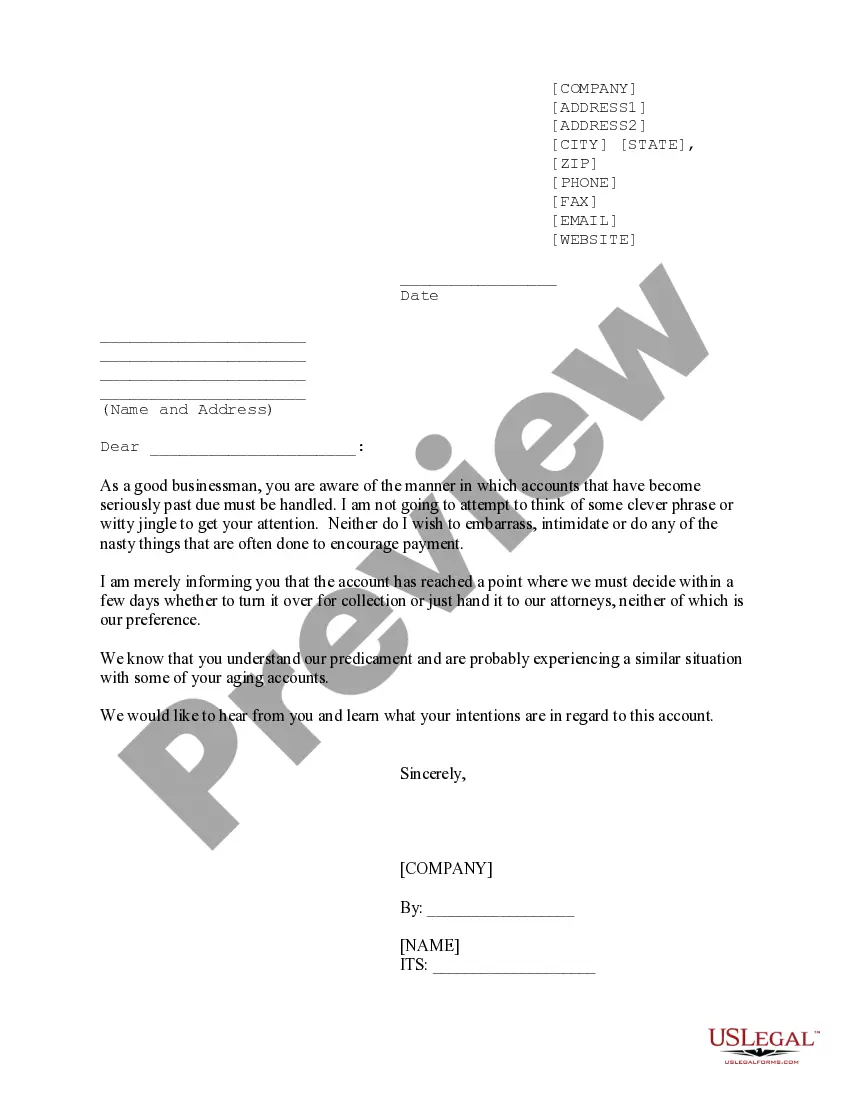

Houston Texas Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

How long does it generally take you to produce a legal document.

Considering that each state has its own laws and regulations for every life situation, locating a Houston Template of a Collection Letter to Small Business in Advance that meets all local requirements can be exhausting, and obtaining it from a qualified attorney is frequently expensive.

Several online services provide the most commonly used state-specific documents for download, but utilizing the US Legal Forms library is the most advantageous.

Click Buy Now once you have confidence in the chosen file.

- US Legal Forms is the most extensive online catalog of templates, compiled by states and areas of application.

- In addition to the Houston Template of a Collection Letter to Small Business in Advance, you can discover any specific form required to conduct your business or personal matters, in accordance with your county's requirements.

- Experts verify all templates for their accuracy, ensuring you can prepare your documents correctly.

- Using the service is relatively straightforward.

- If you already possess an account on the platform and your subscription is active, you only need to Log In, choose the desired template, and download it.

- You can save the file in your profile at any later time.

- If you are new to the platform, there will be additional steps to follow before acquiring your Houston Template of a Collection Letter to Small Business in Advance.

- Review the content of the page you’re on.

- Examine the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

Form popularity

FAQ

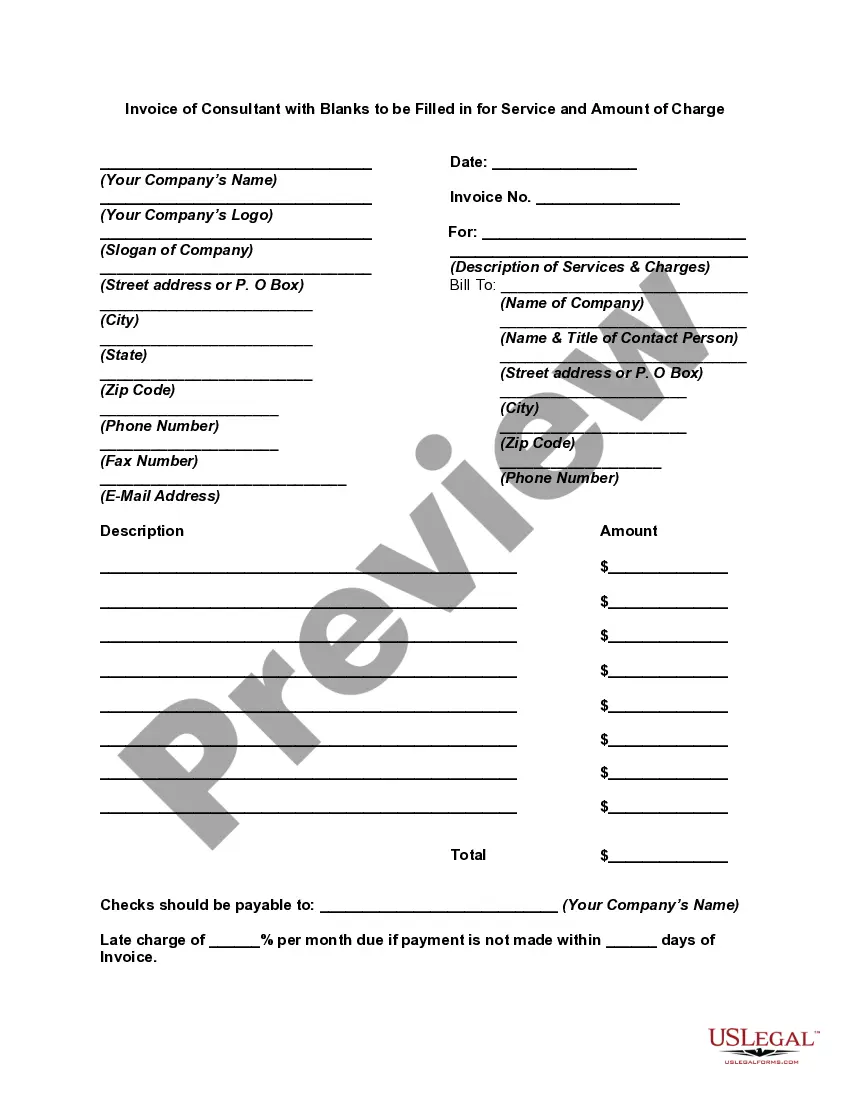

A collection letter should include essential elements like the creditor's contact information, a detailed description of the debt, and a clear request for payment. It's vital to maintain a courteous tone throughout the letter. Utilizing the Houston Texas Sample of a Collection Letter to Small Business in Advance will help ensure all necessary components are covered, making your letter compelling.

A collection letter typically begins with a polite tone, clearly states the amount owed, and includes payment options. You can find a practical illustration in the Houston Texas Sample of a Collection Letter to Small Business in Advance. This example can guide you in drafting your letter while maintaining professionalism and clarity.

To send a bill for collection, you should first prepare a well-structured collection letter that outlines the debt. Next, choose a reliable method of delivery, such as certified mail, to ensure it reaches the right person. Using the Houston Texas Sample of a Collection Letter to Small Business in Advance can help you format your correspondence correctly and increase the chance of resolution.

To create an effective collection letter, you should clearly identify the debt, stating the amount owed and any relevant details. Additionally, it should contain a call to action, encouraging the recipient to resolve the matter promptly. Referencing the Houston Texas Sample of a Collection Letter to Small Business in Advance will aid in ensuring you meet these requirements.

A small business typically follows a step-by-step approach when sending someone to collections. First, they attempt to collect the debt directly through invoices and phone contacts. If unsuccessful, they might choose to work with a collections agency or send a formal demand letter. For effective communication, consider using a Houston Texas Sample of a Collection Letter to Small Business in Advance to ensure your message is clear and professional.

To send a debt collection letter, start by clearly stating the amount owed and any relevant account information. Provide a brief summary of the debt, the due date, and any previous attempts to collect. It is also wise to convey contact information for further discussions. A Houston Texas Sample of a Collection Letter to Small Business in Advance can guide you in crafting a compelling and precise letter.

To send someone to collections, a business usually hires a collections agency or takes the matter to a legal entity. They will provide details about the debt, including the amount owed and any previous attempts to collect. After reviewing the case, the agency will reach out to the debtor. Utilizing a Houston Texas Sample of a Collection Letter to Small Business in Advance can help businesses format their initial communication effectively.

Before sending you to collections, a company must attempt to collect the debt through various means, such as sending reminders, making phone calls, or negotiating a payment plan. It's essential they document these efforts for their records. Failing to document can impact their ability to pursue collections later. A Houston Texas Sample of a Collection Letter to Small Business in Advance shows how businesses typically structure these communications.

To send someone to collections in a small business, ensure all communication attempts have been documented and provide the debtor with ample notice. After following up professionally, use the services of a collection agency if necessary. A well-structured Houston Texas Sample of a Collection Letter to Small Business in Advance can be an effective first step to initiate this process.

A collection letter should be clear, concise, and professional. It must provide all necessary information about the debt while maintaining a respectful tone that encourages communication. Utilizing a Houston Texas Sample of a Collection Letter to Small Business in Advance can be highly beneficial, ensuring your letter conveys the right message while fostering goodwill.