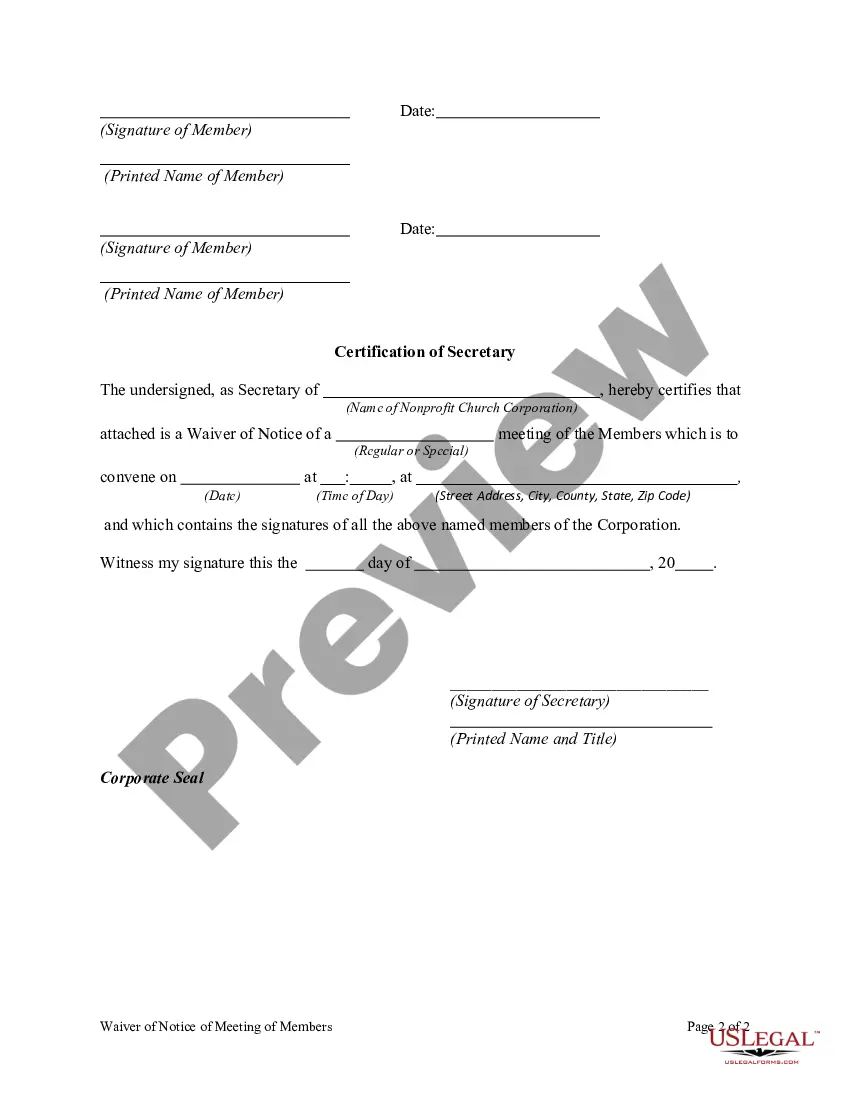

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Travis Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is an essential legal document used in the state of Texas. This waiver allows members of a nonprofit church corporation to forgo the typical notice requirements for a meeting, streamlining the decision-making process within the organization. It is important for members to understand the purpose, usage, and types of waivers available to ensure compliance with the state's nonprofit laws. The primary purpose of the Travis Texas Waiver of Notice of Meeting is to expedite the decision-making process by bypassing notice requirements. By signing this waiver, members acknowledge their consent to hold a meeting without prior notice. It is crucial to note that all members must voluntarily and willingly sign a waiver to validate its effectiveness. This ensures that all participating members are aware of the meeting and are willing to proceed without an official notice period. Keywords: Travis Texas, Waiver of Notice, Meeting of Members, Nonprofit Church Corporation, legal document, Texas nonprofit laws, decision-making process, notice requirements, expedite, consent, prior notice, participating members, effectiveness. Different types of Travis Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation may include: 1. General Waiver of Notice of Meeting: This type of waiver is the most common and covers regular meetings of the nonprofit church corporation. It allows members to bypass the notice requirements for regular meetings, thereby facilitating prompt decision-making. 2. Special Waiver of Notice of Meeting: This waiver is used for specific or special meetings where prompt action is required. It may be necessary when there is an urgent matter or time-sensitive issue that needs to be addressed immediately. 3. Annual Waiver of Notice of Meeting: Nonprofit church corporations often hold an annual meeting, which typically involves electing board members, approving financial reports, and discussing important matters. The annual waiver of notice allows members to waive the notice period specifically for this annual gathering. 4. Emergency Waiver of Notice of Meeting: In rare cases of emergencies or unforeseen circumstances, an emergency waiver of notice may be used. This type of waiver ensures that members can quickly convene a meeting without the customary notice period to address urgent matters affecting the nonprofit church corporation. Understanding the various types of Travis Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is crucial for members of a nonprofit church corporation to effectively navigate the governance procedures and make timely decisions that impact the organization's operations and mission. It is advisable to seek legal counsel or consult the bylaws of the specific nonprofit church corporation to ensure compliance and proper utilization of these waivers.Travis Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is an essential legal document used in the state of Texas. This waiver allows members of a nonprofit church corporation to forgo the typical notice requirements for a meeting, streamlining the decision-making process within the organization. It is important for members to understand the purpose, usage, and types of waivers available to ensure compliance with the state's nonprofit laws. The primary purpose of the Travis Texas Waiver of Notice of Meeting is to expedite the decision-making process by bypassing notice requirements. By signing this waiver, members acknowledge their consent to hold a meeting without prior notice. It is crucial to note that all members must voluntarily and willingly sign a waiver to validate its effectiveness. This ensures that all participating members are aware of the meeting and are willing to proceed without an official notice period. Keywords: Travis Texas, Waiver of Notice, Meeting of Members, Nonprofit Church Corporation, legal document, Texas nonprofit laws, decision-making process, notice requirements, expedite, consent, prior notice, participating members, effectiveness. Different types of Travis Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation may include: 1. General Waiver of Notice of Meeting: This type of waiver is the most common and covers regular meetings of the nonprofit church corporation. It allows members to bypass the notice requirements for regular meetings, thereby facilitating prompt decision-making. 2. Special Waiver of Notice of Meeting: This waiver is used for specific or special meetings where prompt action is required. It may be necessary when there is an urgent matter or time-sensitive issue that needs to be addressed immediately. 3. Annual Waiver of Notice of Meeting: Nonprofit church corporations often hold an annual meeting, which typically involves electing board members, approving financial reports, and discussing important matters. The annual waiver of notice allows members to waive the notice period specifically for this annual gathering. 4. Emergency Waiver of Notice of Meeting: In rare cases of emergencies or unforeseen circumstances, an emergency waiver of notice may be used. This type of waiver ensures that members can quickly convene a meeting without the customary notice period to address urgent matters affecting the nonprofit church corporation. Understanding the various types of Travis Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is crucial for members of a nonprofit church corporation to effectively navigate the governance procedures and make timely decisions that impact the organization's operations and mission. It is advisable to seek legal counsel or consult the bylaws of the specific nonprofit church corporation to ensure compliance and proper utilization of these waivers.