Riverside California is a vibrant city located in the Inland Empire region of Southern California. Known for its beautiful landscapes, diverse cultural scene, and thriving economy, Riverside attracts many individuals and businesses alike. When it comes to filing corporate tax returns to Riverside California, it is important to ensure accuracy and compliance with local laws and regulations. A sample letter for corporate tax return to Riverside California may vary depending on the specific circumstances of the company. Here are a few common types of sample letters that businesses in Riverside might use when filing their corporate tax returns: 1. Standard Corporate Tax Return Letter: This type of letter is typically used by businesses in Riverside to provide the necessary information required for filing their annual corporate tax return. It includes details such as the company's name, address, tax identification number, and a breakdown of income, expenses, deductions, and credits. 2. Tax Extension Request Letter: If a corporation needs additional time to prepare and file its corporate tax return, a tax extension request letter should be submitted to the applicable tax authorities. This letter explains the reasons for the extension and provides information on the estimated tax liability to be paid by the original due date. 3. Amended Corporate Tax Return Letter: In certain cases, a business may need to amend its previously submitted corporate tax return due to errors, omissions, or changes in financial information. An amended corporate tax return letter is used to inform tax authorities about the changes made and provide the corrected figures. 4. Tax Payment Plan Request Letter: If a company is unable to pay its tax liability in full by the due date, a tax payment plan request letter is submitted to request a payment arrangement. This letter outlines the reasons for the financial hardship and proposes a reasonable repayment plan based on the business's current financial situation. 5. Tax Return Review Request Letter: Sometimes, businesses may want to request a review or audit of their corporate tax return filed in Riverside. This type of letter seeks a review of the filed tax return based on discrepancies or concerns identified by the business or its tax professionals. When drafting any of these sample letters for corporate tax return to Riverside California, it is crucial to include accurate and complete information to ensure compliance with local tax laws. Additionally, seeking professional advice from tax experts or consulting resources provided by the Internal Revenue Service (IRS) can aid in preparing and submitting a comprehensive and error-free corporate tax return.

Riverside California Sample Letter for Corporate Tax Return

Description

How to fill out Riverside California Sample Letter For Corporate Tax Return?

Drafting documents for the business or individual needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Riverside Sample Letter for Corporate Tax Return without professional assistance.

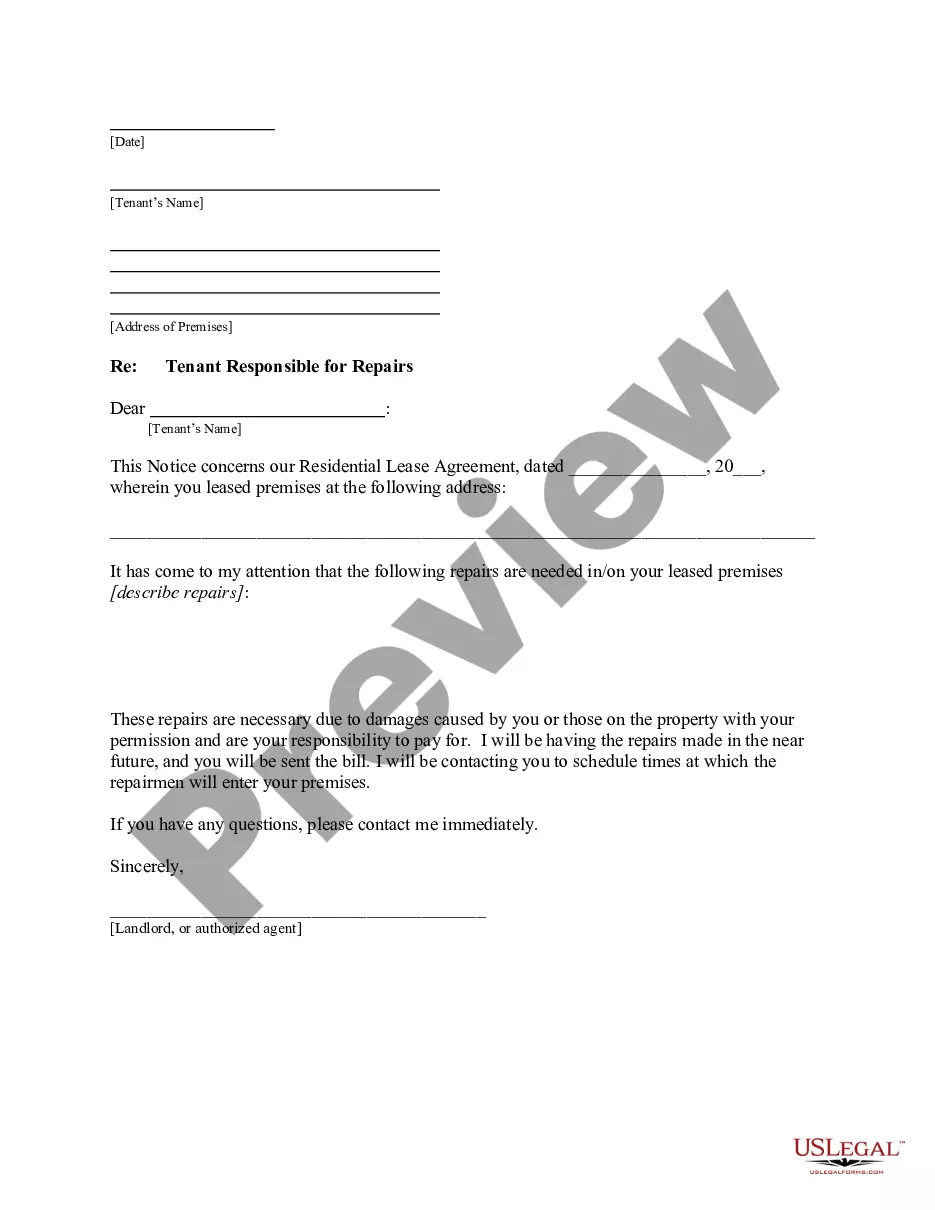

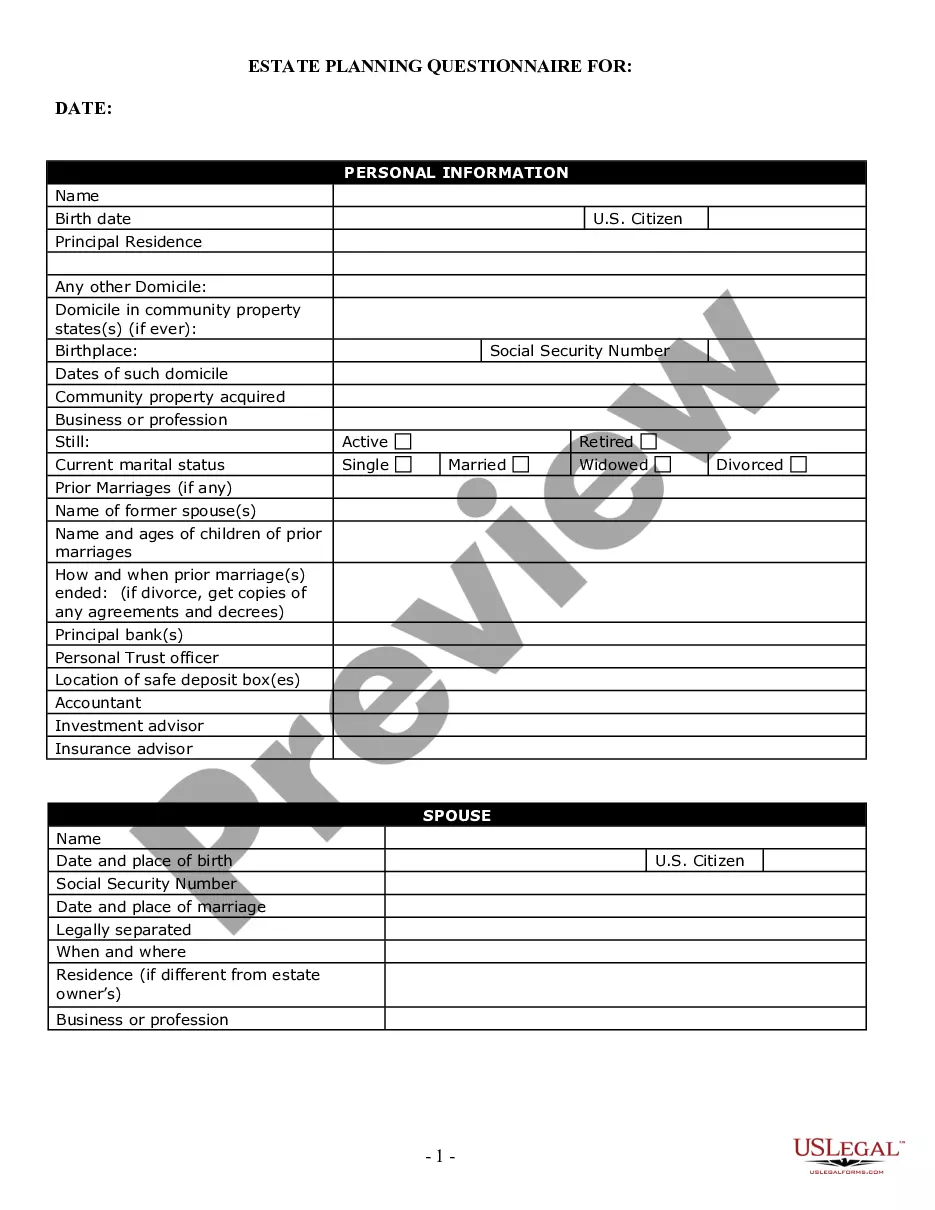

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Riverside Sample Letter for Corporate Tax Return on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Riverside Sample Letter for Corporate Tax Return:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a few clicks!