A Wake North Carolina Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a legal arrangement established in the state of North Carolina to secure the financial future of a wife and children following the death of the husband. When a person creates a will in Wake County, North Carolina, they may include provisions for a testamentary trust that ensures their estate's remaining assets (the residue) will be managed and distributed in a specific manner. In this particular type of trust, the primary beneficiary is the wife. The trust is designed to provide financial security and support to the surviving wife after the death of her spouse. The Wake North Carolina Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife can have various types depending on the specific instructions provided in the will. Some potential variations of this trust include: 1. Irrevocable Testamentary Trust: Once the trust is established, the provisions cannot be altered or revoked. 2. Revocable Testamentary Trust: The trust may be modified or terminated during the lifetime of the testator. 3. Discretionary Testamentary Trust: The trustee has the authority to distribute assets to the wife and children based on their individual needs and circumstances. 4. Protective Testamentary Trust: The trust aims at protecting the assets from potential creditors or creditors of the beneficiaries. 5. Spendthrift Testamentary Trust: The trust restricts the beneficiaries from directly accessing the trust assets, protecting the funds from ill-advised spending or mismanagement. The Wake North Carolina Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife provides a comprehensive plan to ensure that the wife receives financial support and protection, while also safeguarding the children's welfare and inheritance. This type of trust can offer peace of mind to the testator, knowing their loved ones will be cared for and their assets will be managed responsibly.

Wake North Carolina Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Wake North Carolina Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Wake Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Wake Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Wake Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife:

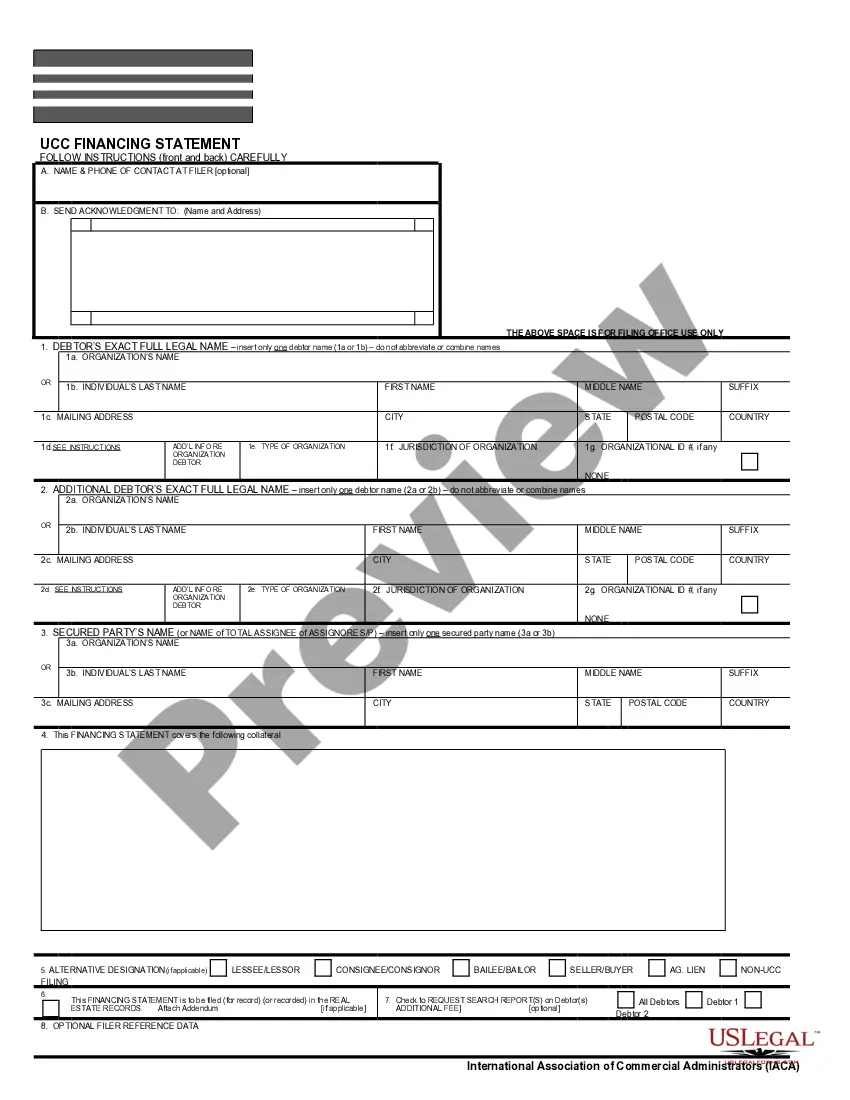

- Take a look at the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!