Dear [Company Name], We hope this letter finds you well. As tax season approaches, we would like to provide you with a detailed description of the Oakland, Michigan Sample Letter for Corporate Tax Return. Our aim is to assist you in navigating the intricacies of corporate tax filing, maximizing your deductions, and ensuring compliance with applicable tax regulations. Oakland, Michigan is a prosperous county located in the southeastern part of the state. It is home to a diverse range of businesses, from small startups to large corporations, and has established itself as an economic hub in the region. It encompasses several cities, including Troy, Rochester Hills, and Farmington Hills. When it comes to corporate tax return preparation in Oakland, Michigan, there are various types of sample letters you may encounter: 1. Standard Corporate Tax Return Letter: This sample letter is designed for businesses that follow standard tax filing procedures and require a comprehensive summary of income, deductions, and credits. It covers reporting requirements for both federal and state corporate tax returns. 2. Small Business Corporate Tax Return Letter: Geared towards small businesses, this letter includes specific guidelines and considerations tailored to their unique needs. It may cover topics such as tax breaks available for startups, allowable small business deductions, and simplified reporting options. 3. Partnership Corporate Tax Return Letter: For businesses organized as partnerships or multi-member LCS, this letter provides information on the tax reporting requirements for such entities. It outlines the necessary forms, schedules, and partner allocations required for accurate tax filing. 4. S Corporation Tax Return Letter: This sample letter is designed for businesses that have elected to be treated as S corporations for tax purposes. It covers the specific tax rules and regulations applicable to these entities, including how to report income, losses, and shareholder distributions. Regardless of the type of business you operate, our Oakland, Michigan Sample Letter for Corporate Tax Return is crafted to address your specific needs. It takes into account the latest changes in tax laws, ensuring accuracy and compliance. Our letter includes detailed instructions on gathering the necessary financial documents, completing the appropriate tax forms, and ensuring all deductions and credits are properly accounted for. We are committed to providing you with a comprehensive guide that simplifies the tax filing process and maximizes your tax benefits. In conclusion, our Oakland, Michigan Sample Letter for Corporate Tax Return is a valuable resource that caters to the diverse business community in the county. It encompasses standard corporate tax returns, as well as specialized letters for small businesses, partnerships, and S corporations. By utilizing this sample letter, you can navigate the complex world of corporate taxation with confidence, knowing that your tax return is accurate, compliant, and optimized for maximum tax benefits. Should you require further assistance or have any questions regarding your tax preparation, please do not hesitate to reach out to our dedicated team. We are here to guide you every step of the way. Sincerely, [Your Name] [Your Title/Position] [Company Name]

Oakland Michigan Sample Letter for Corporate Tax Return

Description

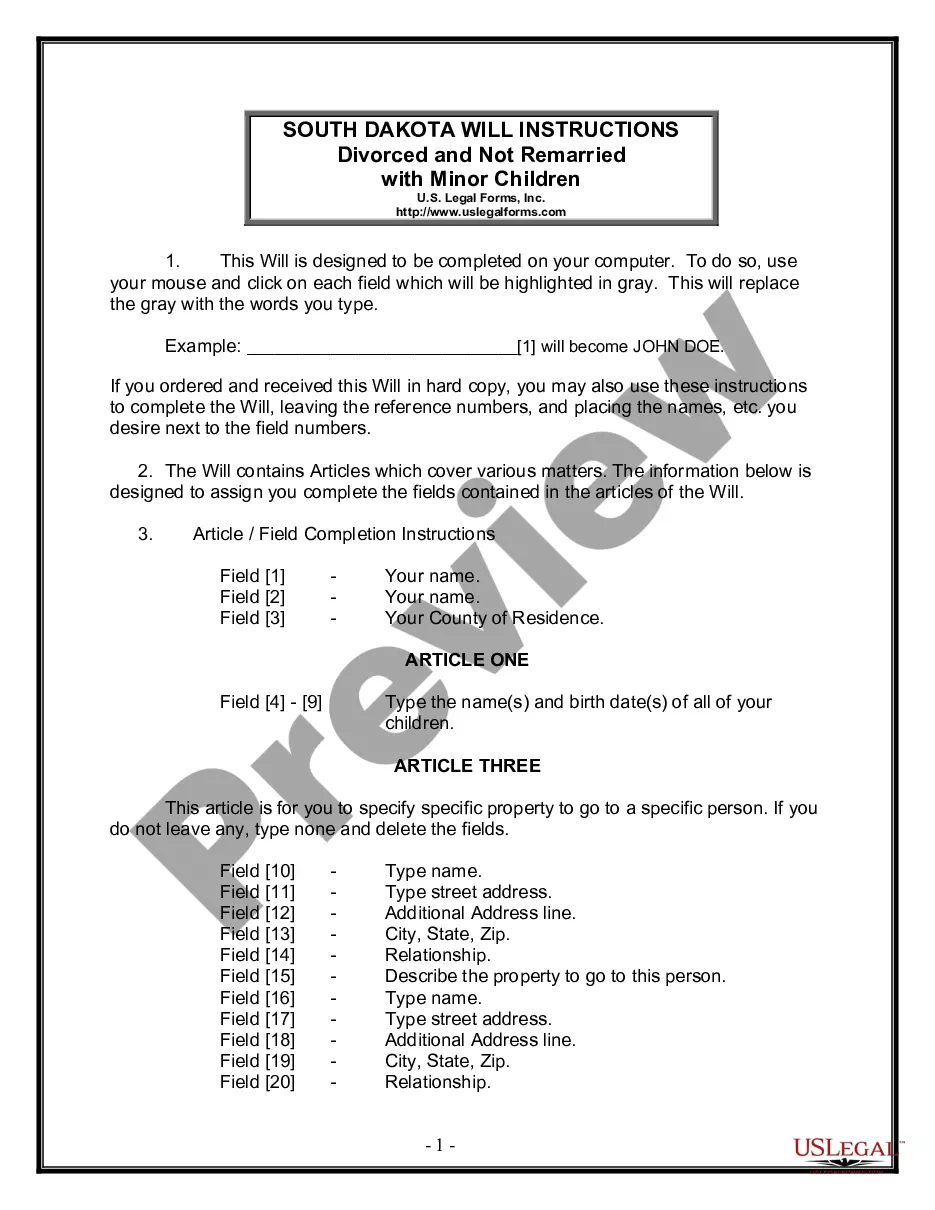

How to fill out Oakland Michigan Sample Letter For Corporate Tax Return?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business purpose utilized in your region, including the Oakland Sample Letter for Corporate Tax Return.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Oakland Sample Letter for Corporate Tax Return will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Oakland Sample Letter for Corporate Tax Return:

- Make sure you have opened the right page with your regional form.

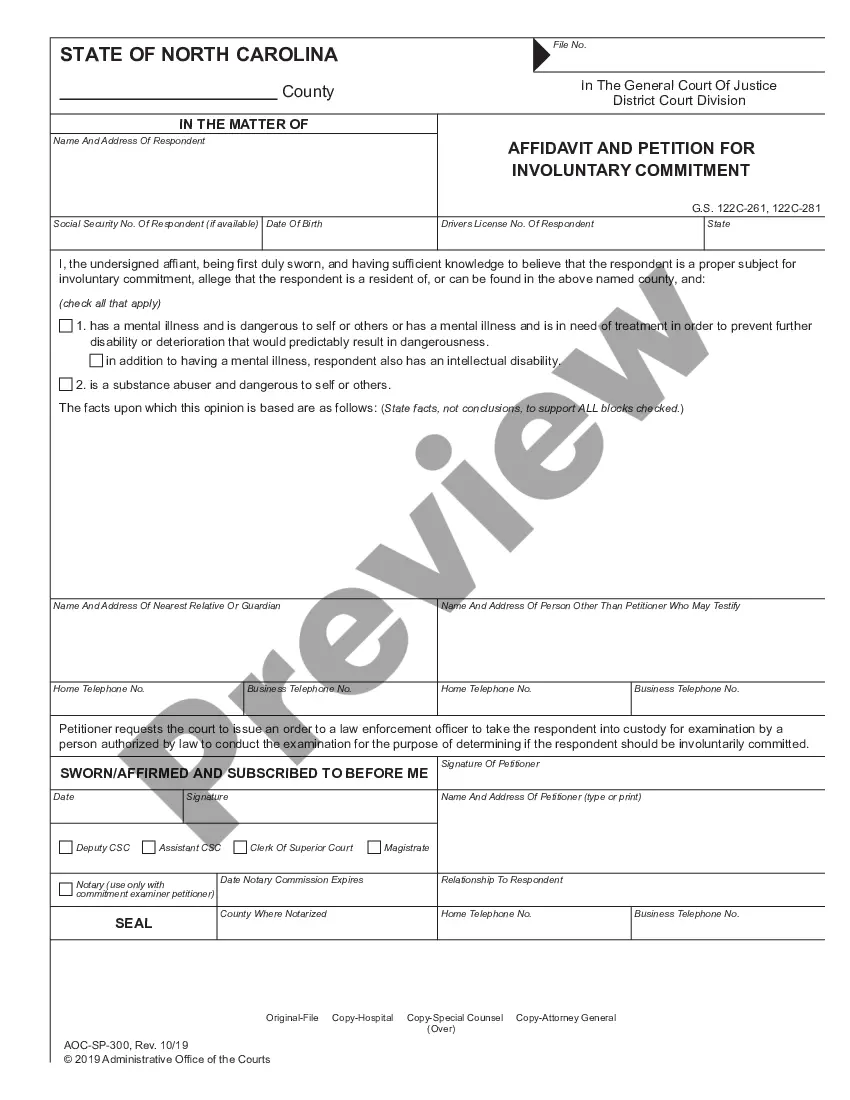

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Oakland Sample Letter for Corporate Tax Return on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!