Suffolk, New York, is a county located on Long Island, within the state of New York. When it comes to the sale of assets of a corporation in Suffolk, it is crucial to understand the specific laws and regulations that apply. One type of sale that can occur in this jurisdiction is the Sale of Assets of a Corporation with No Necessity to Comply with Bulk Sales Laws. In the context of business transactions, the sale of assets refers to the transfer of ownership of a company's tangible or intangible assets to another entity. Typically, these assets include real estate, equipment, inventory, intellectual property, customer lists, and goodwill. However, the sale of assets of a corporation in Suffolk has a unique characteristic: there is no requirement to comply with bulk sales laws. Bulk sales laws are regulations that govern the sale of a significant portion of a business's assets outside its ordinary course of business. These laws aim to protect creditors by ensuring that the sale proceeds are used to satisfy outstanding debts. However, in certain situations, a corporation in Suffolk may be exempt from complying with these laws, allowing for a simplified sales process. The Sale of Assets of a Corporation with No Necessity to Comply with Bulk Sales Laws can occur under various circumstances. Some examples include: 1. Intercompany Transfers: When a parent corporation sells assets to its subsidiary or vice versa, bulk sales laws may not apply. This exemption recognizes that both entities are part of the same corporate structure and are therefore less likely to present a risk to creditors. 2. Asset Sales for Fair Value: In cases where the sale price is deemed "fair value" by a court, it may be exempt from bulk sales laws. This exemption ensures that the proceeds will cover the corporation's liabilities adequately, eliminating the need for additional oversight. 3. Sale of Assets in the Ordinary Course of Business: If a corporation sells assets as part of its regular business operations, bulk sales laws may not be applicable. This exemption allows companies to continue operating efficiently without unnecessary legal burdens. In conclusion, the Sale of Assets of a Corporation with No Necessity to Comply with Bulk Sales Laws in Suffolk, New York, offers companies a streamlined process for transferring ownership of their assets. These exemptions acknowledge specific scenarios where the risk to creditors is minimal, making it easier for corporations in Suffolk to engage in asset sales confidently.

Suffolk New York Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Suffolk New York Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

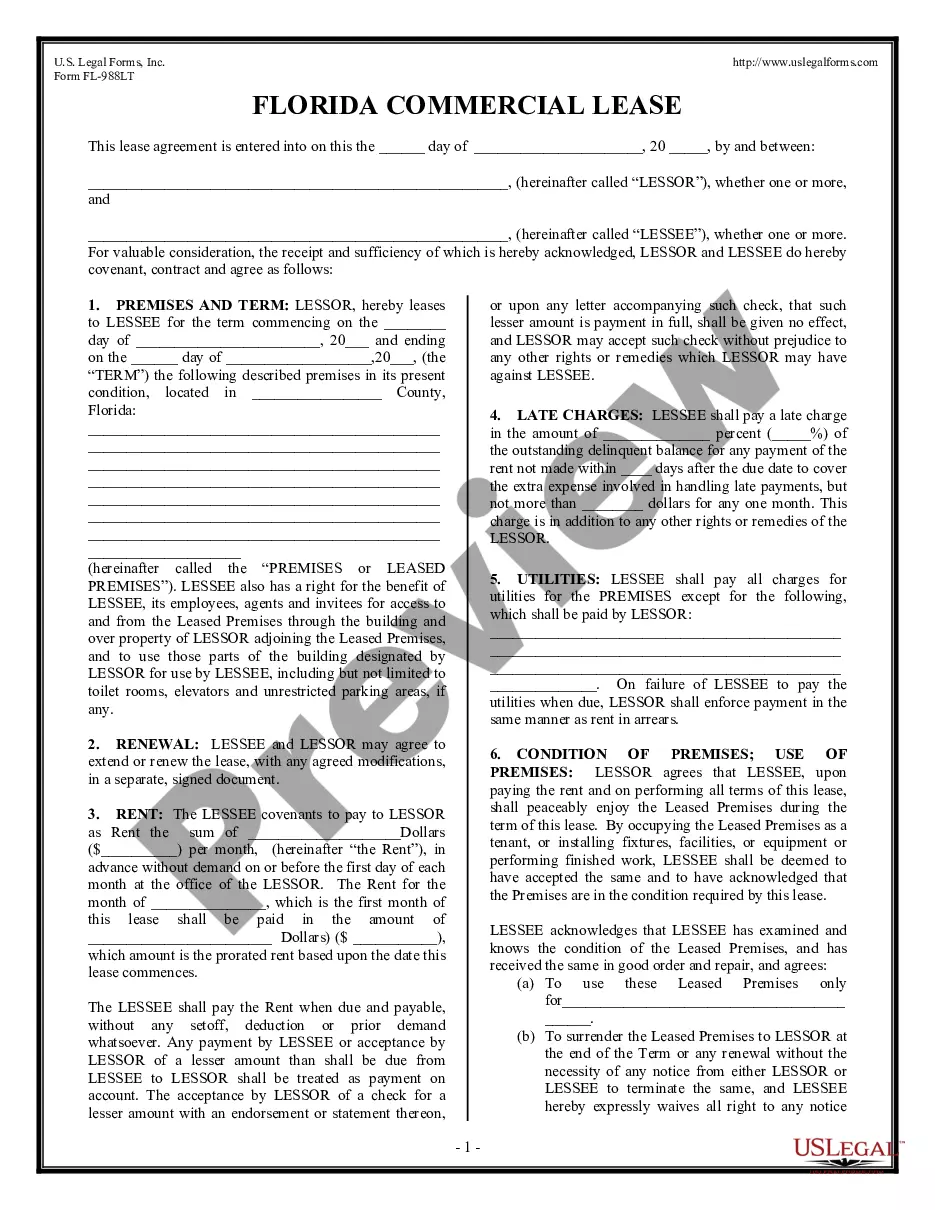

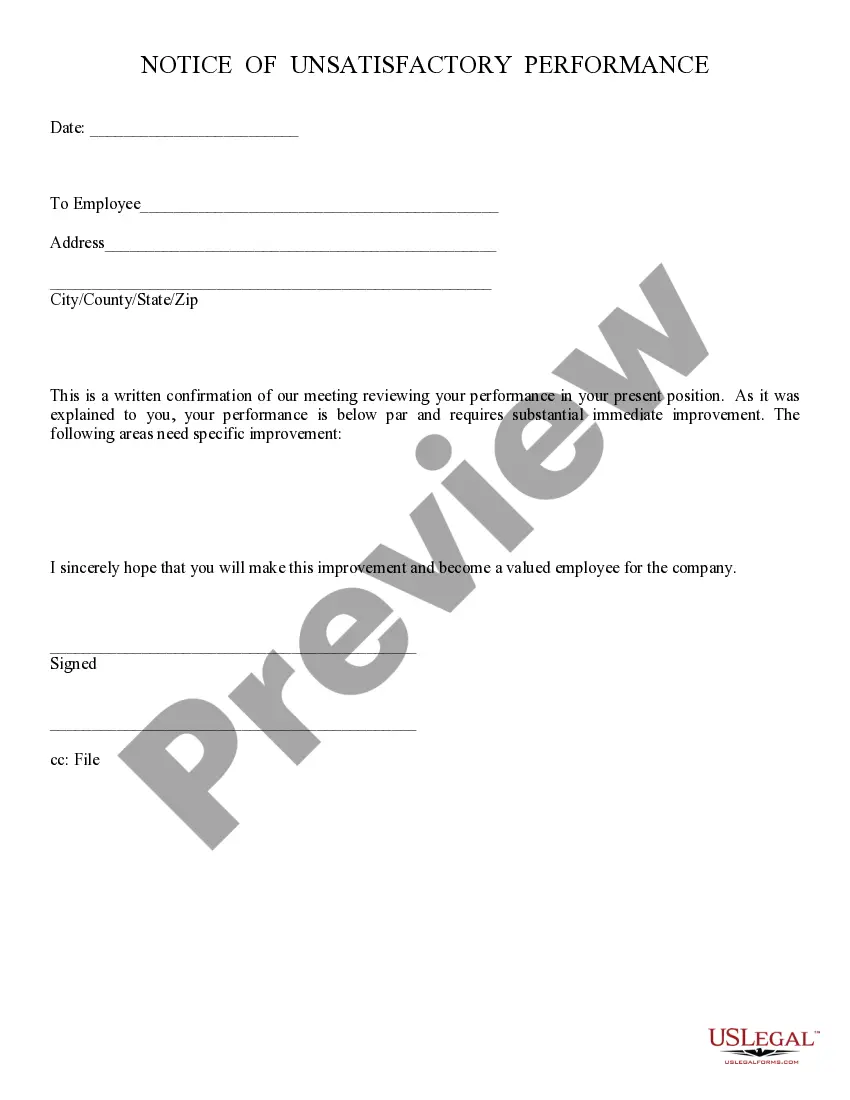

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Suffolk Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Suffolk Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!