Subject: Allegheny, Pennsylvania Sample Letter for Corporate Tax Return — Comprehensive Guide Dear [Company Name], I hope this letter finds you well. As tax season approaches, we understand the importance of filing your corporate tax return accurately and promptly. To assist you in this process, we have prepared a detailed description of Allegheny, Pennsylvania's corporate tax return requirements, procedure, and noteworthy considerations. This comprehensive guide aims to simplify your tax filing obligations and ensure compliance with all relevant regulations. 1. Allegheny, Pennsylvania Corporate Tax Overview: Allegheny County, located in the state of Pennsylvania, imposes specific tax obligations on corporations operating within its jurisdiction. Corporations carrying on business activities, generating income, or maintaining a physical presence in Allegheny County must file an annual corporate tax return. 2. Letter Format: When preparing your corporate tax return, it is crucial to follow the specific format specified by the Allegheny County Tax Office. Your letter should include essential details, such as the company's legal name, address, EIN (Employer Identification Number), and fiscal year-end date. 3. Required Documentation: Ensure all necessary documentation is enclosed with your corporate tax return letter. This includes the federal Form 1120, Pennsylvania Form RCT-101, and applicable schedules, along with supporting financial statements, such as the income statement, balance sheet, and statement of cash flows for the relevant tax year. 4. Key Deadlines and Extensions: Allegheny, Pennsylvania follows the federal tax filing deadline, which is generally on or around the 15th of March for calendar year-end corporations. If additional time is required, you can request an extension by filling out Form RCT-101E. However, please note that an extension only provides extra time to file your return, and not to pay any outstanding tax liabilities. 5. Important Considerations: When completing your corporate tax return, pay attention to the following considerations: a. Apportionment: Allegheny County utilizes an apportionment formula to determine a company's taxable income allocated to the county. Understanding this allocation process is crucial for accurate tax reporting. b. Nexus Requirements: It's essential to evaluate whether your corporation has sufficient nexus with Allegheny County, as this determines whether you have a filing obligation. c. Deductible Expenses: Familiarize yourself with Allegheny County's specific guidelines regarding deductible expenses. This helps optimize tax planning, minimize tax liability, and avoid potential audit triggers. d. Tracking Local Tax Rates: Keep track of any changes in local tax rates as they might affect your corporate tax liability. 6. Types of Allegheny, Pennsylvania Sample Letters for Corporate Tax Return: While there are no distinct types of sample letters for corporate tax returns to Allegheny, Pennsylvania, the above information serves as a comprehensive guide applicable to all corporations filing returns to the county. We hope this detailed description of Allegheny, Pennsylvania corporate tax returns has provided you with valuable insights. If you require further assistance or have any questions, please do not hesitate to contact our knowledgeable tax experts. Wishing you a successful tax filing season! Best regards, [Your Name] [Company Name] [Contact Information]

Allegheny Pennsylvania Sample Letter for Corporate Tax Return

Description

How to fill out Allegheny Pennsylvania Sample Letter For Corporate Tax Return?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Allegheny Sample Letter for Corporate Tax Return, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Allegheny Sample Letter for Corporate Tax Return from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Allegheny Sample Letter for Corporate Tax Return:

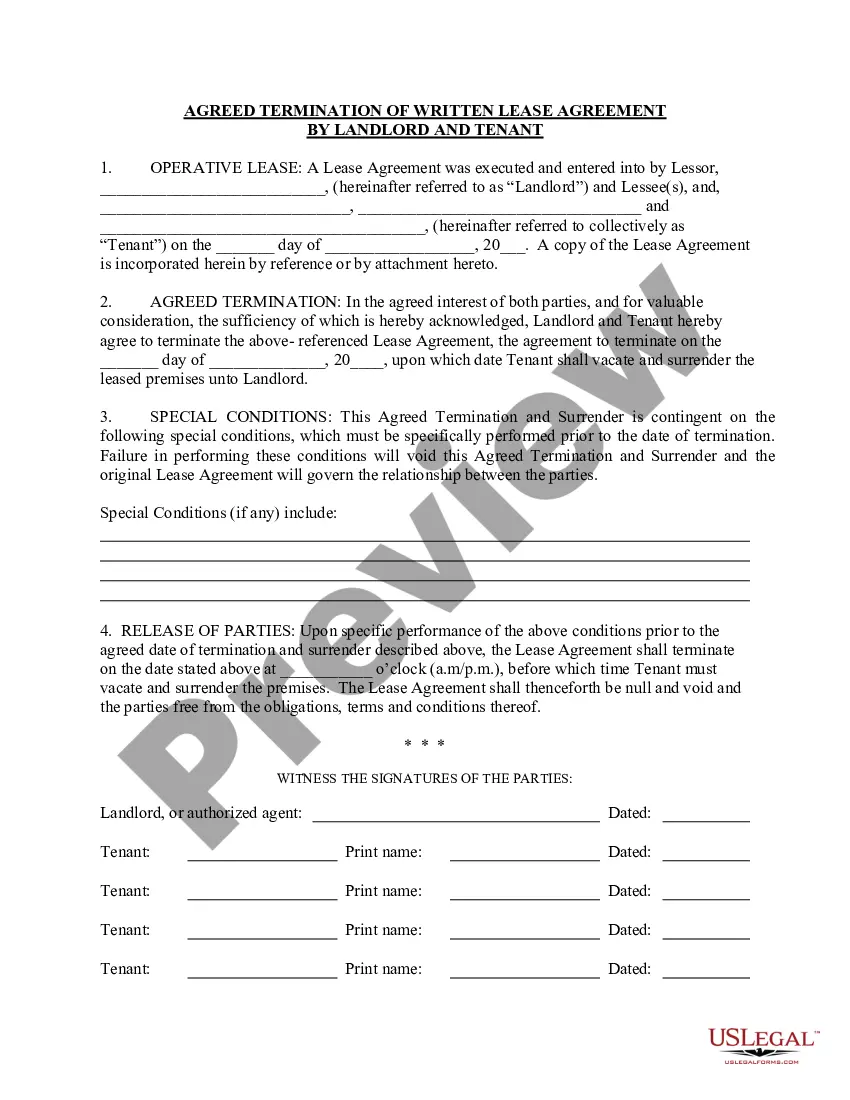

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!