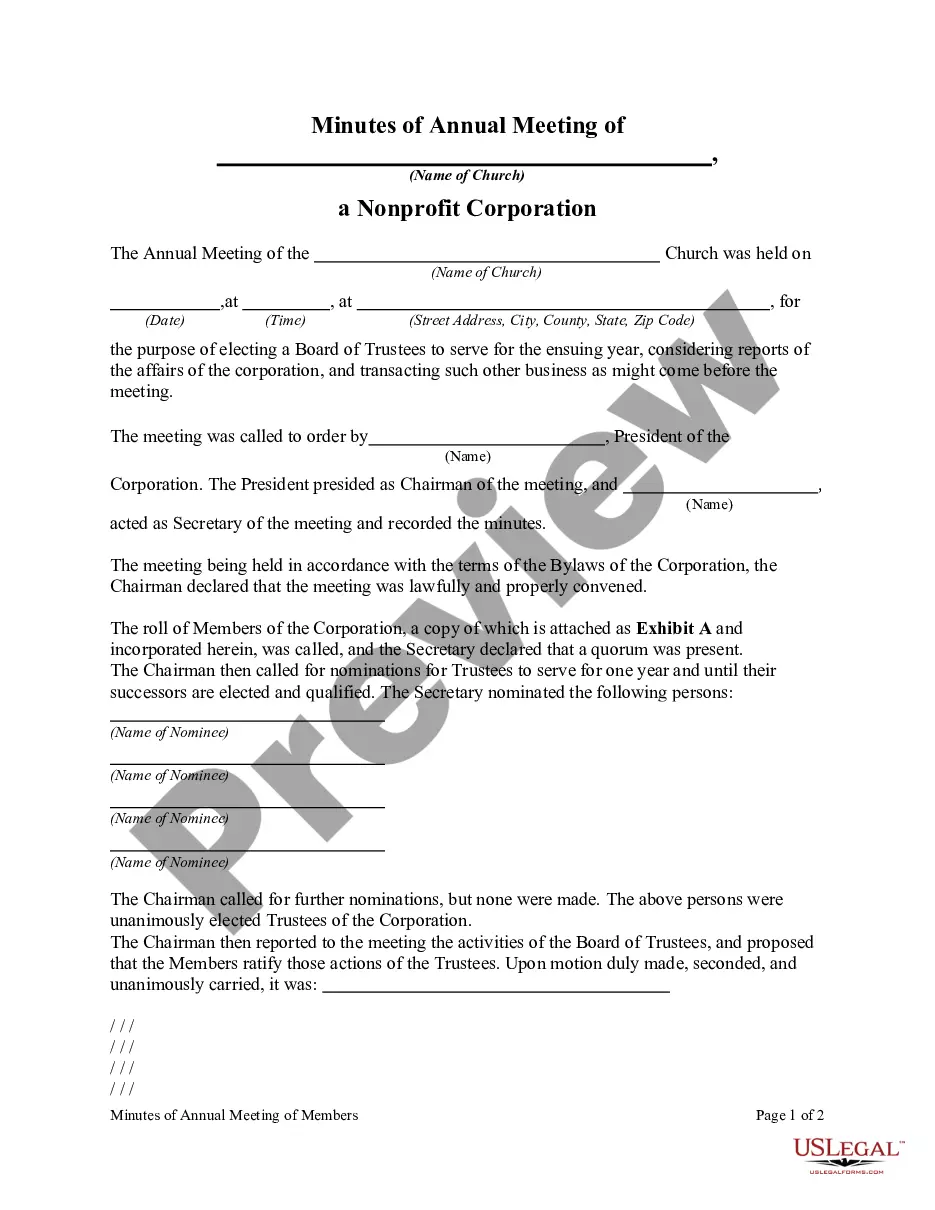

Generally, the members of a nonprofit corporation must exercise their control of corporate policies at regularly called meetings of the members. A corporation has a duty to keep a record of the meetings of its members, showing the dates such meetings were held and listing the members present or showing the number of voting shares represented at the meeting in person or by proxy. It is the duty of the secretary to prepare and enter the minutes of such meetings in the corporate records.

Title: Oakland Michigan Minutes of Annual Meeting of a Non-Profit Corporation Introduction: The Minutes of Annual Meeting of a Non-Profit Corporation in Oakland, Michigan provide a comprehensive record of the proceedings and decisions made during the annual meeting of a non-profit organization. These minutes serve as an official document that offers insight into the governance and operations of the corporation. All vital discussions, resolutions, elections, reports, and other significant matters are documented in detail to ensure transparency and compliance with legal requirements. Keywords: Oakland Michigan, Minutes of Annual Meeting, Non-Profit Corporation, governance, transparency, legal requirements, decision-making. Types of Oakland Michigan Minutes of Annual Meeting of a Non-Profit Corporation: 1. Regular Minutes: Regular annual meeting minutes involve the routine activities and decisions that typically occur during an organization's annual meeting. They encompass discussions on financial reports, committee reports, changes to bylaws or articles of incorporation, election of officers, and any other crucial business matters. These minutes are crucial for maintaining a comprehensive record of the corporation's activities, ensuring transparency and accountability. Keywords: Regular annual meeting minutes, routine activities, financial reports, committee reports, bylaws, articles of incorporation, election of officers, transparency, accountability. 2. Special Minutes: Special annual meeting minutes are created when an organization conducts an additional meeting apart from the regular annual meeting. These meetings are usually held to address specific urgent matters such as amending bylaws, fundraising campaigns, organizational restructuring, or emergency situations. Special minutes provide a concise record of discussions and decisions made during these extraordinary meetings. Keywords: Special annual meeting minutes, urgent matters, bylaw amendments, fundraising campaigns, organizational restructuring, emergency situations, decisive discussions. 3. Annual Meeting Minutes for Tax Purposes: Non-profit corporations are required to maintain detailed annual meeting minutes for tax purposes. These minutes primarily focus on the financial aspects of the organization, including discussions on donations, grants, fundraising efforts, and other revenue-generating activities. They provide documentary evidence for compliance with tax regulations, ensuring the corporation maintains its non-profit status. Keywords: Annual meeting minutes for tax purposes, financial aspects, donations, grants, fundraising efforts, revenue-generating activities, compliance, non-profit status. Conclusion: The Minutes of Annual Meeting of a Non-Profit Corporation in Oakland, Michigan play a crucial role in documenting the decision-making processes, discussions, and important business matters of non-profit organizations. They provide transparency, accountability, and compliance with legal requirements. Regular, special, and tax-related minutes are some types associated with these important records. By maintaining consistent and detailed minutes, non-profit corporations in Oakland, Michigan can establish credibility and ensure the efficient functioning of their organizations. Keywords: Minutes of Annual Meeting, decision-making, discussions, business matters, transparency, accountability, legal requirements, credibility, efficient functioning.Title: Oakland Michigan Minutes of Annual Meeting of a Non-Profit Corporation Introduction: The Minutes of Annual Meeting of a Non-Profit Corporation in Oakland, Michigan provide a comprehensive record of the proceedings and decisions made during the annual meeting of a non-profit organization. These minutes serve as an official document that offers insight into the governance and operations of the corporation. All vital discussions, resolutions, elections, reports, and other significant matters are documented in detail to ensure transparency and compliance with legal requirements. Keywords: Oakland Michigan, Minutes of Annual Meeting, Non-Profit Corporation, governance, transparency, legal requirements, decision-making. Types of Oakland Michigan Minutes of Annual Meeting of a Non-Profit Corporation: 1. Regular Minutes: Regular annual meeting minutes involve the routine activities and decisions that typically occur during an organization's annual meeting. They encompass discussions on financial reports, committee reports, changes to bylaws or articles of incorporation, election of officers, and any other crucial business matters. These minutes are crucial for maintaining a comprehensive record of the corporation's activities, ensuring transparency and accountability. Keywords: Regular annual meeting minutes, routine activities, financial reports, committee reports, bylaws, articles of incorporation, election of officers, transparency, accountability. 2. Special Minutes: Special annual meeting minutes are created when an organization conducts an additional meeting apart from the regular annual meeting. These meetings are usually held to address specific urgent matters such as amending bylaws, fundraising campaigns, organizational restructuring, or emergency situations. Special minutes provide a concise record of discussions and decisions made during these extraordinary meetings. Keywords: Special annual meeting minutes, urgent matters, bylaw amendments, fundraising campaigns, organizational restructuring, emergency situations, decisive discussions. 3. Annual Meeting Minutes for Tax Purposes: Non-profit corporations are required to maintain detailed annual meeting minutes for tax purposes. These minutes primarily focus on the financial aspects of the organization, including discussions on donations, grants, fundraising efforts, and other revenue-generating activities. They provide documentary evidence for compliance with tax regulations, ensuring the corporation maintains its non-profit status. Keywords: Annual meeting minutes for tax purposes, financial aspects, donations, grants, fundraising efforts, revenue-generating activities, compliance, non-profit status. Conclusion: The Minutes of Annual Meeting of a Non-Profit Corporation in Oakland, Michigan play a crucial role in documenting the decision-making processes, discussions, and important business matters of non-profit organizations. They provide transparency, accountability, and compliance with legal requirements. Regular, special, and tax-related minutes are some types associated with these important records. By maintaining consistent and detailed minutes, non-profit corporations in Oakland, Michigan can establish credibility and ensure the efficient functioning of their organizations. Keywords: Minutes of Annual Meeting, decision-making, discussions, business matters, transparency, accountability, legal requirements, credibility, efficient functioning.