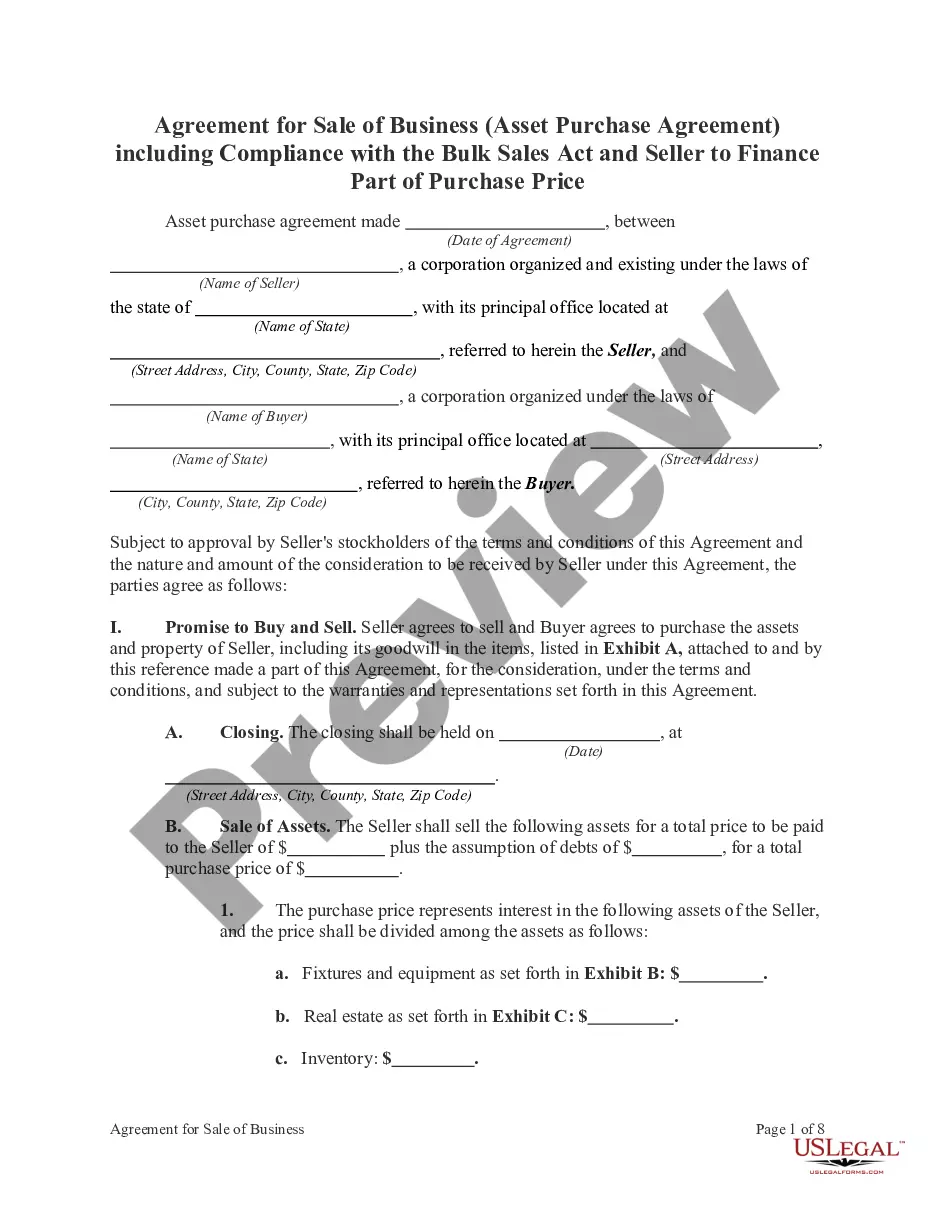

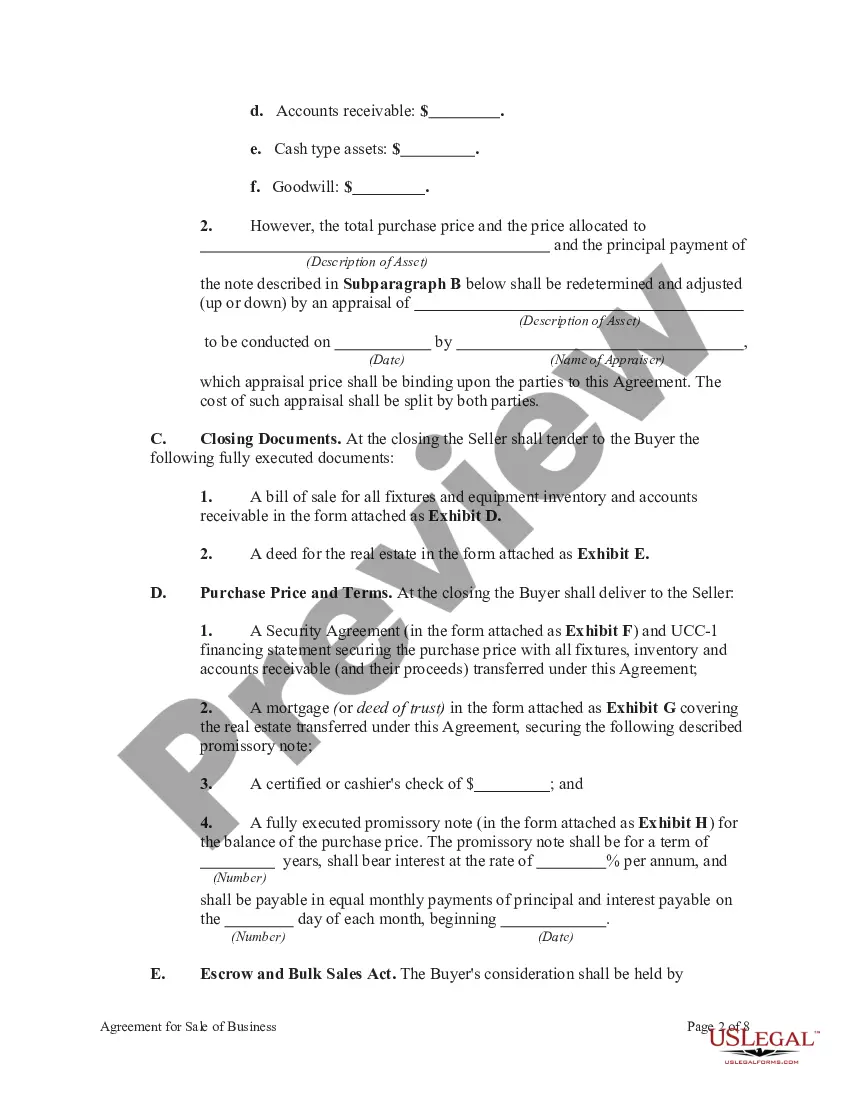

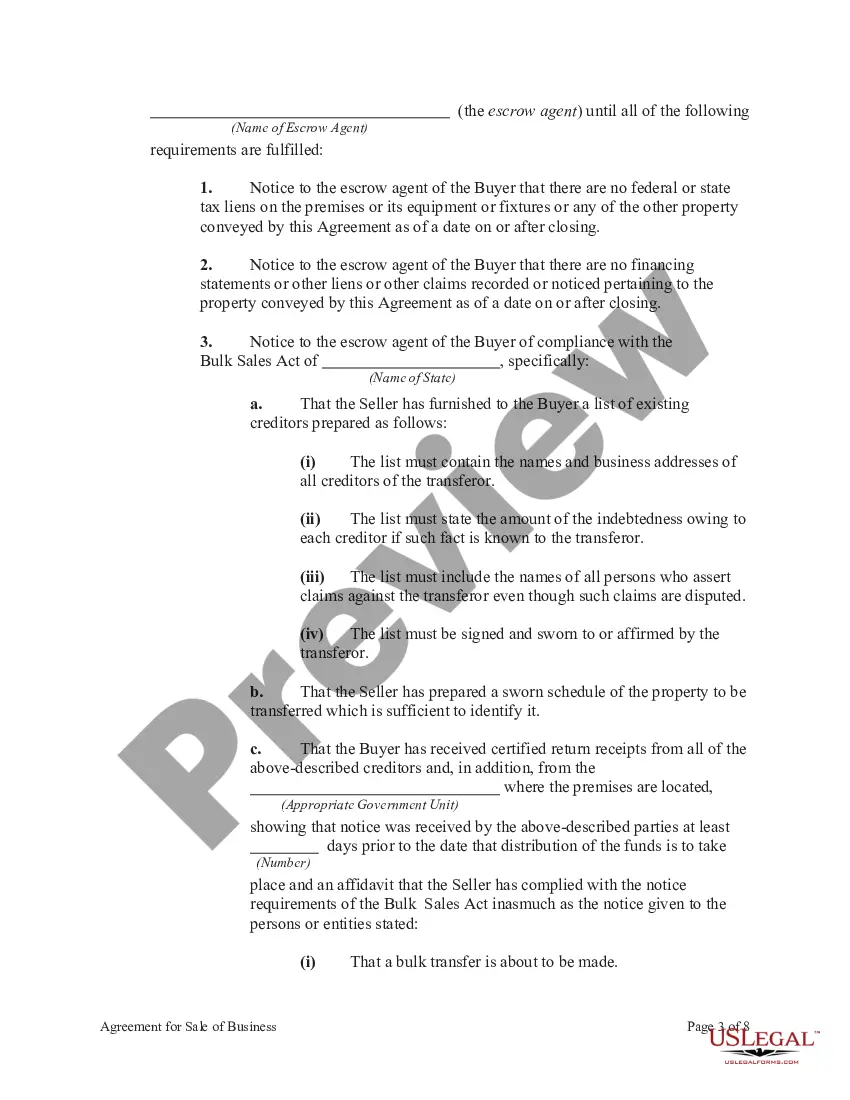

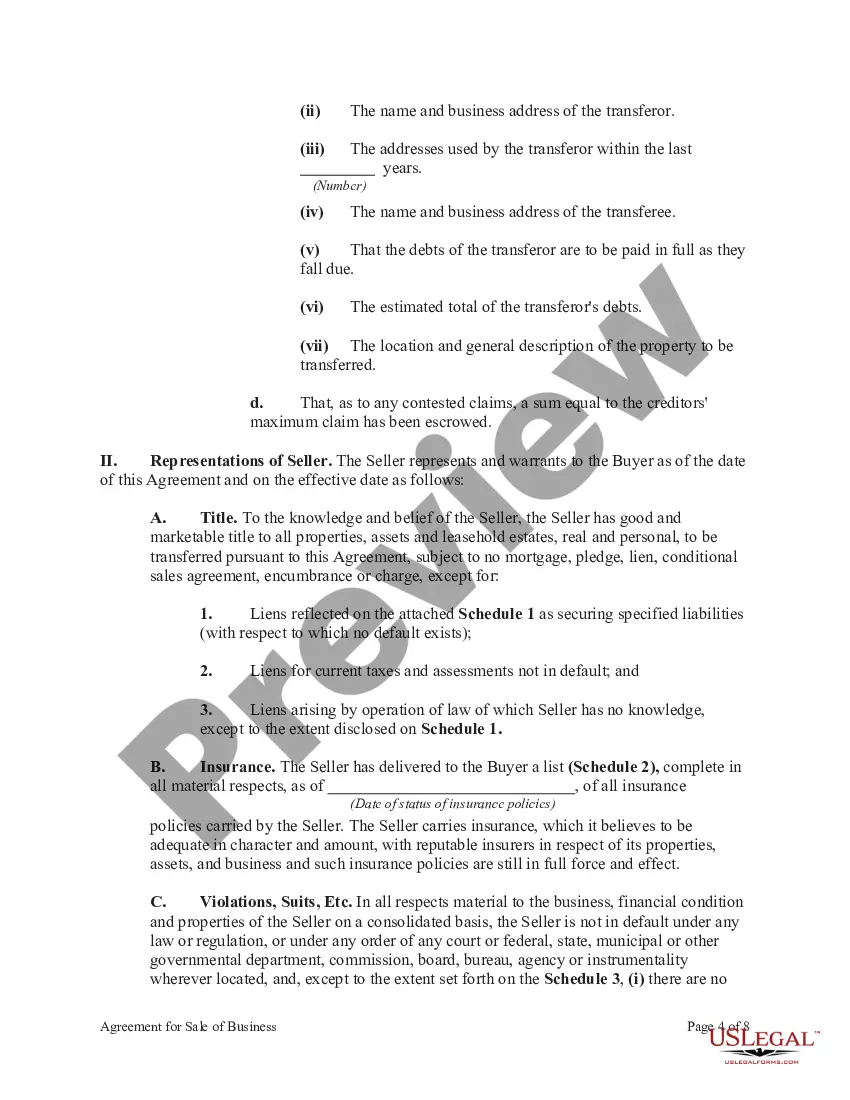

Oakland Michigan Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price is a legal document used in Oakland, Michigan, when selling a business. This agreement outlines the terms and conditions of the sale, ensuring compliance with the Bulk Sales Act and includes provisions for the seller to finance part of the purchase price. The agreement is designed to protect both the buyer and the seller in a business transaction. By complying with the Bulk Sales Act, which regulates the sale of a significant portion of a business's assets, the agreement ensures that the buyer is acquiring the business's assets free and clear of any undisclosed liabilities. This helps to minimize any potential risks for the buyer. In addition to compliance with the Bulk Sales Act, the agreement includes provisions for the seller to finance part of the purchase price. This means that a portion of the agreed-upon purchase price will be paid to the seller over a specified period, usually with interest. Seller financing can be beneficial to both parties, as it allows the buyer to acquire the business without needing to secure traditional financing, while the seller receives a steady stream of income from the buyer. The Oakland Michigan Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price can be customized based on the specific needs of the parties involved. Different types or variations of this agreement may exist depending on the nature of the business being sold and the terms negotiated between the buyer and the seller. Potential variations of this agreement may include specific clauses related to: 1. Assets: An agreement may outline in detail the specific assets being sold, including tangible assets such as equipment, inventory, and real estate, as well as intangible assets like intellectual property or customer lists. 2. Purchase Price and Payment Terms: The agreement should clearly state the total purchase price, the amount being financed by the seller, and the agreed-upon payment terms, including the interest rate, installment amounts, and the duration over which the remaining balance will be paid. 3. Representations and Warranties: Both the buyer and the seller may include representations and warranties to protect their interests. These clauses may cover the accuracy of financial statements, the condition of assets being sold, and any legal obligations. 4. Non-Compete and Restrictive Covenants: The agreement may include provisions preventing the seller from directly competing with the buyer's business within a specified geographic area or for a certain period after the sale. 5. Default and Remedies: The agreement should address the consequences of default by either party, including potential remedies such as termination, forfeiture of payments, or legal action. 6. Governing Law and Dispute Resolution: This section establishes the jurisdiction in which any disputes will be resolved and the method of resolution, such as arbitration or mediation. It is crucial for both parties to review and understand the terms of the Oakland Michigan Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price before signing. To ensure legal compliance and comprehensive protection, it is recommended that each party consults with a qualified attorney specializing in business transactions.

Oakland Michigan Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price

Description

How to fill out Oakland Michigan Agreement For Sale Of Business Including Compliance With Bulk Sales Act And Seller To Finance Part Of Purchase Price?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Oakland Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Aside from the Oakland Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Oakland Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Oakland Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!