Title: Harris Texas Sample Letter for Corporate Tax Return: A Comprehensive Guide Introduction: Filing corporate tax returns is an essential obligation for businesses operating in Harris County, Texas. To assist companies in fulfilling this duty efficiently, the Harris Texas Sample Letter for Corporate Tax Return serves as a reliable resource. This article will delve into the details of this sample letter, providing an overview of its purpose, format, and some different variants that exist. Keywords: Harris Texas, Sample Letter, Corporate Tax Return, comprehensive guide, businesses, Harris County, obligation, efficient, resource, purpose, format, variants. 1. Purpose of Harris Texas Sample Letter for Corporate Tax Return: The primary objective of the Harris Texas Sample Letter for Corporate Tax Return is to provide corporate taxpayers a reference template, offering guidance on properly completing and submitting their annual tax returns. It aims to assist businesses in adhering to the necessary regulations set forth by the Harris County Tax Office. 2. Format and Structure: The sample letter for corporate tax return to Harris Texas typically follows a structured format, including the following key components: a) Company Information: Begin the letter by providing accurate details about the corporation, such as name, legal structure, address, Employer Identification Number (EIN), and tax year. b) Financial Information: Present a comprehensive breakdown of the corporation's financial data, including revenue, expenses, assets, liabilities, and any other relevant financial statements. c) Deductions and Credits: Clearly outline eligible deductions and credits that the corporation is claiming, accompanied by supporting documents. d) Signature and Contact Information: Conclude the letter with the authorized representative's signature, title, and contact information for any potential follow-ups. 3. Types of Harris Texas Sample Letters for Corporate Tax Return: a) Standard Corporate Tax Return Letter: This variant caters to regular corporations that file their tax return to Harris County, Texas, following the usual requirements and procedures. b) Amended Corporate Tax Return Letter: This type of sample letter assists corporations that need to amend their previously filed tax returns. It includes a detailed explanation of the amendments and necessary supporting documents. c) Extension Request Corporate Tax Return Letter: For corporations seeking an extension to file their tax return beyond the standard deadline, this variant outlines the reason for the extension and justifies the need for additional time. Conclusion: The Harris Texas Sample Letter for Corporate Tax Return plays a crucial role in facilitating efficient tax return filing procedures for businesses in Harris County. By understanding the purpose, format, and different variations available, corporations can effectively utilize this valuable resource to ensure their compliance with tax regulations.

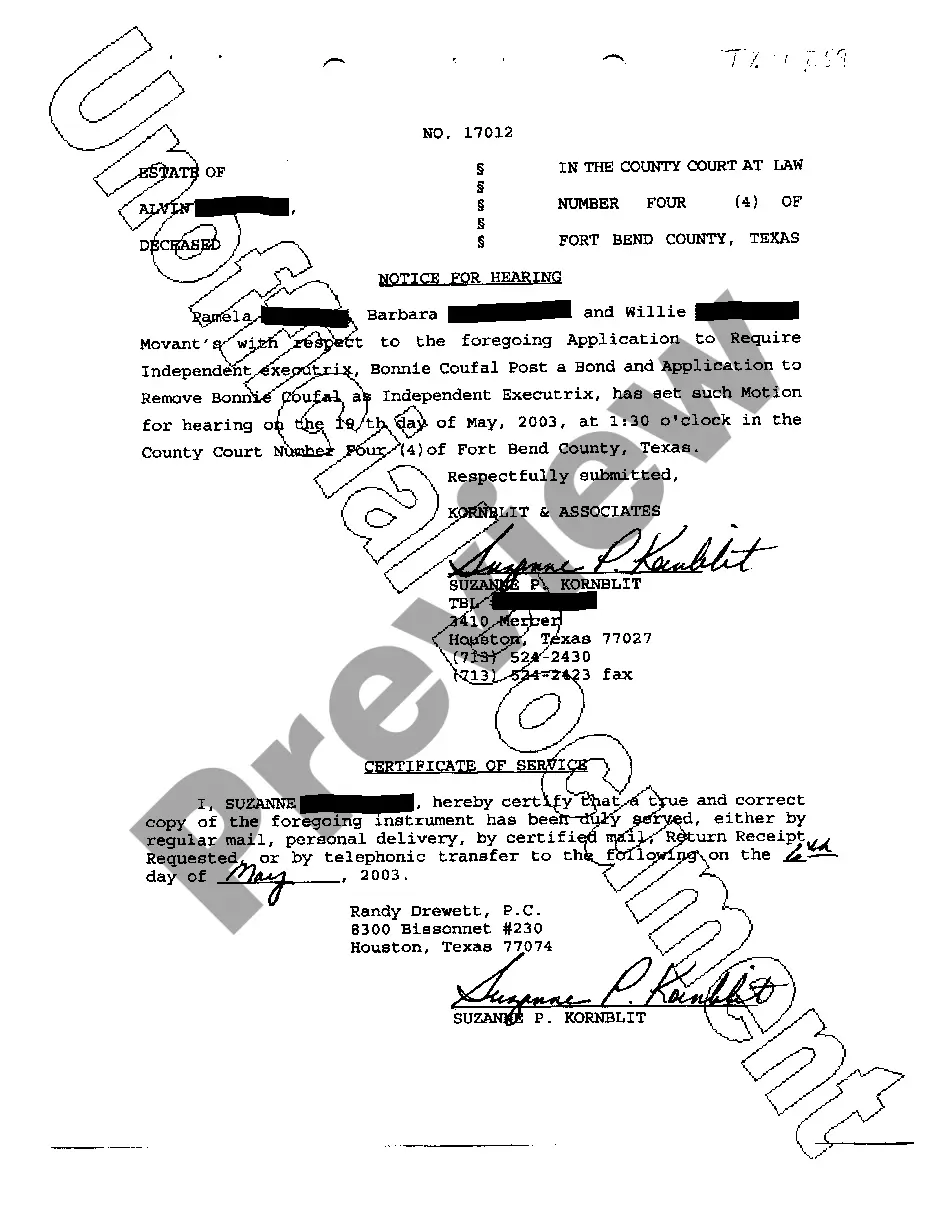

Harris Texas Sample Letter for Corporate Tax Return

Description

How to fill out Harris Texas Sample Letter For Corporate Tax Return?

Creating documents, like Harris Sample Letter for Corporate Tax Return, to manage your legal affairs is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for various cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Harris Sample Letter for Corporate Tax Return form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before getting Harris Sample Letter for Corporate Tax Return:

- Ensure that your template is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Harris Sample Letter for Corporate Tax Return isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our service and get the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!