Subject: Comprehensive Description of Maricopa, Arizona Sample Letter for Corporate Tax Return Dear [Recipient's Name], I hope this letter finds you well. As a certified public accountant serving numerous businesses in Maricopa, Arizona, I am pleased to provide you with detailed information regarding our sample letter for corporate tax returns. This letter aims to assist corporations in correctly completing their tax filing obligations and optimizing their financial operations. Maricopa, Arizona, known for its warm climate and vibrant community, is an ideal location for businesses to thrive. Whether your corporation is an established enterprise or a start-up, filing accurate corporate tax returns is crucial for maintaining compliance and maximizing your financial benefits. We understand that tax preparation can be a complex process, so we have devised a comprehensive Maricopa, Arizona sample letter for corporate tax returns to simplify the procedure for businesses of all sizes. Our sample letter includes the following key sections, each tailored to meet the unique requirements of corporate tax returns: 1. Introduction: This section serves as a proper salutation to the respective tax authority. It introduces your corporation, providing important identification details, such as Legal Name, Employer Identification Number (EIN), and the tax year under consideration. 2. Executive Summary: Here, corporations can concisely summarize the tax position and any notable financial and operational changes that may have occurred during the tax year. The summary can include significant capital transactions, investments, and other relevant information. 3. Detailed Financial Statements: To assist corporations in reporting their financial information accurately, we offer a preformatted section that covers the Statement of Financial Position (Balance Sheet), Statement of Comprehensive Income (Income Statement), and Statement of Cash Flows. This segment ensures the proper reflection of the corporation's financial standing. 4. Supporting Schedules: In this part, corporations can provide additional supporting schedules to substantiate certain line items on their financial statements. These schedules may include details about depreciation, loans, investments, and any other significant financial activities. 5. Notes to the Financial Statements: A crucial section that provides explanations and disclosures related to numerous accounting policies, assumptions, and additional data. These notes ensure transparency and compliance with relevant financial reporting standards. 6. Checklist: Lastly, we have designed a comprehensive checklist to guide corporations and ensure they have accurately compiled all necessary documents for their corporate tax return. This checklist covers areas such as income sources, deductions, credits, and exemptions. Aside from the Maricopa, Arizona sample letter for corporate tax returns, we also provide specialized versions for different types of corporate entities, such as: 1. C Corporation Sample Letter: Designed for corporations that operate as separate legal entities, this sample letter allows accurate reporting of income, deductions, and tax liability for C corporations. 2. S Corporation Sample Letter: For corporations that have elected the S Corporation tax status, this sample letter enables proper reporting of income and deductions, while also considering factors unique to S Corporations, such as pass-through taxation. 3. LLC Sample Letter: This sample letter caters to Limited Liability Companies (LCS) operating in Maricopa, Arizona, helping them properly report their income and deductions while factoring in the tax implications specific to this business structure. By utilizing our Maricopa, Arizona sample letter for corporate tax returns, corporations can ensure compliance with local and federal regulations while maximizing their available tax incentives and deductions. If you require further assistance or have specific inquiries, please feel free to reach out to our trained team of tax professionals. Our expertise is at your disposal to help you navigate the complexities of corporate tax return filings and ensure your financial success. Thank you for considering our services. We look forward to serving you and your corporation in Maricopa, Arizona. Sincerely, [Your Name] [Your Title] [Company Name] [Contact Information]

Maricopa Arizona Sample Letter for Corporate Tax Return

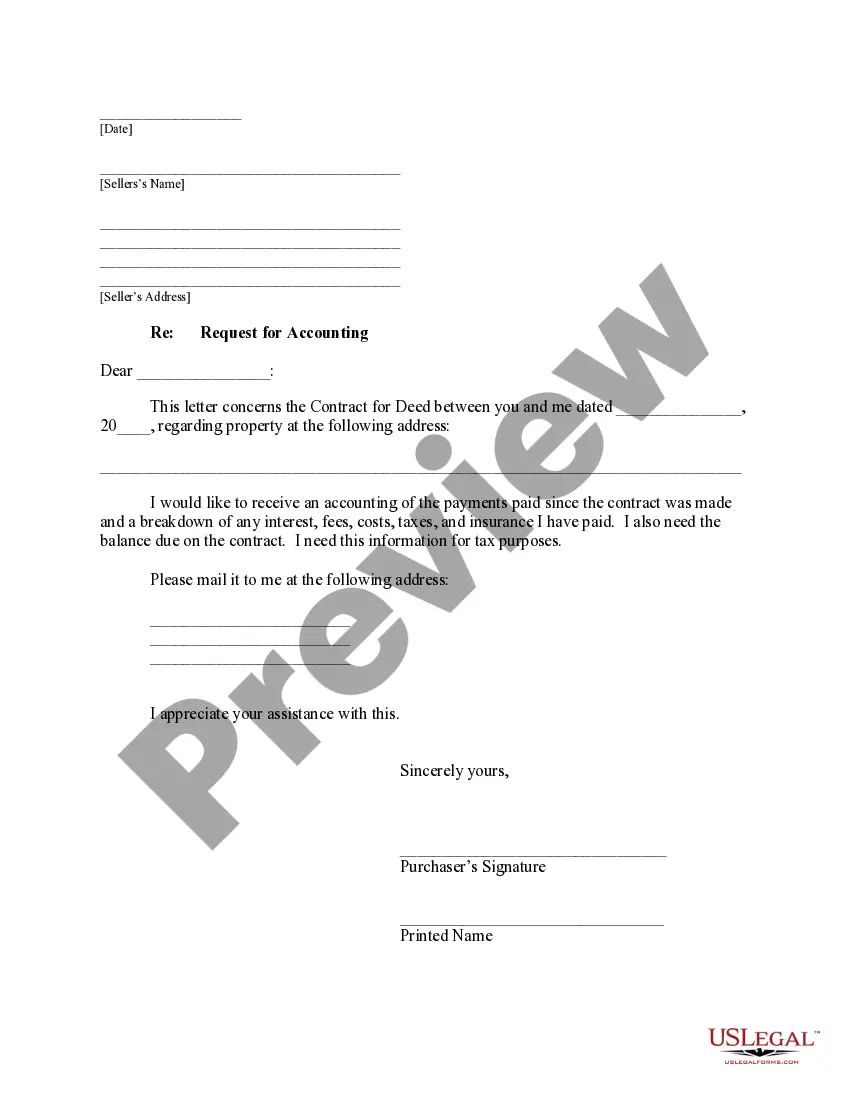

Description

How to fill out Maricopa Arizona Sample Letter For Corporate Tax Return?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Maricopa Sample Letter for Corporate Tax Return meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Maricopa Sample Letter for Corporate Tax Return, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Maricopa Sample Letter for Corporate Tax Return:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Maricopa Sample Letter for Corporate Tax Return.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!