Harris Texas Termination of Trust by Trustee: Explained In Harris County, Texas, the termination of a trust by a trustee involves formally ending the trust arrangement and distributing the assets held within it to the beneficiaries. The process requires adherence to specific legal procedures outlined in the Texas Trust Code. This article provides a detailed description of the Harris Texas Termination of Trust by Trustee, including its significance, procedures, and potential types of termination. Terminating a trust can occur for various reasons, such as achieving the trust's purpose, expiration of the trust's duration, changes in circumstances, or the beneficiaries' consent. The trust's creator, also known as the granter or settler, typically addresses the termination conditions in the trust instrument. However, the trust's trustee holds the power to initiate the termination process by following prescribed legal steps. 1. Voluntary Termination: One type of termination is voluntary, wherein the trustee and beneficiaries jointly agree to dissolve the trust. Voluntary terminations occur when the trust's purpose has been fulfilled, or the beneficiaries unanimously request termination. The trustee must obtain unanimous consent through a written agreement, clearly indicating their intentions to dissolve the trust. 2. Mandatory Termination: Another type is mandatory termination, which occurs when the trust's terms explicitly state specific conditions under which the trust is to be terminated. These conditions can include predetermined events, such as the attainment of a certain age by the beneficiaries or the occurrence of a specific date. 3. Judicial Termination: In some cases, the trustee may seek judicial intervention to terminate the trust when situations arise that were not anticipated in the trust instrument. The trustee must file a petition with the Harris County Probate Court, providing valid reasons justifying the trust's termination. This may include cases where continuation of the trust becomes impracticable, uneconomical, or no longer serves the initial purpose. The termination process involves precise steps that the trustee must follow: a. Review the Trust Instrument: The trustee thoroughly examines the trust instrument to ascertain if it contains specific provisions governing termination and if any conditions must be met. b. Obtain Beneficiary Consent or Determine Mandatory Termination Conditions: If the trust instrument allows voluntary termination or specifies mandatory termination conditions, the trustee seeks the beneficiaries' consent or waits for said conditions to occur. c. File a Petition (if needed): In cases of judicial termination, the trustee prepares and files a petition with the Harris County Probate Court. The petition outlines the reason for seeking termination and provides all necessary supporting documentation. d. Court Hearing: Once the court receives the petition, a hearing date is set. The trustee attends the hearing and presents the case for termination. The court reviews all information and may ask for additional documentation or evidence. e. Distribution of Trust Assets: Upon receiving court approval for termination, the trustee must distribute the trust's remaining assets according to the trust instrument or as directed by the court. This involves transferring property titles, closing accounts, and finalizing any outstanding obligations. It is crucial for the trustee to ensure compliance with legal requirements and the trust instrument to avoid any complications during the termination process. Seeking legal guidance and professional advice can greatly aid trustees in efficiently navigating the termination process. In summary, Harris Texas Termination of Trust by Trustee involves dissolving a trust arrangement and distributing the assets contained in the trust to the beneficiaries. The termination can be voluntary, mandatory, or pursued through judicial intervention. Proper understanding of the trust instrument's provisions, beneficiary consent, legal procedures, and court requirements are essential to successfully terminate a trust in Harris County, Texas.

Harris Texas Termination of Trust by Trustee

Description

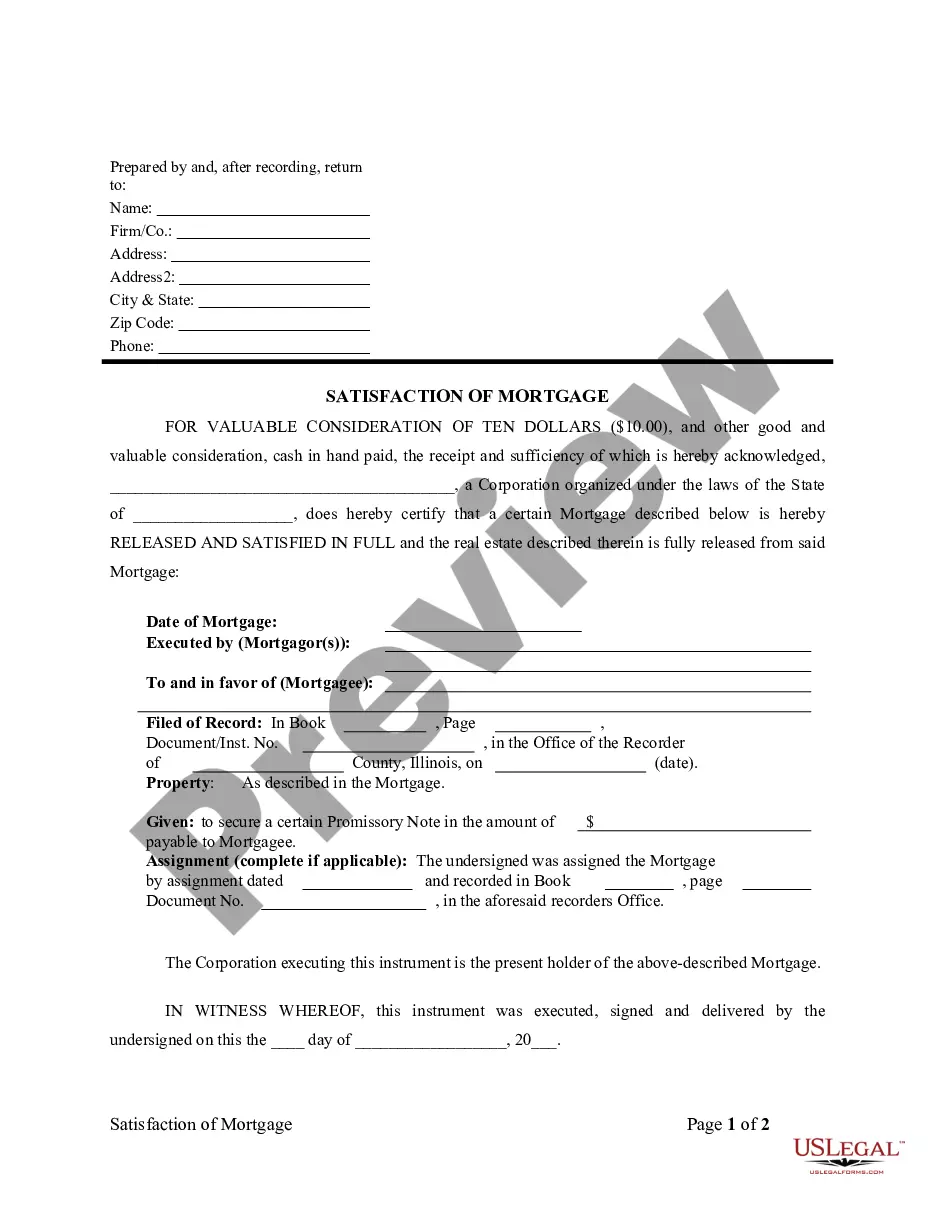

How to fill out Harris Texas Termination Of Trust By Trustee?

Draftwing paperwork, like Harris Termination of Trust by Trustee, to manage your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for various cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Harris Termination of Trust by Trustee template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Harris Termination of Trust by Trustee:

- Make sure that your form is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Harris Termination of Trust by Trustee isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our service and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!