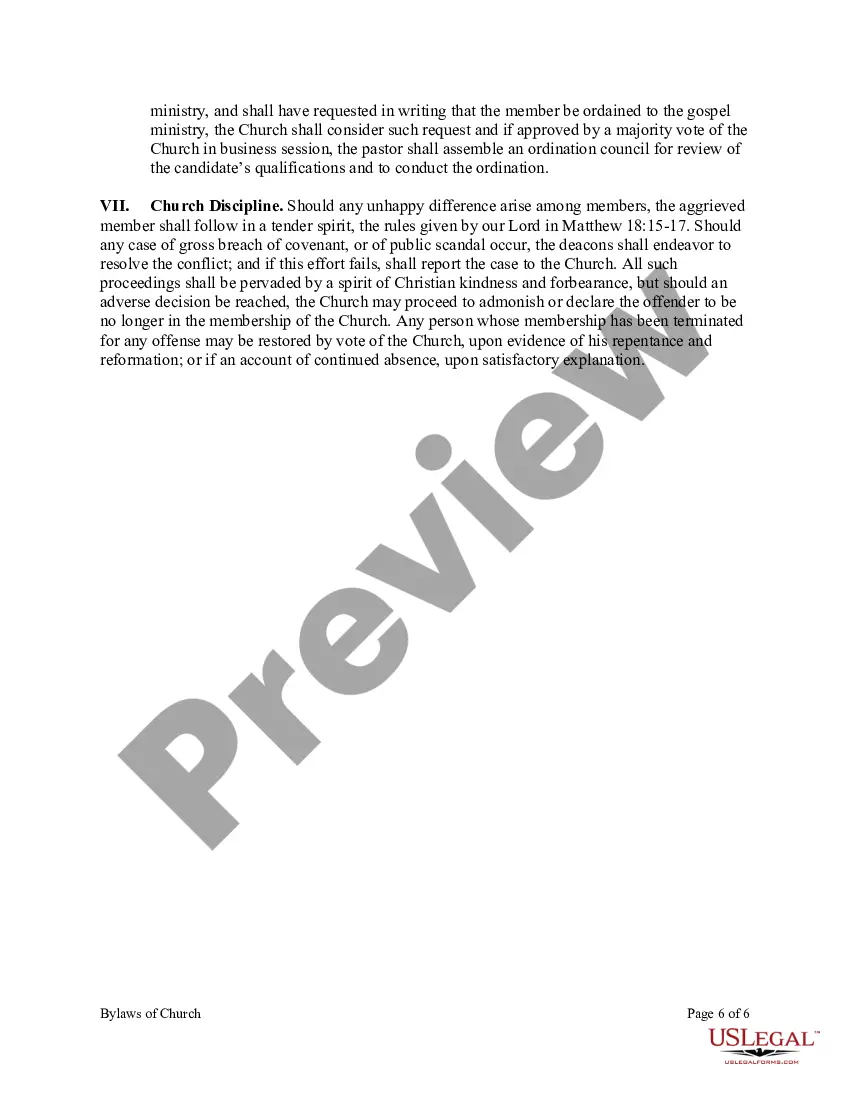

For many religious nonprofits, drafting bylaws is one of the steps involved in officially forming the organization. However, the IRS may recognize a church as an exempt nonprofit even if the church is not incorporated and does not have bylaws. If you choose to incorporate your church at the state level, the laws of the state may require the organization to draft bylaws. Just like any other type of nonprofit, churches must follow the laws of the state throughout the incorporation process.

The Internal Revenue Service automatically recognizes certain churches as tax-exempt nonprofits, meaning that the church does not have to pay federal income tax and donations to the church are tax-deductible for the donor. In order to be considered a tax-exempt nonprofit by the IRS, the church must be organized for a religious or charitable purpose, which may be reflected in the organization's bylaws. The income of the church must be used to promote its religious and charitable purposes and not for the benefit of any individual member of the church, apart from reasonable compensation for work performed. Additionally, the IRS bans exempt churches from participating in political activity, such as lobbying or intervening in political campaigns. However, the IRS may recognize a church as exempt even if it is unincorporated and does not have bylaws.