Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, Travis Texas: Explained In Travis County, Texas, a sale of assets of a corporation can be conducted with no necessity to comply with bulk sales laws. This specific type of transaction allows for the smooth transfer of assets from one business entity to another without the need to adhere to the legal requirements and regulations typically associated with bulk sales. When a corporation decides to sell its assets, it typically involves the transfer of significant property, real estate, or tangible and intangible assets to another entity. However, in a sale of assets with no necessity to comply with bulk sales laws, the involved parties can bypass the burdensome legal processes typically associated with bulk sales. This type of sale is advantageous for both the seller and the purchaser. The seller can effectively divest assets while avoiding the time-consuming and potentially costly compliance procedures. On the other hand, the purchaser can acquire assets quickly and often at a lower cost without the need for extensive due diligence and compliance verification. Several scenarios may fall under the umbrella of the Travis Texas sale of assets of a corporation with no necessity to comply with bulk sales laws: 1. Sale to a Subsidiary or Affiliate: When a corporation wishes to transfer its assets to a subsidiary or an affiliated entity, this type of sale can enable a seamless transfer without invoking bulk sales laws. 2. Sale to an Acquiring Company: In cases where a corporation is being acquired by another business entity, the non-compliance with bulk sales laws allows for a straightforward transfer of assets, reducing the administrative burden for both parties involved. 3. Sale to a Management Buyout Group: In management buyout situations, where the existing management team plans to purchase the corporation's assets, non-compliance with bulk sales laws simplifies the acquisition process. It is important to note that while this type of sale relieves the involved parties from adhering to bulk sales laws, it is still crucial to ensure all legal requirements specific to Travis County, Texas, are met. Working with a knowledgeable attorney experienced in corporate transactions in Travis County can help ensure a smooth and legally sound sale of assets. In summary, the sale of assets of a corporation with no necessity to comply with bulk sales laws in Travis County, Texas, offers a convenient and streamlined process for transferring assets from one business entity to another. By bypassing bulk sales requirements, corporations can efficiently divest assets, while purchasers can acquire them swiftly and often at a reduced cost.

Travis Texas Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

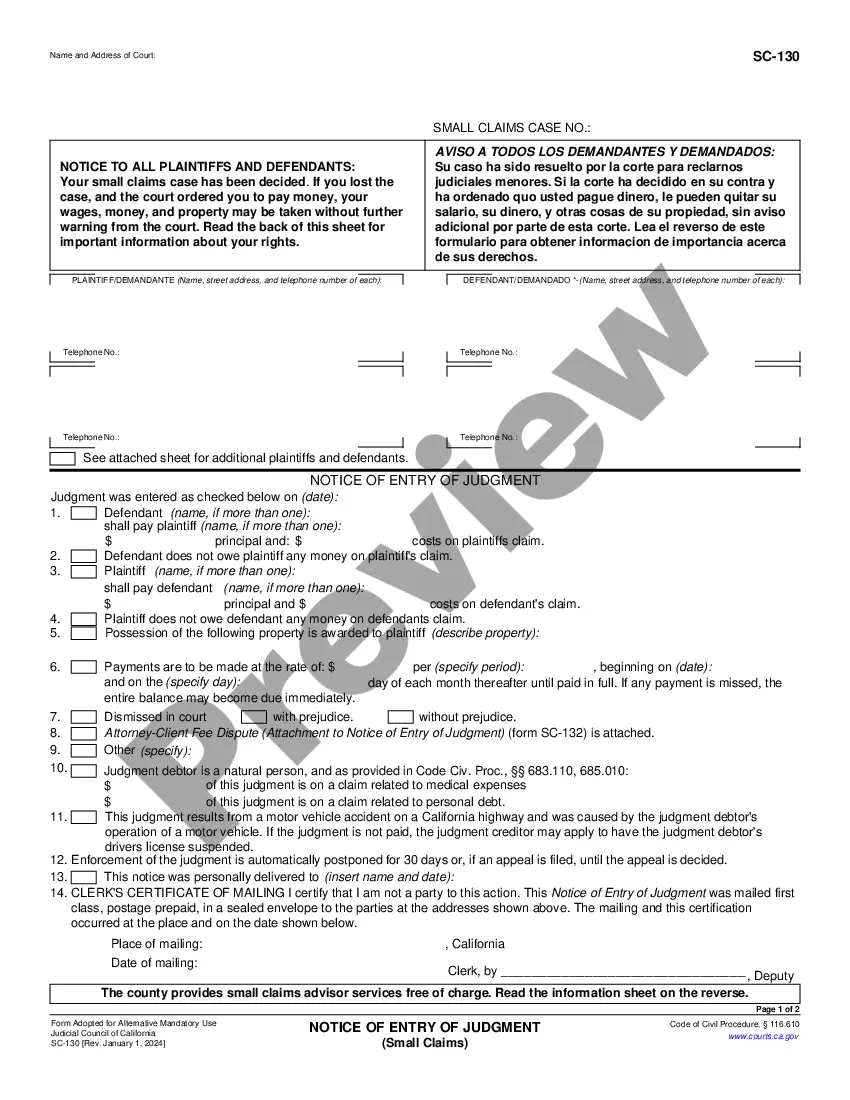

How to fill out Travis Texas Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Travis Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Travis Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Travis Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws:

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!