Title: The Complete Guide to King Washington Sample of a Collection Letter to Small Business in Advance Introduction: In this article, we will provide you with a detailed description of what King Washington sample of a collection letter to small businesses in advance is all about. We will explore the importance of such letters, how they can benefit both parties involved, and offer key tips on crafting an effective letter. By the end, you will have a clear understanding of this collection strategy and be equipped to address any outstanding payments with professionalism and efficiency. 1. Understanding King Washington: King Washington is a renowned expert in the field of collections and specializes in providing small businesses with effective strategies to recover past-due payments. Their sample of a collection letter to small businesses in advance serves as a powerful tool for dealing with outstanding invoices in a prompt and professional manner. 2. Importance of Collection Letters: Collection letters play a crucial role in maintaining a healthy cash flow for small businesses. By sending a well-crafted letter to customers who have not made timely payments, businesses can assert their right to receive the outstanding payments while maintaining a positive relationship with the debtor. King Washington's sample collection letter template enables businesses to communicate their expectations firmly yet politely. 3. Benefits of Sending Collection Letters in Advance: Sending a collection letter in advance helps businesses prevent delayed payments before they become critical. By addressing the issue promptly, businesses can improve their chances of recovering the outstanding balance without resorting to legal action or affecting customer relations negatively. 4. Components of a King Washington Sample Collection Letter: a) Clear and concise subject line: A subject line that explicitly mentions the purpose of the letter, making it easier for the recipient to understand its importance. b) Polite yet firm language: A tone that conveys professionalism while expressing the urgency of the matter. c) Specific payment details: Clearly state the invoice number, due date, and the amount owed. d) Offer solutions: Propose alternative payment plans or arrangements, if appropriate, to encourage immediate action. e) Consequences of non-payment: Emphasize the potential consequences of non-payment, such as late fees or escalation to a collection agency, to communicate the seriousness of the matter. Different Types of King Washington Sample Collection Letters to Small Businesses in Advance: Although King Washington primarily focuses on one comprehensive sample collection letter, variations can be made to accommodate specific industry requirements or tailored to address unique debtor circumstances. Examples of such variations may include letters for: 1. Regular customers with a consistent payment history. 2. Long-standing customers with occasional payment delays. 3. Customers who have missed multiple payment deadlines in the past. Conclusion: King Washington's sample collection letter to small businesses in advance serves as a highly effective tool for recovering outstanding payments proactively. By adhering to best practices outlined in the template, businesses can successfully regain their financial stability while maintaining professional relationships with their valued customers. Remember, prompt action through friendly yet assertive communication can make a significant difference in resolving payment issues and fostering long-term business growth.

King Washington Sample of a Collection Letter to Small Business in Advance

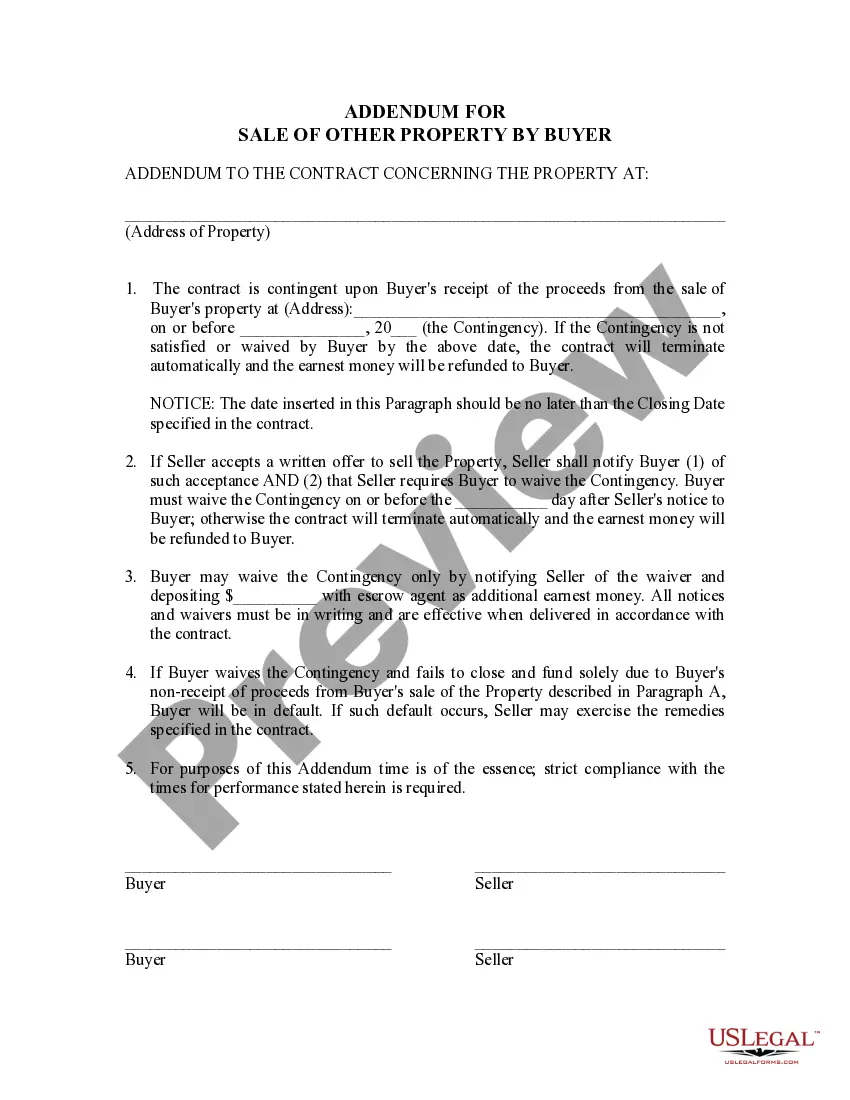

Description

How to fill out King Washington Sample Of A Collection Letter To Small Business In Advance?

Creating forms, like King Sample of a Collection Letter to Small Business in Advance, to manage your legal matters is a challenging and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for different scenarios and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the King Sample of a Collection Letter to Small Business in Advance template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting King Sample of a Collection Letter to Small Business in Advance:

- Ensure that your form is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the King Sample of a Collection Letter to Small Business in Advance isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our website and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!