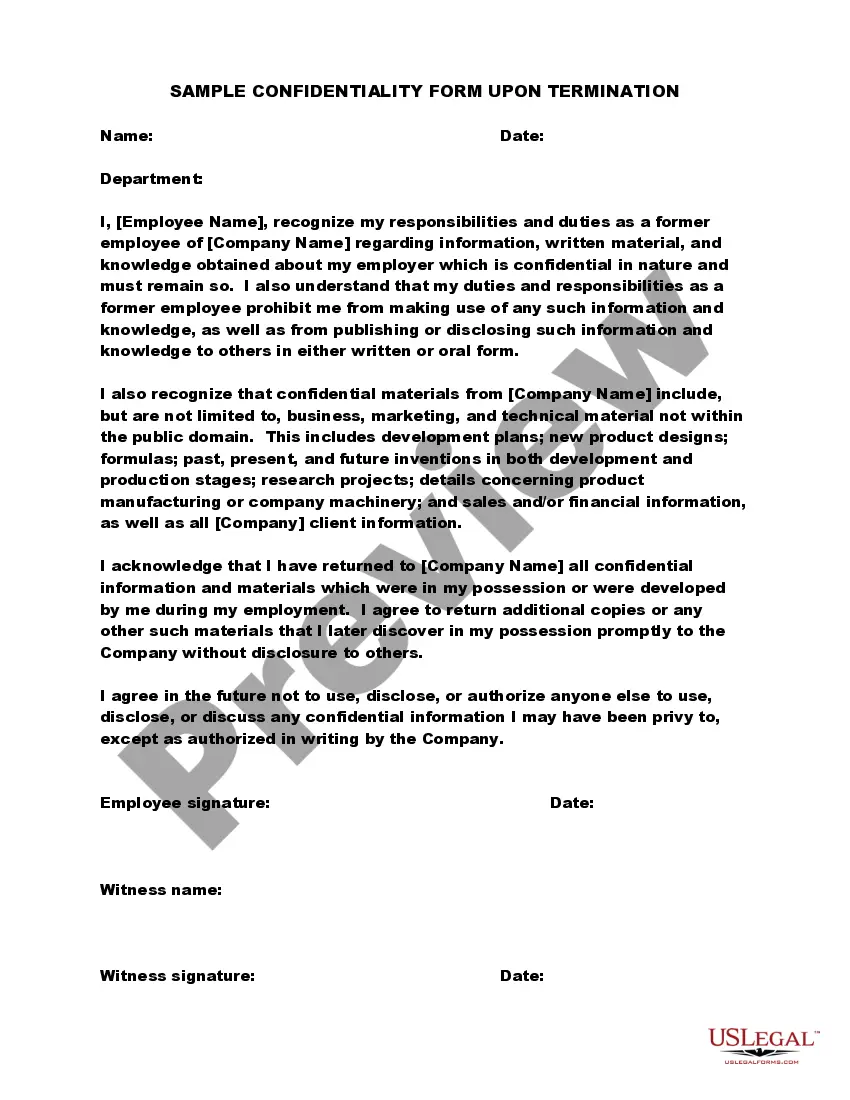

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

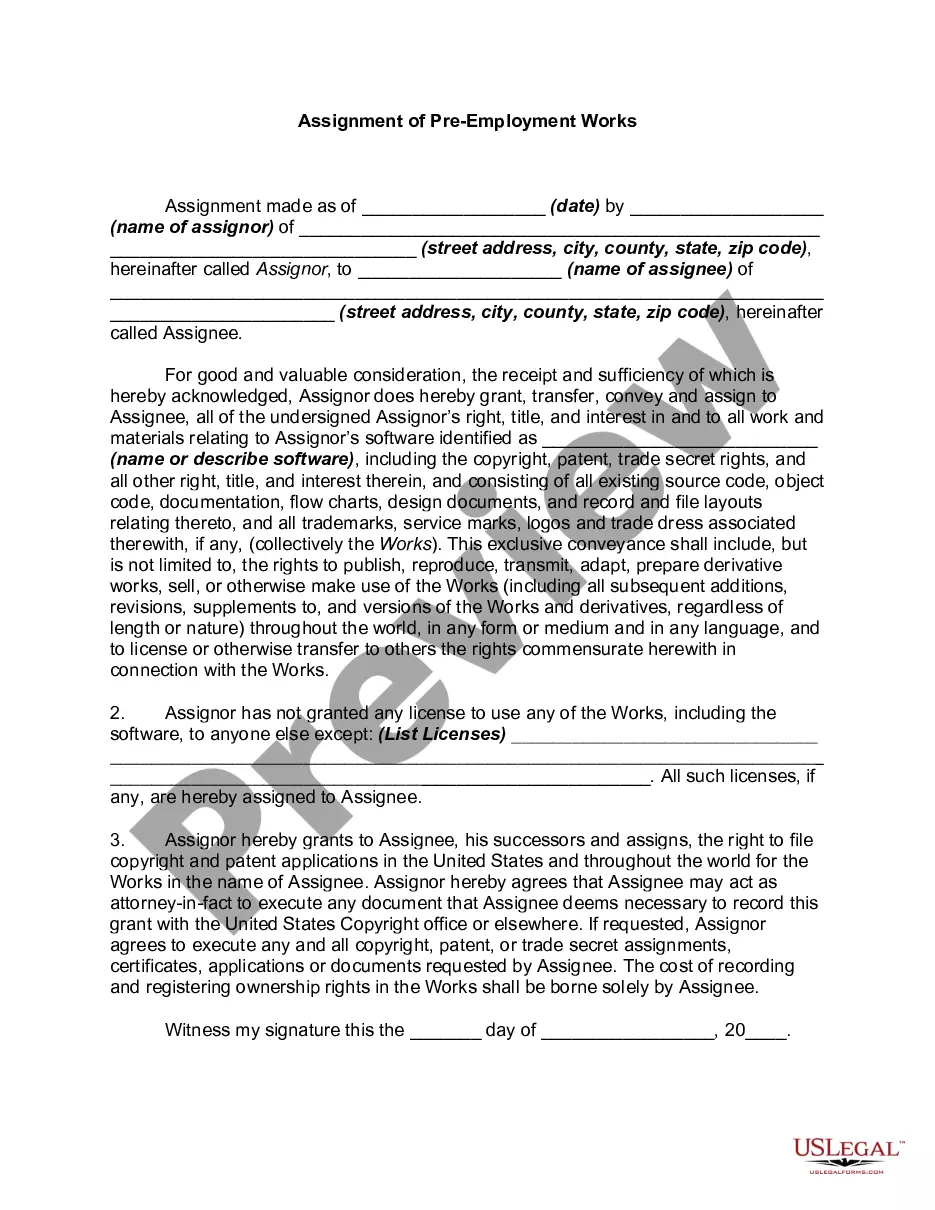

There are several formalities required by the Bulk Sales Law: The sale in bulk to be accompanied by sworn statement of the vendor/mortgagor listing the names and addresses of, and amounts owing to, creditors; The sworn statement shall be furnished to the buyer, the seller is required to prepare an inventory of stocks

The key elements of a ?Bulk Sale? are: any sale outside the ordinary course of the Seller's business. of more than half the Seller's inventory and equipment. as measured by the fair market value on the date of the Bulk Sale Agreement (?Agreement?).