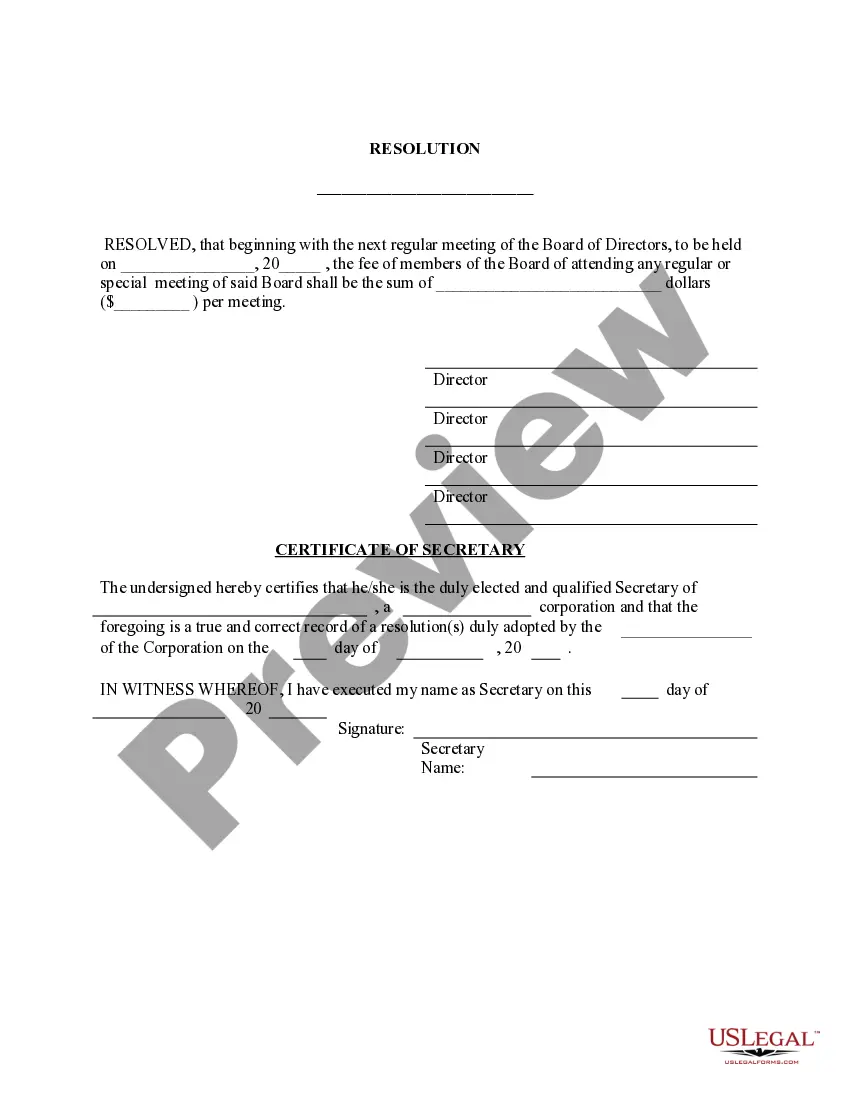

The bylaws of a corporation are the internal rules and guidelines for the day-to-day operation of a corporation, such as when and where the corporation will hold directors' and shareholders' meetings and what the shareholders' and directors' voting requirements are. Typically, the bylaws are adopted by the corporation's directors at their first board meeting. They may specify the rights and duties of the officers, shareholders and directors, and may deal, for example, with how the company may enter into contracts, transfer shares, hold meetings, pay dividends and make amendments to corporate documents. They generally will identify a fiscal year for the corporation.

Title: Understanding the Chicago Illinois Bi-Laws of a Non-Profit Church Corporation Introduction: In Chicago, Illinois, Non-Profit Church Corporations operate under specific bi-laws that govern their activities and ensure their compliance with state laws. These bi-laws outline important legal and operational aspects of running a non-profit church corporation. In this article, we will delve into the details of the Chicago Illinois bi-laws applicable to non-profit church corporations, highlighting key keywords for better understanding. 1. Establishment and Name: The bi-laws of a Non-Profit Church Corporation in Chicago Illinois encompass provisions related to the establishment and naming of the corporation. Keywords: Incorporation, Name reservation, Articles of Incorporation, Registered Agent. 2. Purpose and Powers: This section outlines the purpose and objectives of the church corporation, as well as the powers granted to it. Keywords: Religious purposes, Charitable activities, Powers of the corporation, Internal governance. 3. Board of Directors: Bi-laws specify the composition, duties, and responsibilities of the Board of Directors that govern the operations. Keywords: Board composition, Qualifications, Powers and responsibilities, Board meetings, Conflicts of interest. 4. Membership: Membership rules and requirements of the non-profit church corporation are included in this section. Keywords: Qualifications, Rights and privileges, Termination, Voting rights. 5. Finances and Fiscal Responsibilities: The bi-laws address financial matters, including fundraising, budgeting, and financial reporting. Keywords: Donations, Grants, Fundraising, Budget approval, Financial statements, Annual reports. 6. Meeting Procedures: This section includes guidelines for conducting meetings, such as notice requirements, quorum, and voting procedures. Keywords: Notice of meetings, Quorum, Proxy voting, Resolutions. 7. Amendments and Dissolution: Procedures for amending the bi-laws and the process of dissolution are mentioned here. Keywords: Amendment procedure, Notice requirement, Approval process, Dissolution process, Asset distribution. Types of Chicago Illinois Bi-Laws of a Non-Profit Church Corporation: 1. Basic Bi-Laws: These lay out fundamental provisions required for a non-profit church corporation to exist and operate legally. 2. Customized Bi-Laws: Church corporations may customize their bi-laws to suit their specific needs, as long as they comply with the minimum legal requirements. 3. IRS-Compliant Bi-Laws: For churches seeking tax-exempt status under IRS guidelines, additional provisions may be added to ensure compliance with federal regulations. 4. Bi-Laws for Denominational Affiliated Churches: If a church corporation is affiliated with a specific denomination, they may have additional bi-laws to align with the practices and teachings of that denomination. Conclusion: Understanding the Chicago Illinois bi-laws that govern non-profit church corporations is crucial for proper operation and compliance. Adhering to these bi-laws ensures transparency, accountability, and legal compliance, allowing non-profit church corporations to serve their communities effectively.Title: Understanding the Chicago Illinois Bi-Laws of a Non-Profit Church Corporation Introduction: In Chicago, Illinois, Non-Profit Church Corporations operate under specific bi-laws that govern their activities and ensure their compliance with state laws. These bi-laws outline important legal and operational aspects of running a non-profit church corporation. In this article, we will delve into the details of the Chicago Illinois bi-laws applicable to non-profit church corporations, highlighting key keywords for better understanding. 1. Establishment and Name: The bi-laws of a Non-Profit Church Corporation in Chicago Illinois encompass provisions related to the establishment and naming of the corporation. Keywords: Incorporation, Name reservation, Articles of Incorporation, Registered Agent. 2. Purpose and Powers: This section outlines the purpose and objectives of the church corporation, as well as the powers granted to it. Keywords: Religious purposes, Charitable activities, Powers of the corporation, Internal governance. 3. Board of Directors: Bi-laws specify the composition, duties, and responsibilities of the Board of Directors that govern the operations. Keywords: Board composition, Qualifications, Powers and responsibilities, Board meetings, Conflicts of interest. 4. Membership: Membership rules and requirements of the non-profit church corporation are included in this section. Keywords: Qualifications, Rights and privileges, Termination, Voting rights. 5. Finances and Fiscal Responsibilities: The bi-laws address financial matters, including fundraising, budgeting, and financial reporting. Keywords: Donations, Grants, Fundraising, Budget approval, Financial statements, Annual reports. 6. Meeting Procedures: This section includes guidelines for conducting meetings, such as notice requirements, quorum, and voting procedures. Keywords: Notice of meetings, Quorum, Proxy voting, Resolutions. 7. Amendments and Dissolution: Procedures for amending the bi-laws and the process of dissolution are mentioned here. Keywords: Amendment procedure, Notice requirement, Approval process, Dissolution process, Asset distribution. Types of Chicago Illinois Bi-Laws of a Non-Profit Church Corporation: 1. Basic Bi-Laws: These lay out fundamental provisions required for a non-profit church corporation to exist and operate legally. 2. Customized Bi-Laws: Church corporations may customize their bi-laws to suit their specific needs, as long as they comply with the minimum legal requirements. 3. IRS-Compliant Bi-Laws: For churches seeking tax-exempt status under IRS guidelines, additional provisions may be added to ensure compliance with federal regulations. 4. Bi-Laws for Denominational Affiliated Churches: If a church corporation is affiliated with a specific denomination, they may have additional bi-laws to align with the practices and teachings of that denomination. Conclusion: Understanding the Chicago Illinois bi-laws that govern non-profit church corporations is crucial for proper operation and compliance. Adhering to these bi-laws ensures transparency, accountability, and legal compliance, allowing non-profit church corporations to serve their communities effectively.