Travis Texas Termination of Trust by Trustee refers to the legal process through which a trustee ends a trust arrangement in Travis County, Texas. This termination can occur due to various reasons, including fulfillment of the trust's purpose, changes in the beneficiaries' circumstances, or if the trust no longer serves its intended purpose. The termination of a trust by a trustee involves several important steps and considerations. First, the trustee must thoroughly review the trust document to understand the specific provisions and requirements for terminating the trust. The trustee may also need to consult with an attorney to ensure compliance with all legal obligations and to navigate the complex process. In Travis Texas, there are different types of trust terminations that a trustee may initiate, depending on the circumstances and the terms of the trust. Here are a few common types: 1. Full Termination: This type of termination occurs when the trustee concludes that the trust's purpose has been fulfilled, or that it is no longer necessary or practical to continue the trust. The trustee must follow the specific termination provisions outlined in the trust document and might be required to provide notice to the beneficiaries and interested parties. 2. Partial Termination: In certain cases, a trustee may decide to terminate only a portion of the trust. This could occur if certain assets or properties are no longer needed to fulfill the trust's objectives. The trustee must demonstrate a sound justification for the partial termination and obtain court approval if necessary. 3. Merger or Consolidation: Sometimes, a trustee might consider merging or consolidating multiple trusts into one for administrative ease or better management. This involves transferring the assets and liabilities of the individual trusts into a new, combined trust. However, court approval may be required, and careful consideration must be given to the potential effects on the beneficiaries' interests. 4. Judicial Termination: If conflicts or disputes arise between the trustee and beneficiaries, or if the trust's terms are contested, the termination process may require court intervention. In such cases, the court will review the circumstances and make a decision based on the best interests of the beneficiaries and the intentions of the trust's creator. Overall, Travis Texas Termination of Trust by Trustee involves careful interpretation of the trust document, compliance with legal requirements, and consideration of the beneficiaries' interests. Professional guidance from an attorney experienced in trust law is crucial during this process to ensure all necessary steps are followed and the termination is executed ethically and in accordance with applicable laws.

Travis Texas Termination of Trust by Trustee

Description

How to fill out Travis Texas Termination Of Trust By Trustee?

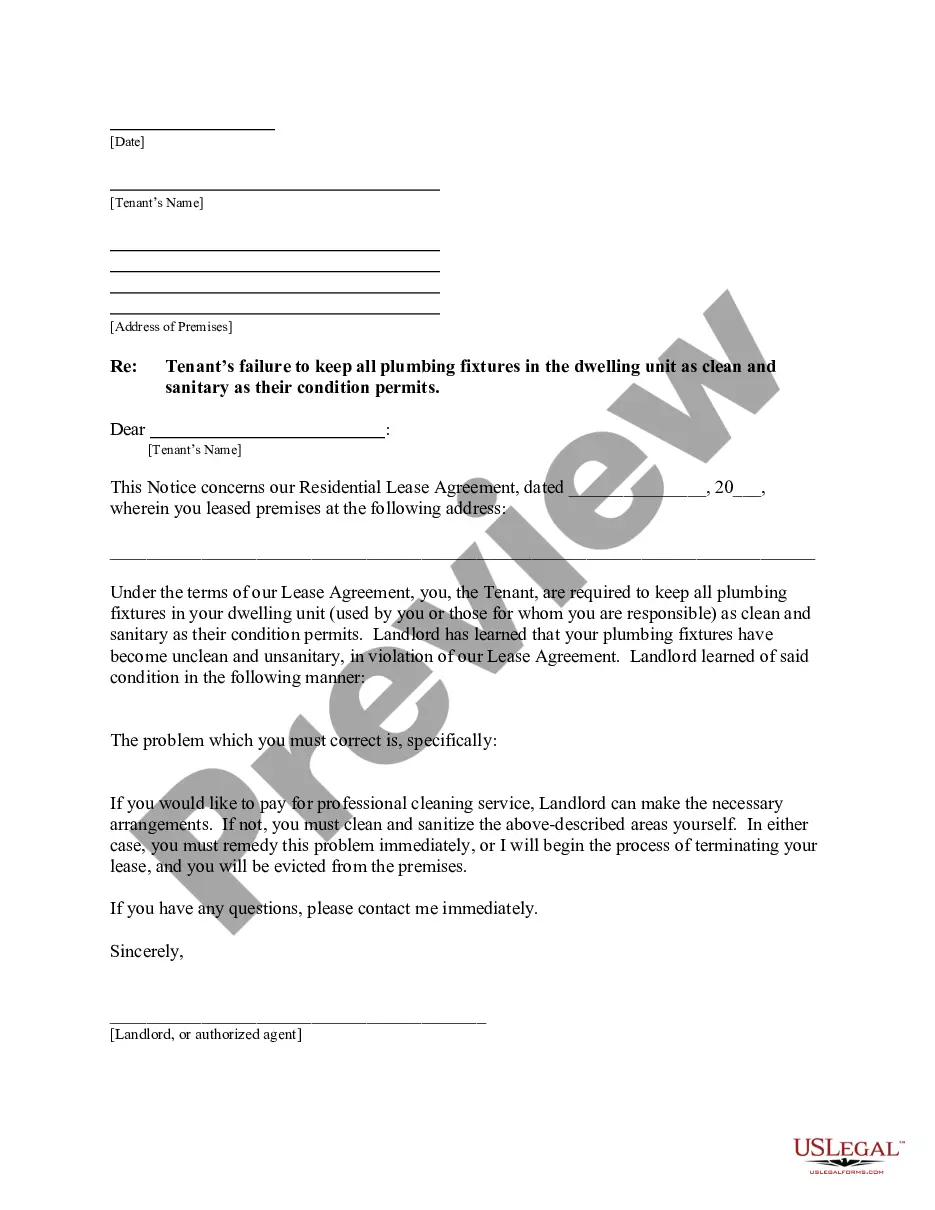

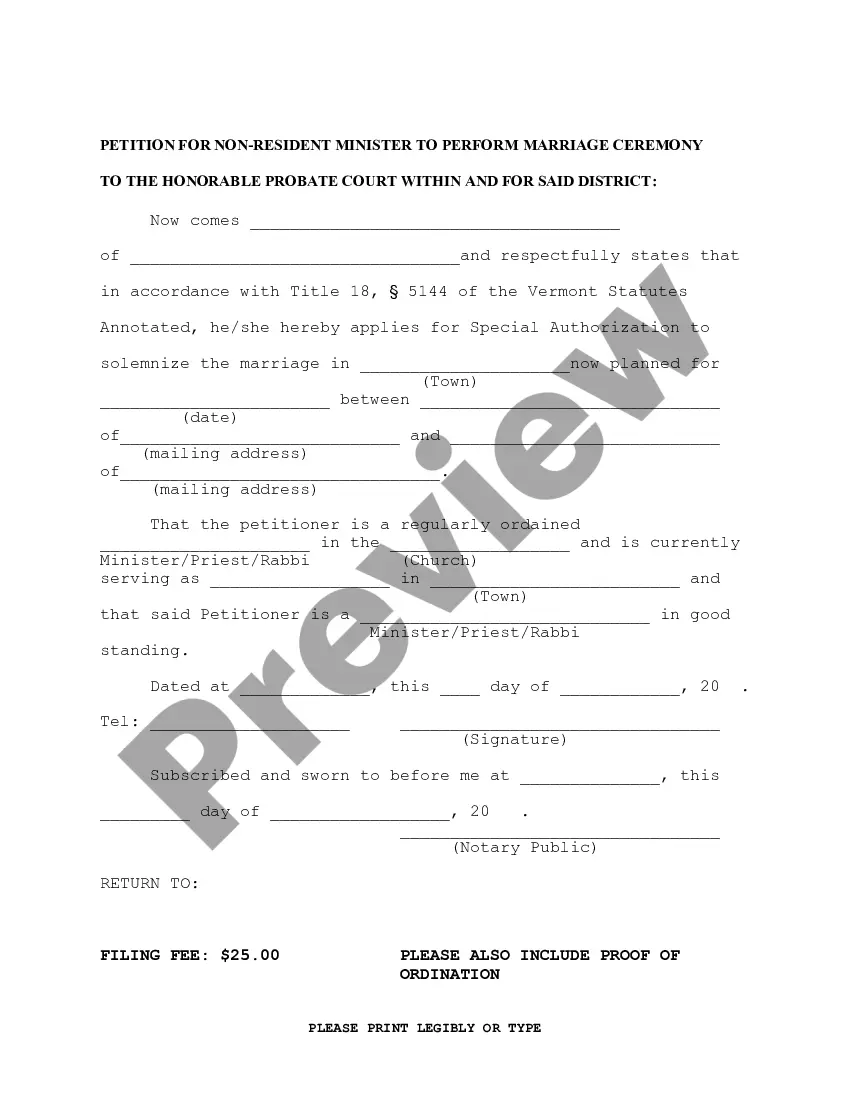

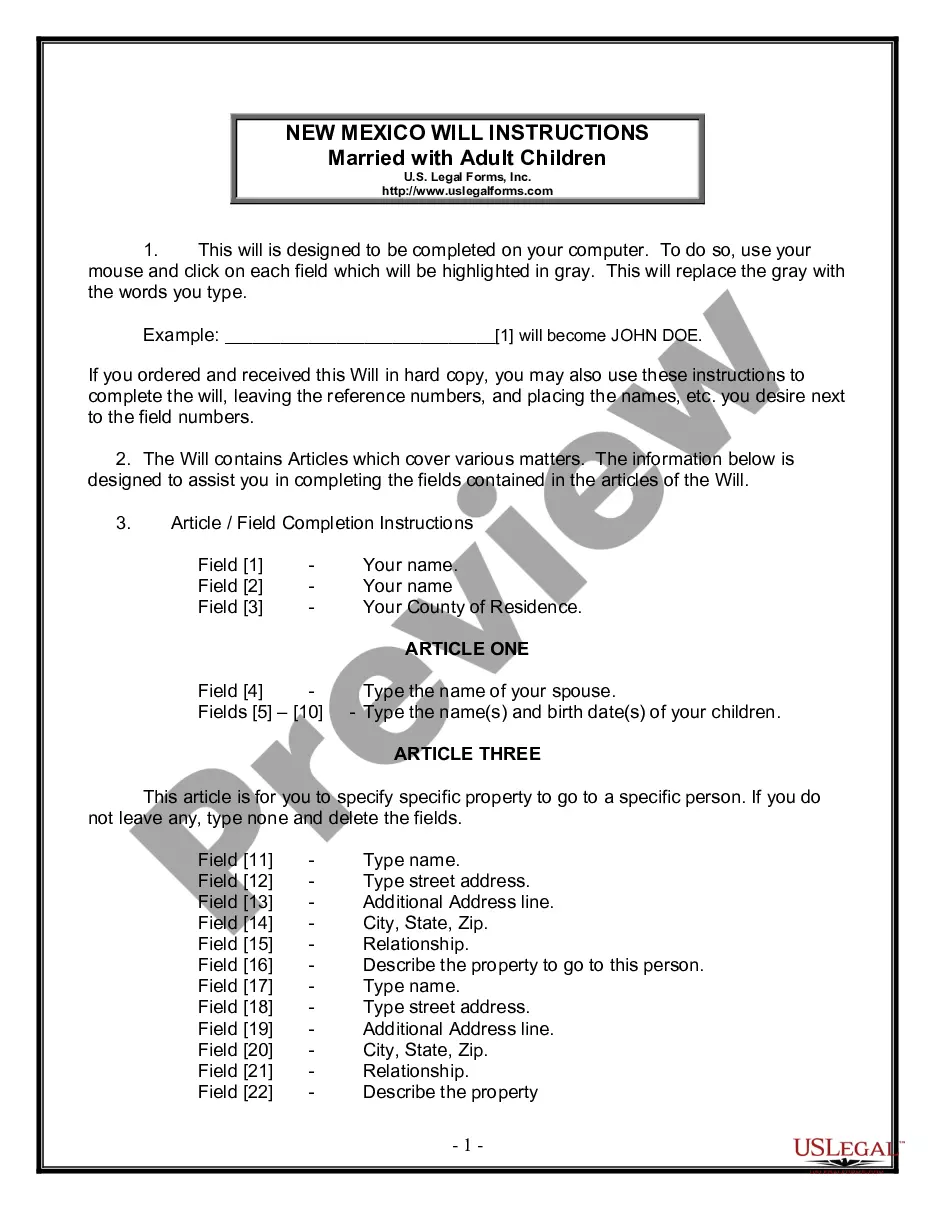

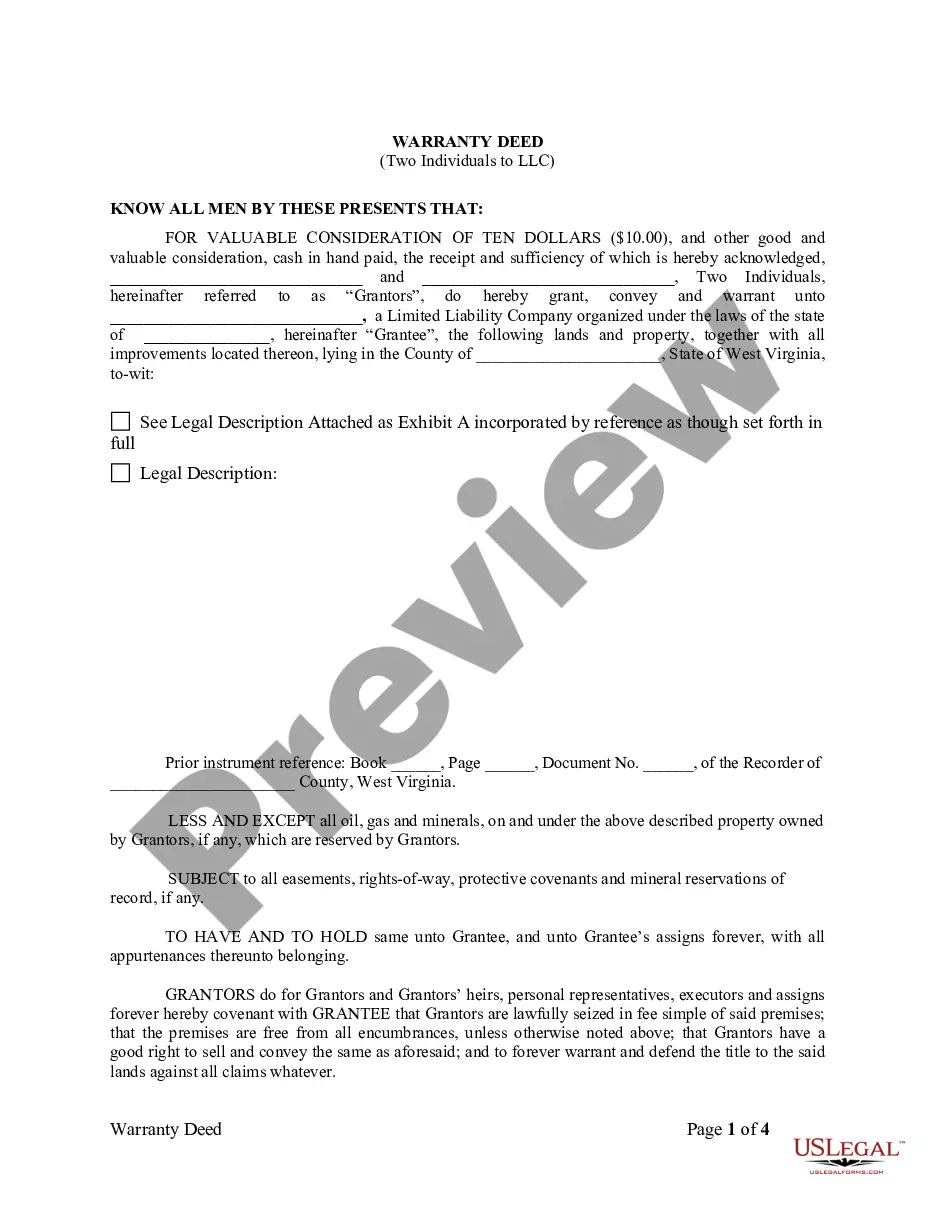

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Travis Termination of Trust by Trustee, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the current version of the Travis Termination of Trust by Trustee, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Termination of Trust by Trustee:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Travis Termination of Trust by Trustee and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

Usually, this means paying any outstanding trust obligations, liquidating assets, filing final income tax returns, preparing a final accounting for the benefit of the beneficiaries, and distributing trust assets to the appropriate beneficiaries.

Usually, this means paying any outstanding trust obligations, liquidating assets, filing final income tax returns, preparing a final accounting for the benefit of the beneficiaries, and distributing trust assets to the appropriate beneficiaries.

Further, a trust will be considered as terminated when all the assets have been distributed except for a reasonable amount which is set aside in good faith for the payment of unascertained or contingent liabilities and expenses (not including a claim by a beneficiary in the capacity of beneficiary).

According to California Probate Code §15642, a trustee can be removed according to the terms of the trust instrument, by the probate court on its own motion, or if the trustmaker, a co-trustee, or a beneficiary files a petition for removal in the probate court.

Principal Distributions. When trust beneficiaries receive distributions from the trust's principal balance, they do not have to pay taxes on the distribution. The Internal Revenue Service (IRS) assumes this money was already taxed before it was placed into the trust.

A trust usually ends under legal and complete circumstances. After the grantor passes away, the trustee handles the property and assets of the grantor, and the assets are transferred to the beneficiary (or beneficiaries) under the terms dictated in the trust by the grantor.

To revoke and/or terminate an irrevocable trust, the settlor and all beneficiaries must express consent. If one party seeks modification of the trust against the interest of another party, the petition will need to be brought before a court to decide.

No, dissolving your revocable trust would not be a taxable event. You should be using one of your social security numbers for the revocable trust, so moving the funds from the trust to new transfer on death (TOD) accounts should be no different from moving money from accounts in your own names.

2. The termination of Trust and the Proposed Distribution will not cause any of the beneficiaries of Trust to be treated as making a taxable gift.