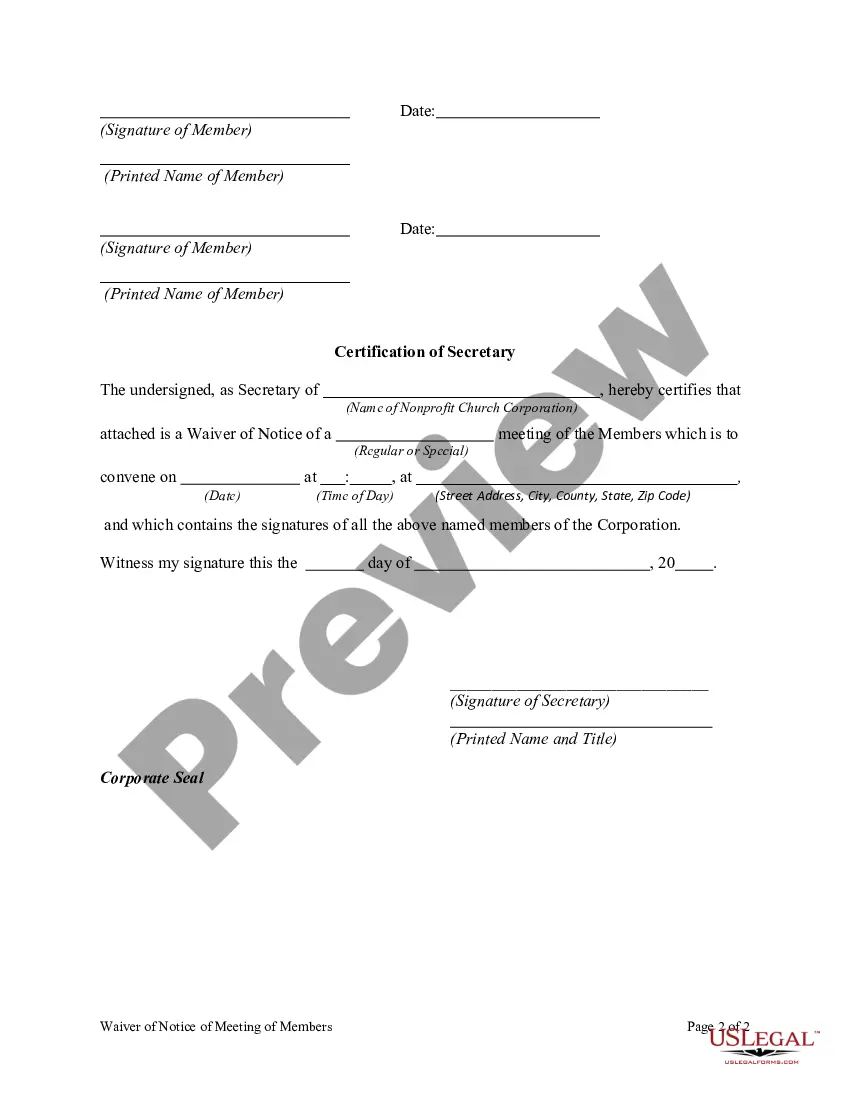

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Houston, Texas is a vibrant city known for its diversity, entrepreneurial spirit, and rich cultural heritage. Situated in Southeast Texas, it is the fourth-largest city in the United States and is home to a diverse population from various backgrounds. Houston is also recognized as a hub for business, commerce, space exploration, and the energy industry. A Nonprofit Church Corporation in Houston, Texas, is an organization established for religious purposes and operates under a specific set of guidelines and regulations. These corporations are usually formed to serve the needs of a religious community, provide religious services, engage in charitable activities, and promote spiritual growth. In the context of a Nonprofit Church Corporation in Houston, Texas, a Waiver of Notice of Meeting is a crucial legal document. This document is typically used to waive the requirement of providing advance notice to members before a scheduled meeting. The Waiver of Notice of Meeting is an important tool as it allows the Nonprofit Church Corporation's members to skip the notice period and proceed with the meeting, even if proper notice was not given. It enables an efficient decision-making process and ensures that the activities of the organization are not delayed due to logistical or administrative constraints. There can be different types of Waiver of Notice of Meeting for the members of a Nonprofit Church Corporation in Houston, Texas, depending on the specific circumstances and requirements of the organization. These may include: 1. General Waiver of Notice: This type of waiver is a broad and all-encompassing document that allows members to waive their right to receive notice for any future meetings of the Nonprofit Church Corporation. 2. Special Purpose Waiver of Notice: In certain situations, the Corporation may need to hold a specific or extraordinary meeting that requires immediate action. A special purpose waiver of notice is used to address these situations, allowing members to waive notice for that particular meeting. 3. Limited Waiver of Notice: Sometimes, only a certain subset of members needs to waive their notice rights for a specific meeting. A limited waiver of notice is used in such cases, allowing only those members who have been identified to waive their right to receive notice. It's important to note that the specific requirements and types of waivers may vary depending on the laws governing Nonprofit Church Corporations in Texas and any additional provisions outlined in the organization's bylaws. In summary, Houston, Texas is a diverse and dynamic city, and a Nonprofit Church Corporation in this region adheres to specific rules and regulations. The Waiver of Notice of Meeting is a vital document that allows members to skip the notice period for a meeting, ensuring efficient decision-making and prompt action. Different types of waivers may exist based on the circumstances and needs of the Corporation.Houston, Texas is a vibrant city known for its diversity, entrepreneurial spirit, and rich cultural heritage. Situated in Southeast Texas, it is the fourth-largest city in the United States and is home to a diverse population from various backgrounds. Houston is also recognized as a hub for business, commerce, space exploration, and the energy industry. A Nonprofit Church Corporation in Houston, Texas, is an organization established for religious purposes and operates under a specific set of guidelines and regulations. These corporations are usually formed to serve the needs of a religious community, provide religious services, engage in charitable activities, and promote spiritual growth. In the context of a Nonprofit Church Corporation in Houston, Texas, a Waiver of Notice of Meeting is a crucial legal document. This document is typically used to waive the requirement of providing advance notice to members before a scheduled meeting. The Waiver of Notice of Meeting is an important tool as it allows the Nonprofit Church Corporation's members to skip the notice period and proceed with the meeting, even if proper notice was not given. It enables an efficient decision-making process and ensures that the activities of the organization are not delayed due to logistical or administrative constraints. There can be different types of Waiver of Notice of Meeting for the members of a Nonprofit Church Corporation in Houston, Texas, depending on the specific circumstances and requirements of the organization. These may include: 1. General Waiver of Notice: This type of waiver is a broad and all-encompassing document that allows members to waive their right to receive notice for any future meetings of the Nonprofit Church Corporation. 2. Special Purpose Waiver of Notice: In certain situations, the Corporation may need to hold a specific or extraordinary meeting that requires immediate action. A special purpose waiver of notice is used to address these situations, allowing members to waive notice for that particular meeting. 3. Limited Waiver of Notice: Sometimes, only a certain subset of members needs to waive their notice rights for a specific meeting. A limited waiver of notice is used in such cases, allowing only those members who have been identified to waive their right to receive notice. It's important to note that the specific requirements and types of waivers may vary depending on the laws governing Nonprofit Church Corporations in Texas and any additional provisions outlined in the organization's bylaws. In summary, Houston, Texas is a diverse and dynamic city, and a Nonprofit Church Corporation in this region adheres to specific rules and regulations. The Waiver of Notice of Meeting is a vital document that allows members to skip the notice period for a meeting, ensuring efficient decision-making and prompt action. Different types of waivers may exist based on the circumstances and needs of the Corporation.