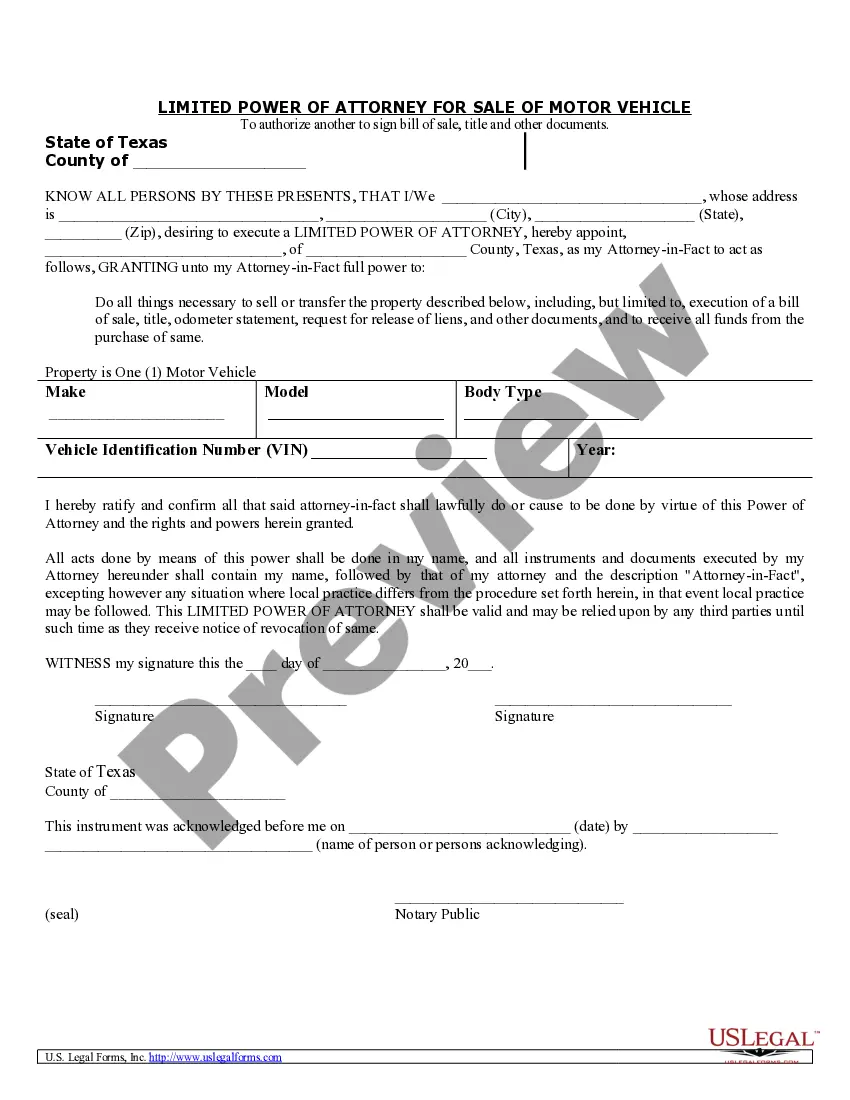

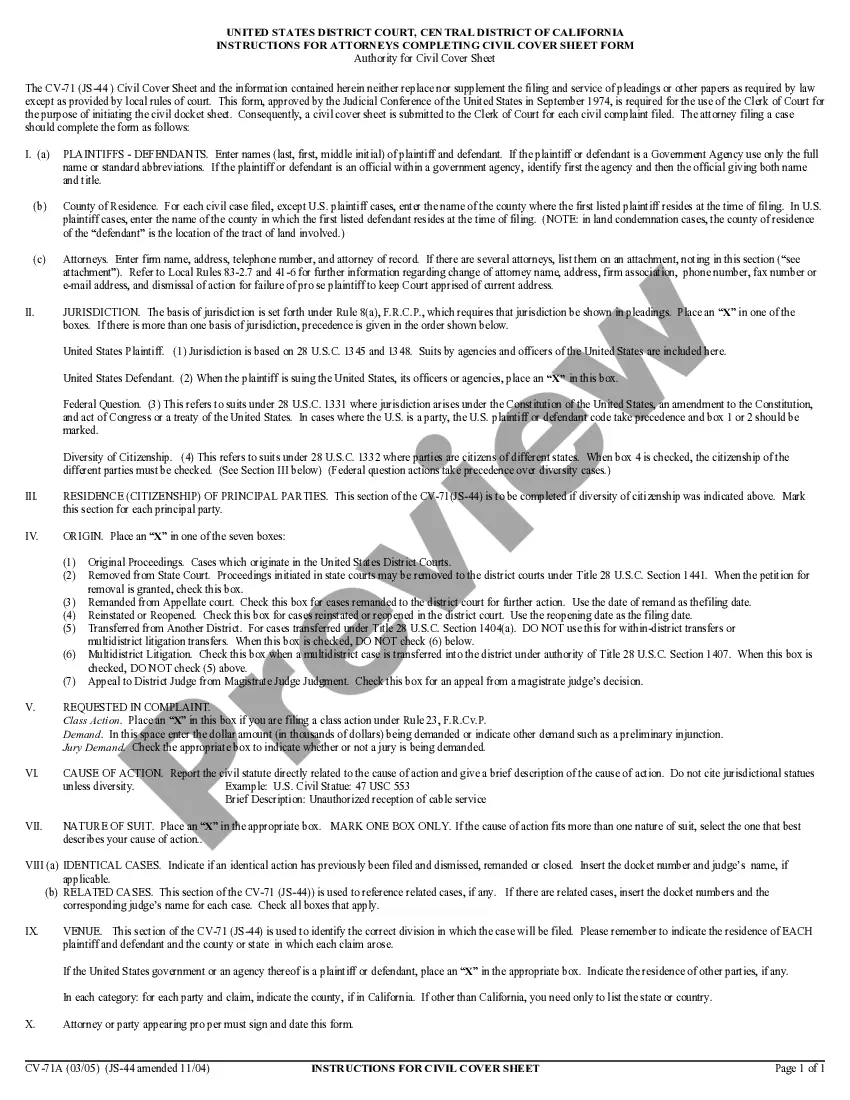

Title: Hennepin Minnesota Sample Letter for Authorized Signatories for Partnerships or Corporations Introduction: In the state of Minnesota, Hennepin County is known as the most populous and vibrant county, home to the city of Minneapolis. When forming a partnership or corporation within Hennepin County, it is crucial to establish authorized signatories to ensure that all legal obligations and transactions are properly executed. This article aims to provide a detailed description of Hennepin Minnesota Sample Letters for Authorized Signatories for Partnerships or Corporations. 1. General Sample Letter for Authorized Signatories: This type of letter serves as a general template to designate individuals authorized to sign on behalf of a partnership or corporation. It includes essential information such as business name, registered address, and Federal Employer Identification Number (VEIN). The authorized signatories' names, titles, and signatures are also included in the letter. Moreover, the letter should clearly state the scope and limitations of their signing authority. 2. Letter for Authorized Signatories for Financial Transactions: Partnerships or corporations often need to engage in financial transactions, including opening bank accounts, obtaining loans, or signing financial contracts. This letter specifically designates authorized signatories for such financial matters. It may outline the types of financial transactions they can handle and the maximum monetary limit for each transaction. The signatories' knowledge of financial matters and their responsibilities should also be mentioned in the letter. 3. Letter for Authorized Signatories for Legal Documents: Certain legal matters, such as contracts, legal agreements, and court-related documents, require authorized signatories representing partnerships or corporations. This sample letter designates individuals who can legally sign and bind the entity to any legal documents. The letter may include information about the legal areas of authorization, such as contract negotiations, settlement agreements, and litigation-related documents. 4. Letter for Authorized Signatories for Government-Related Matters: Partnerships or corporations often interact with government entities for licenses, permits, tax filings, or other regulatory requirements. This type of letter specifies authorized signatories who can deal with such governmental matters on behalf of the entity. The letter may include sections on tax-related authorizations, permit applications, license renewals, and other government-related functions. Conclusion: In Hennepin County, Minnesota, establishing authorized signatories for partnerships or corporations is an essential step in ensuring the smooth execution of legal and financial transactions. By using appropriate sample letters, entities can clearly define the roles, responsibilities, and limitations of authorized signatories based on the specific type of transactions. These sample letters help businesses operate efficiently while adhering to legal requirements.

Hennepin Minnesota Sample Letter for Authorized Signatories for Partnerships or Corporations

Description

How to fill out Hennepin Minnesota Sample Letter For Authorized Signatories For Partnerships Or Corporations?

Drafting paperwork for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Hennepin Sample Letter for Authorized Signatories for Partnerships or Corporations without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Hennepin Sample Letter for Authorized Signatories for Partnerships or Corporations on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Hennepin Sample Letter for Authorized Signatories for Partnerships or Corporations:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Account Signatory or 'user' means a person who is authorised under an Account Authority from the Account Holder to transact on an Account Holder's Account.

I (your full name) hereby authorize (name of the person to be authorized) to act as a representative on my behalf to collect (name of the documents ) from (name of the source). You can find the identical copy of (name) to enclosed with this letter, to identify the person when they arrive to collect the documents.

The authorization letter format includes the address and date, salutation, body of the letter with the name and signature of the person you are authorizing, the reason for unavailability, complimentary closing, signature and name of the authorizer.

In advertising & entertainment, the term Signatory refers to a company that is signed to agreements of one or more of the unions whose members work on an advertising or entertainment production. Companies signed to union agreements are also called Signatory Producers.

An authorized signatory is a person allowed to act on behalf of your business, and their name is stated in your official business/company records. Sometimes there can be more than one authorized signatory, so two or more persons need to provide their signatures.

The Chief Executive Officer or the managing director or the manager; the Company Secretary; the Whole-time director; the Chief Financial Officer.

1. What Is an Authorized Signatory? An authorized signatory is defined as a director of the issuer or another person who has been authorized to sign documents and has notified the trustee that they've been given the power to do so.

The purpose of an Authorization Letter is to: (a) demonstrate that the individual(s) signing contracts and reviewing and submitting invoices have been authorized to do so by the organization's Board of Directors; and (b) provide a sample of the signatures of the organization's authorized signatories.

Authorized signers on business bank accounts are people who are legally permitted to spend or commit monies from that account. Limited liability companies are always legally separate from their owners. Therefore, in terms of a business bank account, the owner is stated as the limited liability company.

A Certified Letter of Authorization attests that an individual has the legal authority to act on behalf of an organization or other business entity to carry out an action.