Maricopa Arizona Termination of Trust by Trustee

Description

How to fill out Termination Of Trust By Trustee?

How long does it usually take you to create a legal document.

Considering that each state has its own laws and regulations for various aspects of life, finding a Maricopa Termination of Trust by Trustee that meets all local standards can be exhausting, and hiring a professional attorney is frequently costly.

Numerous online services provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms library is the most advantageous.

Give it a try!

- US Legal Forms represents the largest online collection of templates, organized by state and area of use.

- In addition to the Maricopa Termination of Trust by Trustee, you can access any particular document required for your business or personal activities while adhering to your local standards.

- Experts verify all templates for their relevance, ensuring you can prepare your documents accurately.

- Using the service is quite uncomplicated.

- If you already possess an account on the platform and your subscription is active, you merely need to Log In, select the needed form, and download it.

- You can retrieve the document from your profile at any later time.

- On the other hand, if you are unfamiliar with the platform, additional steps are necessary before obtaining your Maricopa Termination of Trust by Trustee.

- Examine the content of the page you’re visiting.

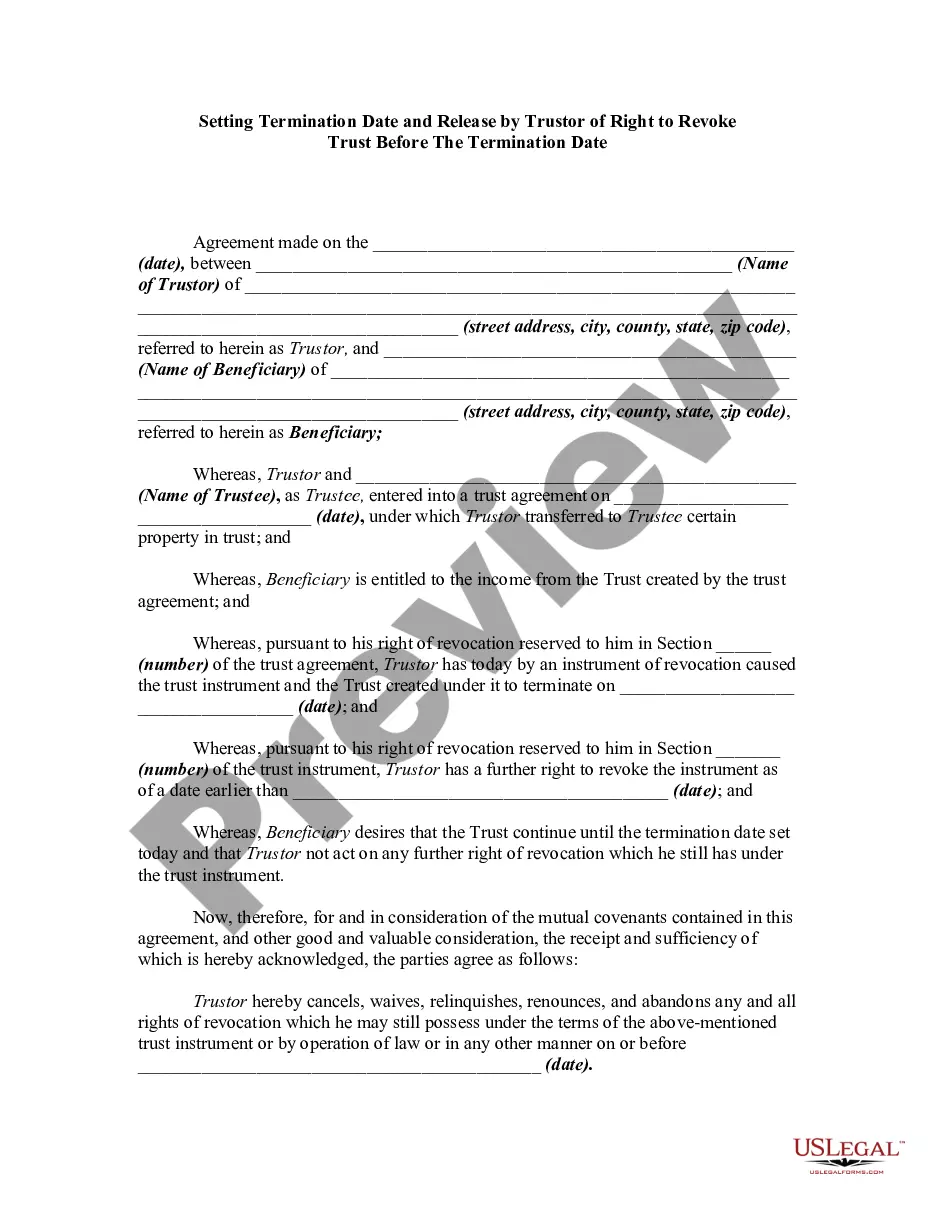

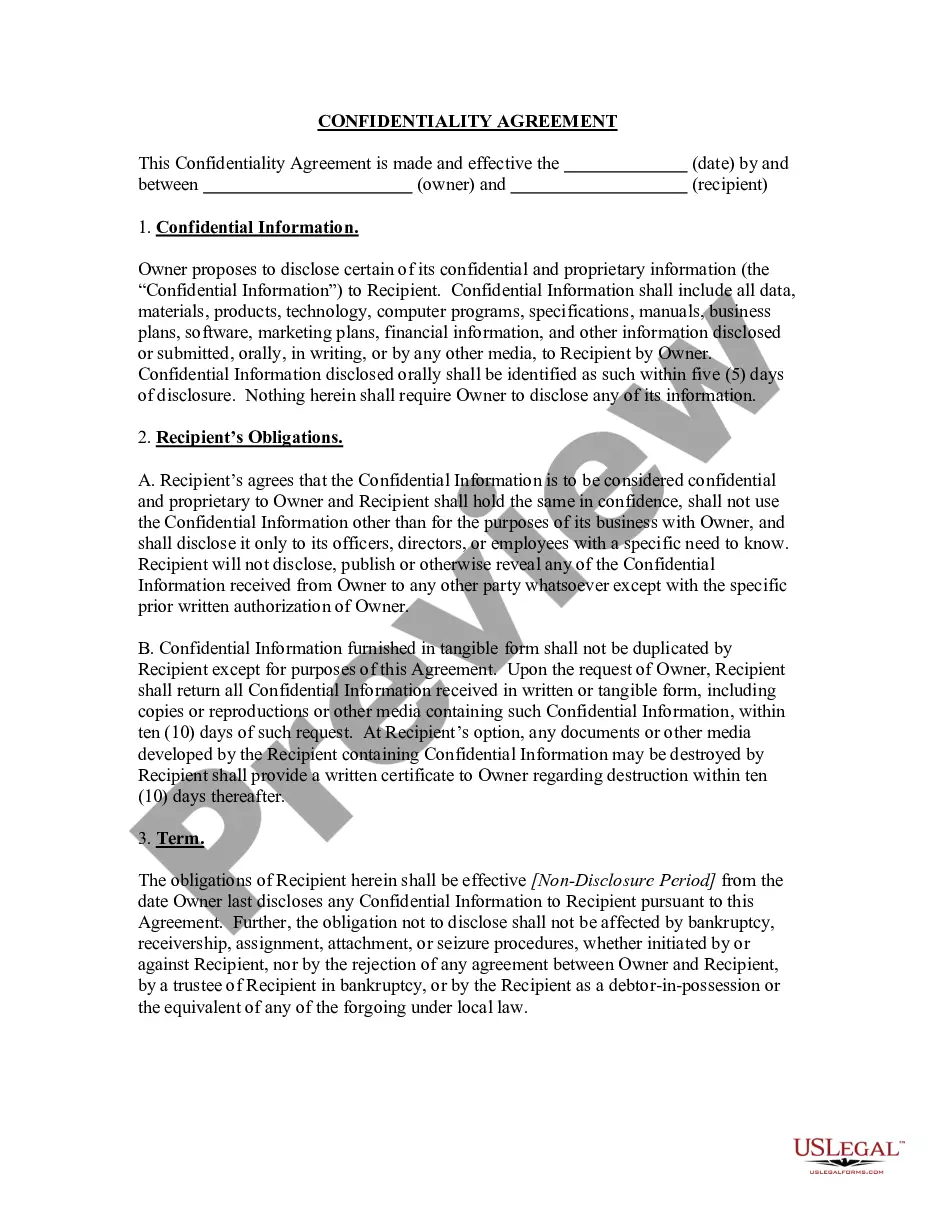

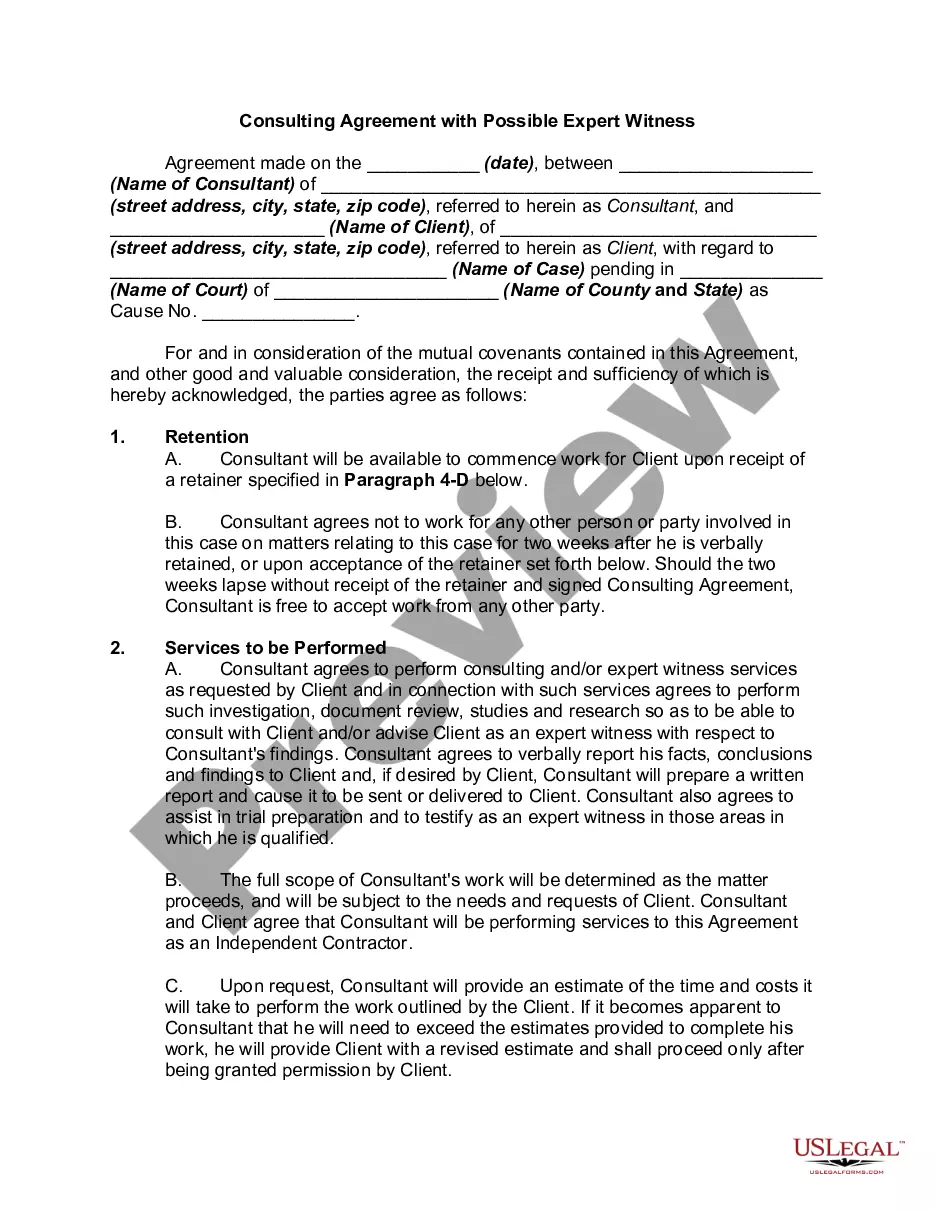

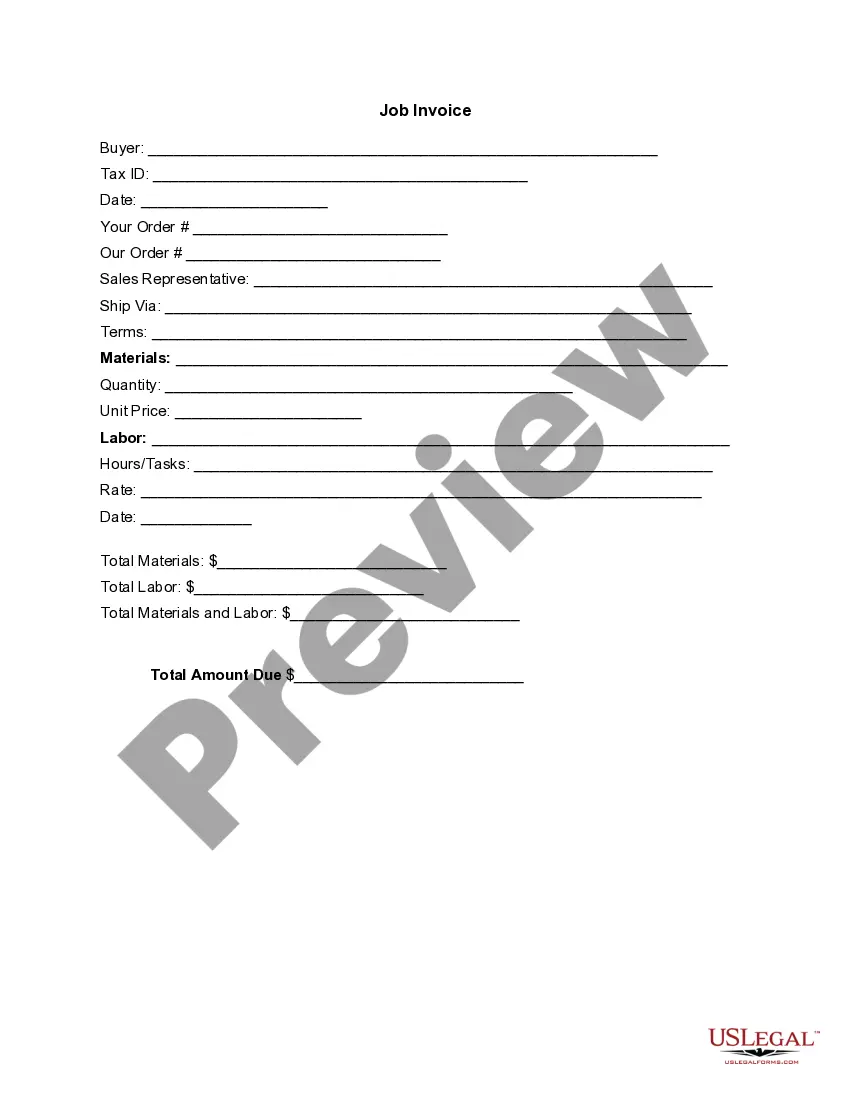

- Review the description of the template or Preview it (if accessible).

- Look for another document using the related feature in the header.

- Click Buy Now once you’re confident in your selected document.

- Select the subscription plan that best fits your needs.

- Create an account on the platform or sign in to move forward with payment options.

- Make a payment via PayPal or with your credit card.

- Alter the file format if needed.

- Click Download to save the Maricopa Termination of Trust by Trustee.

- Print the document or use any preferred online editor to complete it electronically.

- Regardless of how many times you need to use the purchased document, you can find all the templates you’ve ever saved in your profile by accessing the My documents tab.

Form popularity

FAQ

A beneficiary can renounce their interest from the trust and, upon the consent of other beneficiaries, be allowed to exit. A trustee cannot remove a beneficiary from an irrevocable trust.

A trust usually ends under legal and complete circumstances. After the grantor passes away, the trustee handles the property and assets of the grantor, and the assets are transferred to the beneficiary (or beneficiaries) under the terms dictated in the trust by the grantor.

Complete a Written Revocation. This document must include a statement clearly indicating that you intend to revoke the trust. This document should be signed before a notary public, and copies of the revocation should be delivered to the trustees and to anyone else aware of the trust (Ex.

As the Master registers all trusts, the Master also requires confirmation that a trust has been terminated. A trust may be terminated by operation of law, by fulfilment of the trust's objectives, due to destruction of trust property or by the renunciation of the trust by the beneficiary.

Termination by appointment and advancement The trust deed will need to be checked, of course, but typically it would require the trustees to execute a deed of appointment and advancement. It will be important that the provisions of the trust deed are fully complied with.

If the trust no longer serves the purpose for which it was set up, you may revoke it or draw up amendments that substantially change its terms. In most cases, this process will be subject to review by the courts to ensure that the beneficiaries retain the rights they were granted in the original trust.

Further, a trust will be considered as terminated when all the assets have been distributed except for a reasonable amount which is set aside in good faith for the payment of unascertained or contingent liabilities and expenses (not including a claim by a beneficiary in the capacity of beneficiary).

If the trust is intact at the time of your passing, exactly when it will terminate will depend upon the circumstances. For example, if you instruct the trustee to liquidate the property and distribute all of it as soon as possible, the trust would terminate when all the assets were distributed to the beneficiaries.

If the grantor specified an end date or condition for the trust, then the trust would end once that date is reached or that condition is fulfilled. When a trust ends and there is still property contained within the trust, it is up to the trustee and beneficiary to work out how the trust is handled.

Revocable and Irrevocable Trusts If a trust is revocable, it can be canceled at any time. However, if the trust is irrevocable, its terms usually cannot be modified or terminated.