A Miami-Dade Florida Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife is a specific type of trust established in Miami-Dade County, Florida. This trust is created under a will or testamentary document and is designed to protect and preserve the assets of the estate for the benefit of the wife during her lifetime, with the trust continuing for the benefit of the children after her passing. Keywords: Miami-Dade Florida, Testamentary Trust, Residue of an Estate, Benefit of a Wife, Trust Continuation, Benefit of Children. Different types of Miami-Dade Florida Testamentary Trusts of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife may include: 1. Revocable Testamentary Trust: In this type of trust, the creator, usually the husband, retains the right to make changes or revoke the trust during his lifetime. However, upon his death, the trust becomes irrevocable and continues for the benefit of the wife and children. 2. Irrevocable Testamentary Trust: This type of trust cannot be changed or revoked once it is created. It provides a higher level of asset protection as it removes control from the creator. The trust will continue for the benefit of the wife and children as specified in the trust document. 3. Special Needs Testamentary Trust: If one of the children has special needs or requires ongoing support, a special needs trust can be set up within the testamentary trust to ensure their financial needs are met without jeopardizing any government benefits they may be entitled to. 4. Spendthrift Testamentary Trust: This type of trust includes restrictions on the beneficiary's access to the trust assets to protect them from potential creditors or mismanagement. It provides a level of financial security and ensures the assets are distributed wisely and responsibly over time. 5. Charitable Testamentary Trust: If the deceased has a philanthropic intention, a portion of the trust's residue can be designated for charitable purposes, allowing the trust to benefit both the wife, children, and the chosen charitable organizations. It is crucial to consult with a qualified estate planning attorney in Miami-Dade County, Florida, to understand the specific legal requirements, implications, and options for establishing and managing a Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife in Miami-Dade County.

Miami-Dade Florida Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-0462BG

Format:

Word;

Rich Text

Instant download

Description

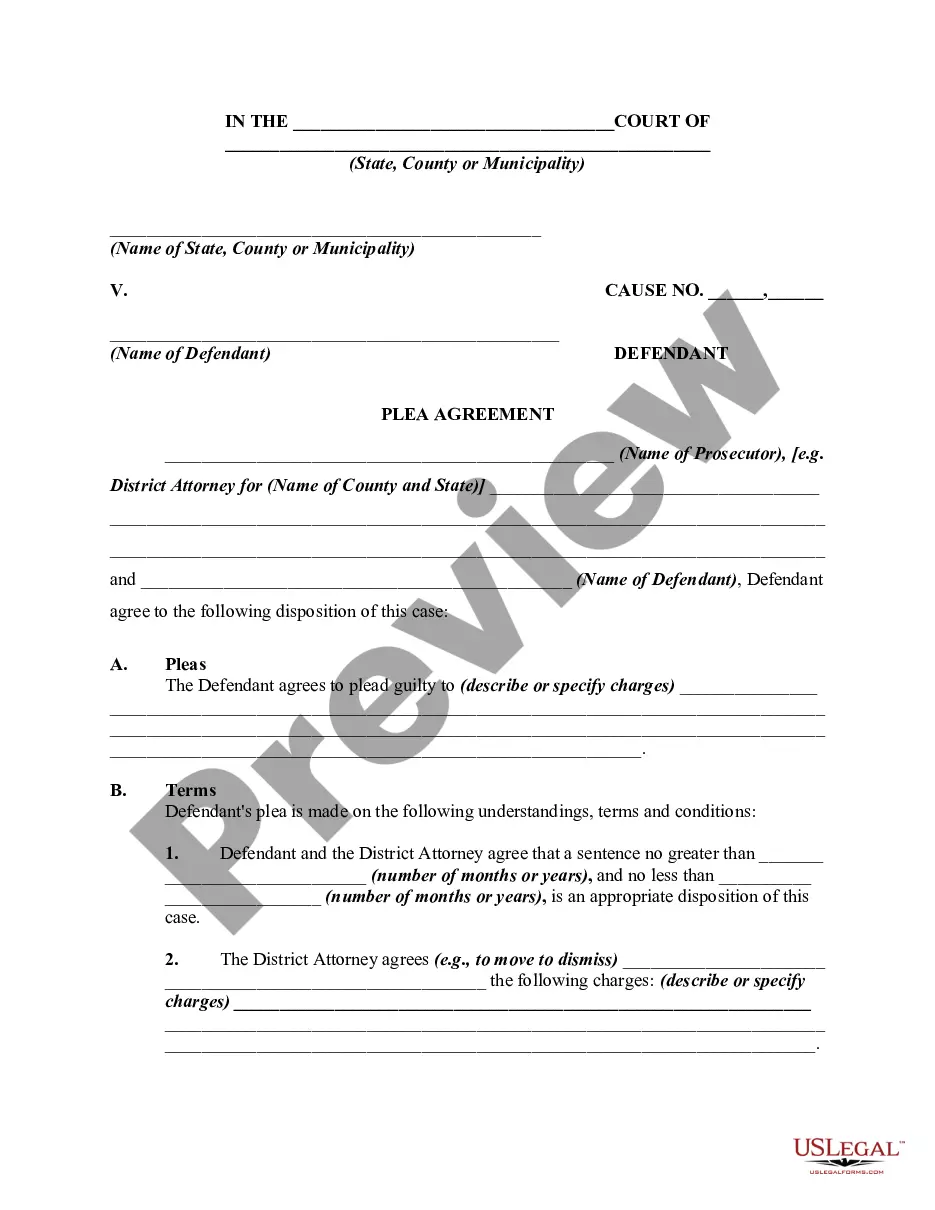

Testamentary means related to a will. A testamentary trust is a trust created by the provisions in a will. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. L

A Miami-Dade Florida Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife is a specific type of trust established in Miami-Dade County, Florida. This trust is created under a will or testamentary document and is designed to protect and preserve the assets of the estate for the benefit of the wife during her lifetime, with the trust continuing for the benefit of the children after her passing. Keywords: Miami-Dade Florida, Testamentary Trust, Residue of an Estate, Benefit of a Wife, Trust Continuation, Benefit of Children. Different types of Miami-Dade Florida Testamentary Trusts of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife may include: 1. Revocable Testamentary Trust: In this type of trust, the creator, usually the husband, retains the right to make changes or revoke the trust during his lifetime. However, upon his death, the trust becomes irrevocable and continues for the benefit of the wife and children. 2. Irrevocable Testamentary Trust: This type of trust cannot be changed or revoked once it is created. It provides a higher level of asset protection as it removes control from the creator. The trust will continue for the benefit of the wife and children as specified in the trust document. 3. Special Needs Testamentary Trust: If one of the children has special needs or requires ongoing support, a special needs trust can be set up within the testamentary trust to ensure their financial needs are met without jeopardizing any government benefits they may be entitled to. 4. Spendthrift Testamentary Trust: This type of trust includes restrictions on the beneficiary's access to the trust assets to protect them from potential creditors or mismanagement. It provides a level of financial security and ensures the assets are distributed wisely and responsibly over time. 5. Charitable Testamentary Trust: If the deceased has a philanthropic intention, a portion of the trust's residue can be designated for charitable purposes, allowing the trust to benefit both the wife, children, and the chosen charitable organizations. It is crucial to consult with a qualified estate planning attorney in Miami-Dade County, Florida, to understand the specific legal requirements, implications, and options for establishing and managing a Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife in Miami-Dade County.

Free preview