Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law is a legal document that outlines the terms and conditions of transferring ownership of a business from a sole proprietor to a buyer, while also adhering to the bulk sales laws in the state of Virginia. This agreement ensures a smooth and legally compliant transaction. The Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law covers various aspects such as: 1. Parties Involved: The agreement clearly identifies the sole proprietor selling the business and the prospective buyer looking to acquire the business. It is important to include their legal names, contact information, and their roles in the transaction. 2. Business Description: A detailed description of the business being sold should be included in the agreement. This includes information about its nature, operations, assets, and any existing contracts or leases associated with the business. 3. Purchase Price and Payment Terms: The agreement specifies the purchase price for the business, including any down payment, installment payments, or financing arrangements agreed upon by both parties. It also outlines the terms and conditions for the method of payment, such as cash, check, or wire transfer. 4. Obligations and Liabilities: This section outlines the obligations and liabilities of both parties before and after the sale. It covers any existing debts, taxes, or outstanding obligations associated with the business, making it clear who will be responsible for these claims. 5. Confidentiality and Non-Compete Clause: The agreement may include provisions to protect the seller's confidential information or trade secrets. It may also include a non-compete clause to prevent the seller from opening a similar business in the same area for a specified period. 6. Closing in Escrow: The agreement states that the closing of the sale will be conducted in escrow, where a neutral third party, such as a title company or an attorney, holds and disburses the funds and necessary documents during the transaction. 7. Compliance with Bulk Sales Law: The agreement ensures compliance with the bulk sales laws of Virginia, which may require certain notices to be sent to creditors, vendors, or taxing authorities before the sale can be finalized. This aims to protect the buyer from potential claims or debts associated with the business. Different types of Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law may include variations based on the specific nature of the business being sold or negotiated terms between the parties involved. However, the main structure and essential elements of the agreement remain consistent.

Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law

Description

How to fill out Fairfax Virginia Agreement For Sale Of Business By Sole Proprietorship With Closing In Escrow To Comply With Bulk Sales Law?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Fairfax Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Fairfax Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law from the My Forms tab.

For new users, it's necessary to make several more steps to get the Fairfax Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law:

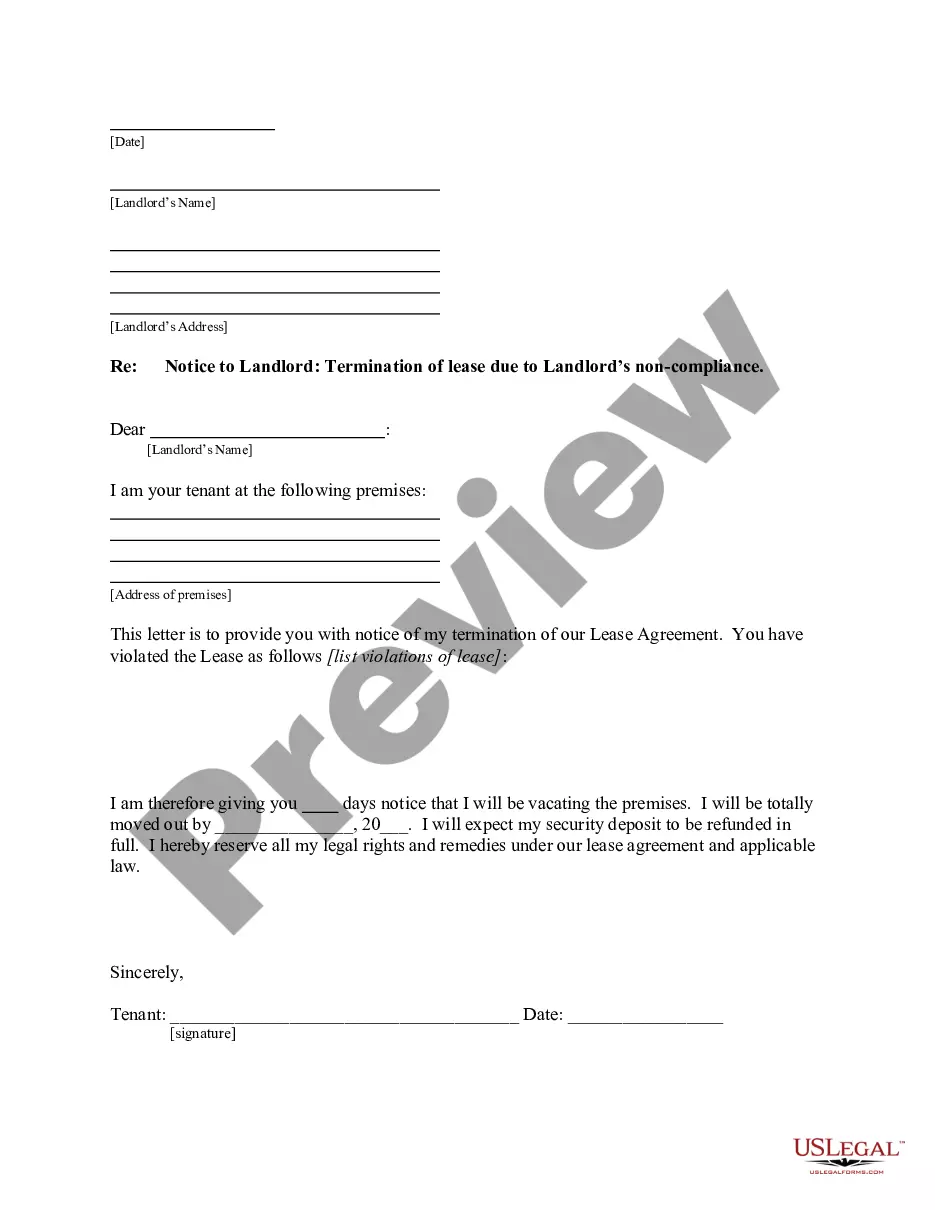

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Bulk sales escrow is an escrow arrangement where the proceeds from the sale of a company or its inventory are placed into a special account, which the seller is forbidden from accessing, to make sure any associated unsecured creditors get their due cash.

The main purpose of the law is to protect a business' creditors by giving them notice of a bulk sale. This prevents a situation where a business or its assets are sold and the seller walks away with the proceeds, leaving creditors unpaid.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

The key elements of a Bulk Sale are: any sale outside the ordinary course of the Seller's business. of more than half the Seller's inventory and equipment. as measured by the fair market value on the date of the Bulk Sale Agreement (Agreement).

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

§12A-1.037(2). Virginia: A bulk sale is exempt if the sale consists of substantially all the assets of a business, where the seller has essentially liquidated its business operation, and where the nature of the sale is not within the course of activities for which the taxpayer is registered to collect sales tax.

WHAT IS THE BULK TRANSFER LAW? The bulk transfer law is a law to protect business creditors. It provides that if a buyer of a business notifies the creditors of the seller in advance that it is buying the seller's assets, then the buyer will not be liable to those creditors for the debts and obligations of the seller.

In general, a bulk sale is a sale to a buyer of all or most of the assets of the business outside the ordinary course of business.