A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Suffolk New York Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

How to fill out Suffolk New York Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Suffolk Articles of Incorporation for Non-Profit Organization, with Tax Provisions, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Suffolk Articles of Incorporation for Non-Profit Organization, with Tax Provisions from the My Forms tab.

For new users, it's necessary to make some more steps to get the Suffolk Articles of Incorporation for Non-Profit Organization, with Tax Provisions:

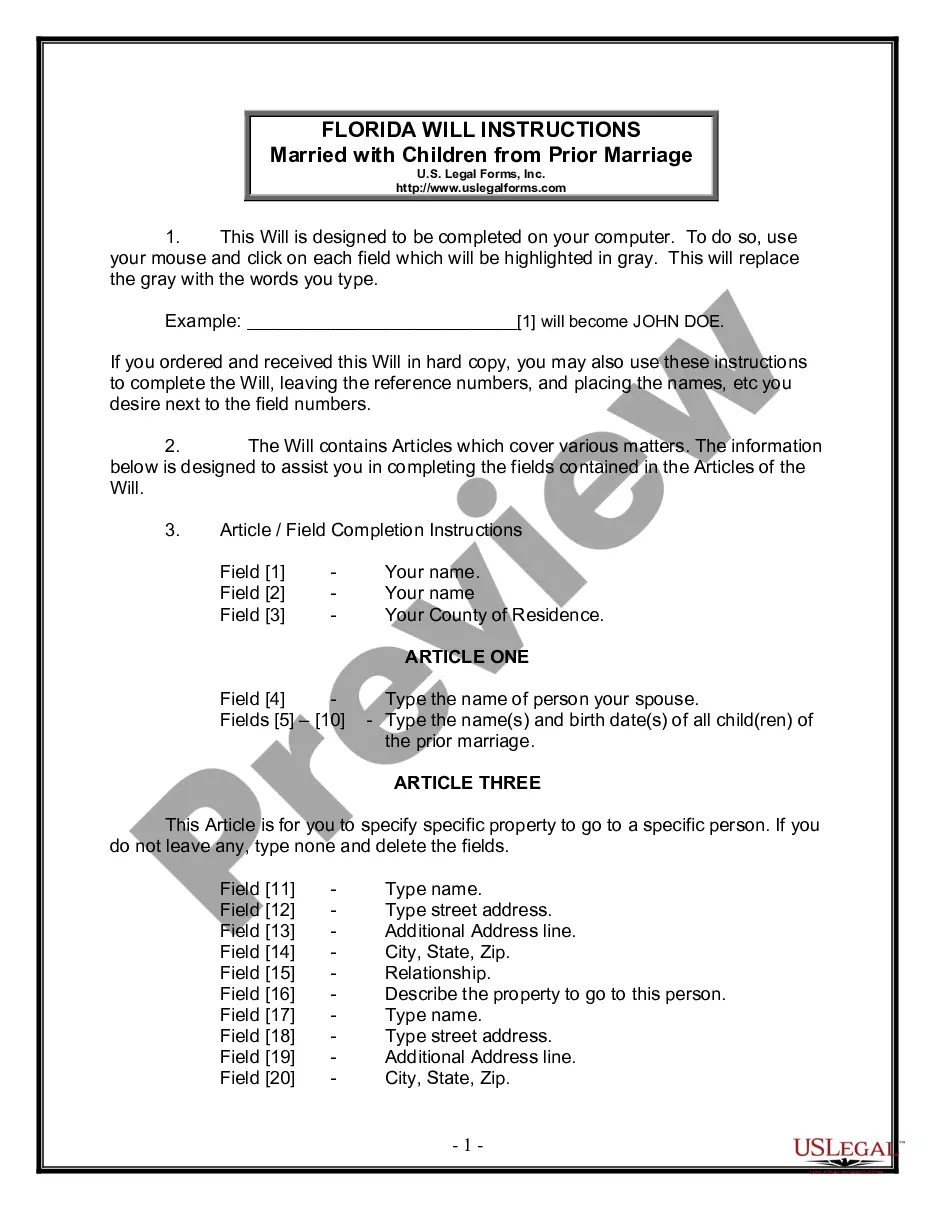

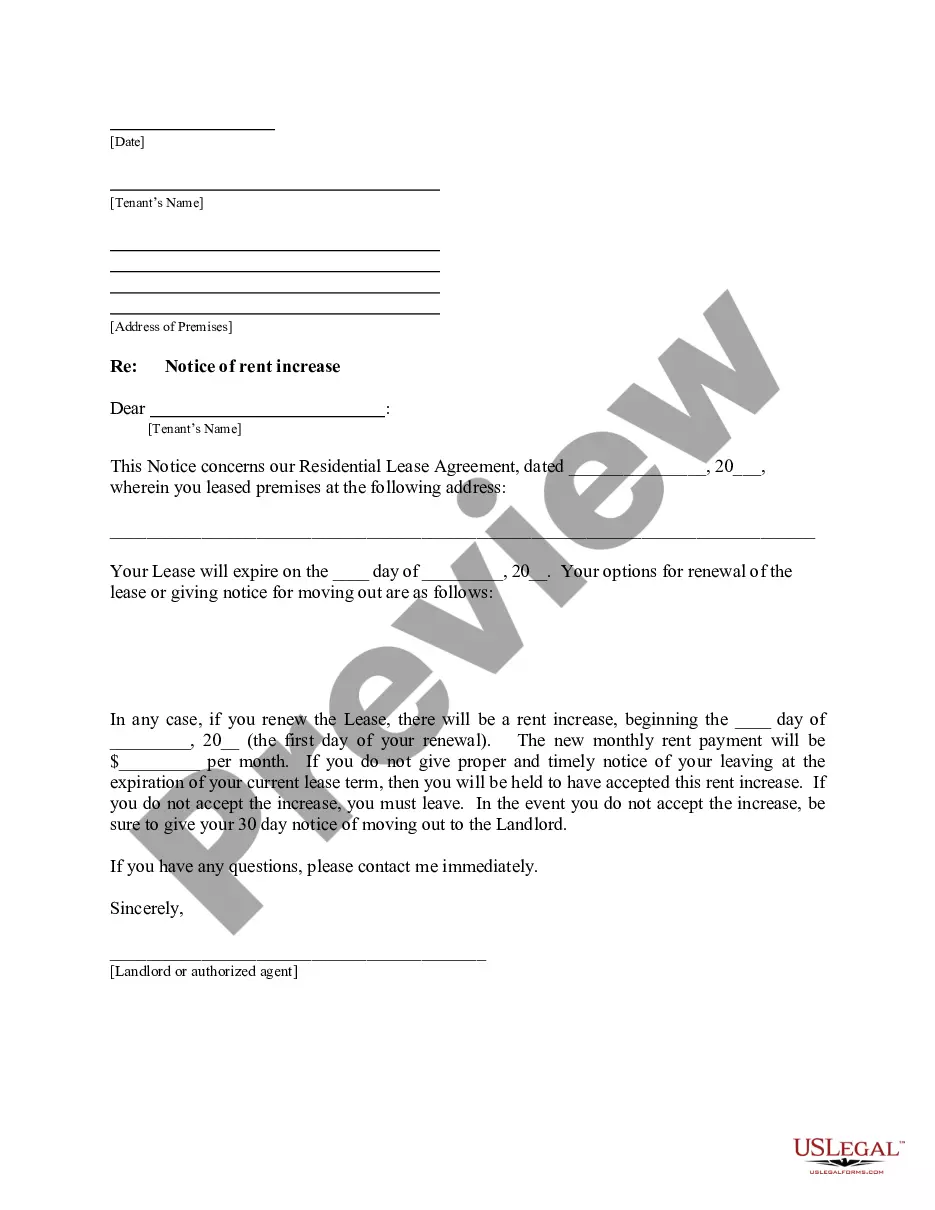

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!