Title: Comprehensive Guide to Houston, Texas Sample Letter for Corporate Tax Returns Introduction: Houston, Texas, is a thriving metropolis known for its robust economy and business-friendly environment. As a corporate entity operating in Houston, it is crucial to file accurate and timely tax returns to ensure compliance with federal and state tax laws. In this article, we provide a detailed description of various types of sample letters for corporate tax returns to Houston, Texas, along with relevant keywords. 1. Standard Houston Texas Sample Letter for Corporate Tax Return: A standard sample letter for corporate tax returns to Houston, Texas serves as a template for businesses to communicate their financial information efficiently to the tax authorities. It includes key components such as company identification, financial statements, tax calculations, and appendices. Use keywords like "standard tax return letter," "corporate tax filing in Houston," "template for tax return letter," and "Houston corporate tax guidelines" when discussing this type of letter. 2. Amendment Letter for Corporate Tax Return: In some cases, corporations may need to make amendments to their previously filed tax returns due to errors or changes in financial circumstances. The amendment letter for corporate tax returns outlines the necessary modifications, providing supporting documentation and explanations for discrepancies between the original filing and the amendments. Keywords to include are "amendment letter for corporate tax return," "tax return correction in Houston TX," and "amending corporate tax returns." 3. Extension Request Letter for Corporate Tax Return: In situations where a company requires additional time to prepare and file its corporate tax return to Houston, Texas, an extension request letter is necessary. This letter formally requests an extension from the tax authorities, explaining the reasons for the delay and providing a proposed new deadline. Keywords to incorporate are "extension request for corporate tax return," "filing deadline extension in Houston TX," and "requesting more time for corporate tax filing." 4. Letter of Explanation for Corporate Tax Return: Occasionally, corporations may receive inquiries or audits from the tax authorities regarding specific items or figures on their tax return. A letter of explanation clarifies any discrepancies, provides supporting documentation, and offers a comprehensive explanation to address the tax authority's concerns. Relevant keywords include "letter of explanation for corporate tax return," "responding to tax authorities in Houston TX," "providing supporting documents for tax audit," and "explaining tax return figures." Conclusion: Effective communication through well-drafted sample letters is crucial during the corporate tax return process in Houston, Texas. The mentioned types of letters (standard, amendment, extension request, and explanation) play significant roles in ensuring accurate and compliant tax filings. Remember to utilize relevant keywords to make your correspondence with the tax authorities as clear and effective as possible.

Houston Texas Sample Letter for Corporate Tax Return

Description

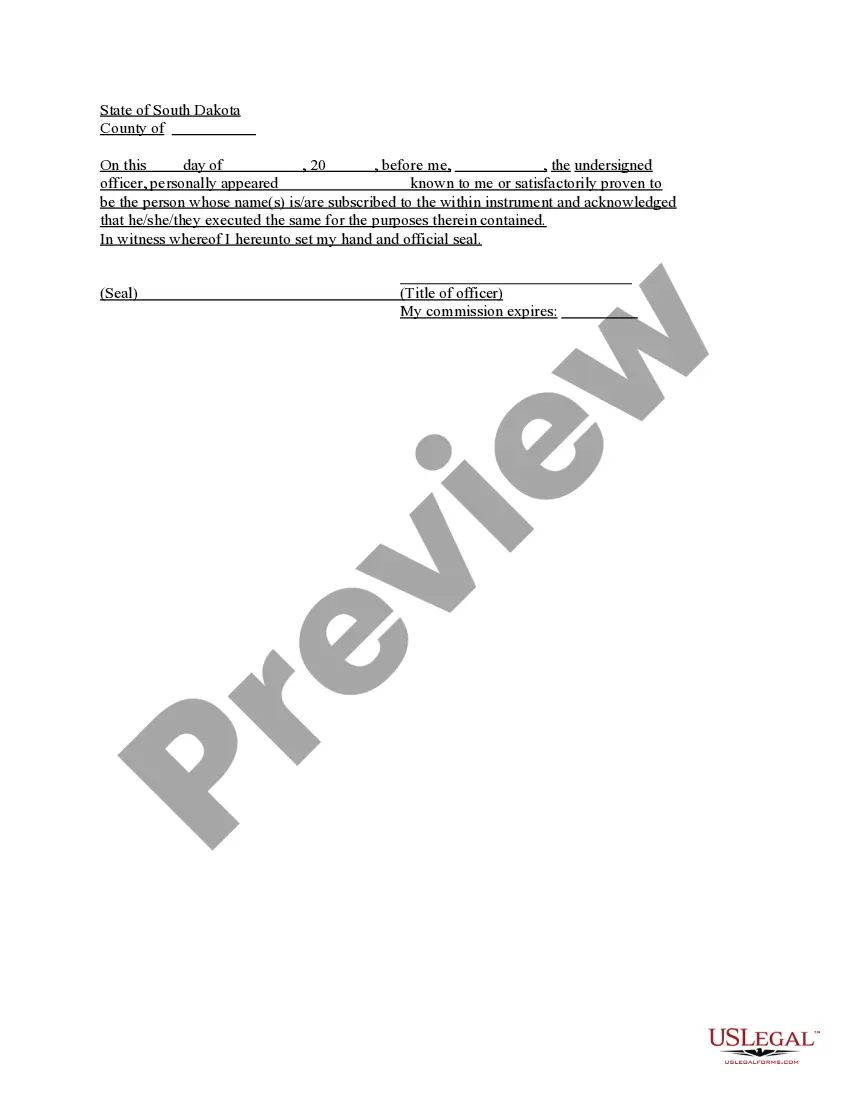

How to fill out Houston Texas Sample Letter For Corporate Tax Return?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Houston Sample Letter for Corporate Tax Return, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Houston Sample Letter for Corporate Tax Return from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Houston Sample Letter for Corporate Tax Return:

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!