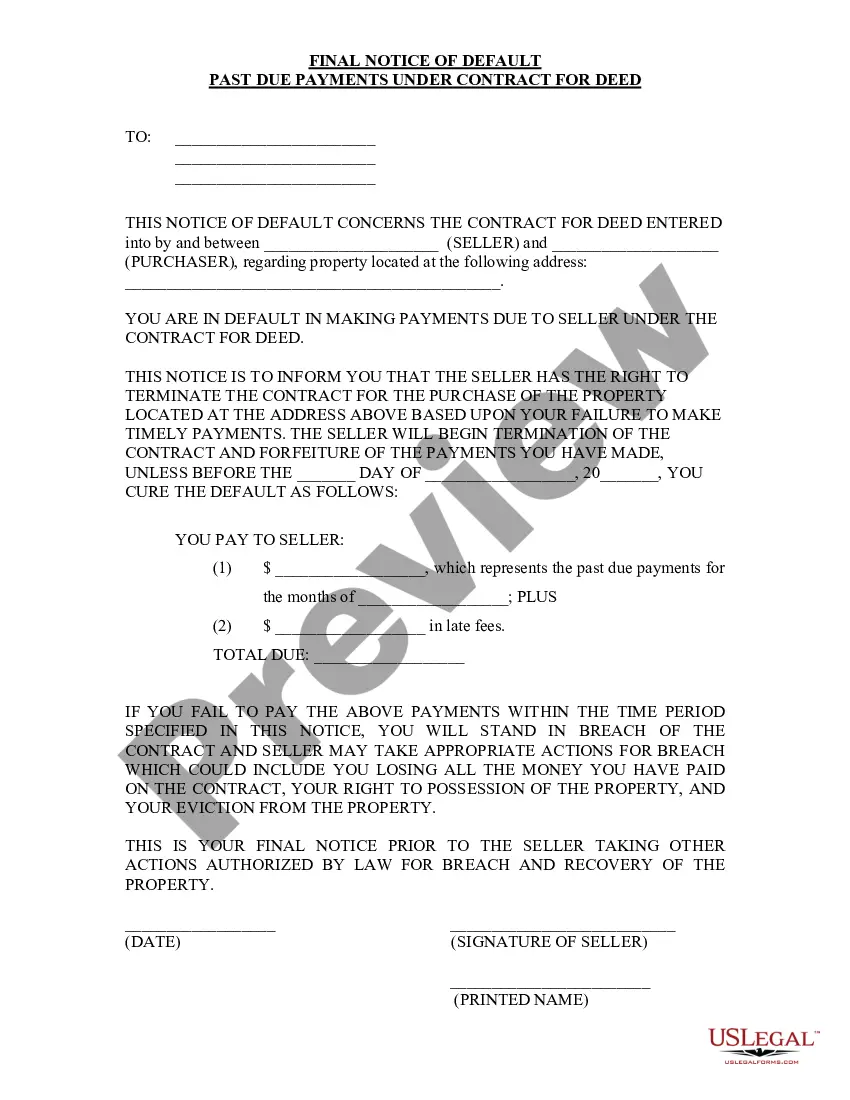

Los Angeles California Demand Letter — Repayment of Promissory Note A Los Angeles California Demand Letter for the repayment of a promissory note is a legally binding document sent by a lender to a borrower in Los Angeles, California, requesting the full repayment of a promissory note within a specified time frame. This letter is often used when the borrower has failed to make the agreed-upon payments or has defaulted on the promissory note. The purpose of the Los Angeles California Demand Letter is to formally demand the borrower to fulfill their financial obligation and repay the outstanding balance, including any accrued interest or late fees. It serves as a first step towards resolving the issue amicably and without involving a court. Key elements of a Los Angeles California Demand Letter for the repayment of a promissory note include: 1. Identification of the parties: The letter should clearly identify the lender and borrower, including their full legal names, addresses, and contact information. 2. Description of the promissory note: The letter should outline the details of the promissory note, including the amount borrowed, the agreed-upon interest rate, the repayment schedule, and any other relevant terms and conditions. 3. Notification of default: The letter should clearly state that the borrower is currently in default of the promissory note due to late or missed payments. 4. Demand for repayment: The letter should explicitly demand the borrower to repay the outstanding balance, specifying the exact amount owed and the deadline for repayment. 5. Consequences of non-compliance: The letter should inform the borrower of the potential legal consequences or further actions that may be taken if the repayment is not made within the specified time frame, such as filing a lawsuit or involving a debt collection agency. 6. Enclosures: If there are any supporting documents, such as copies of the promissory note, proof of payment, or correspondence related to the loan, they should be included with the demand letter. Different types of Los Angeles California Demand Letters for the repayment of a promissory note include: 1. First Demand Letter: The initial letter sent by the lender to the borrower, requesting repayment and outlining the consequences of non-compliance. 2. Follow-up Demand Letter: If the borrower fails to respond or comply with the first demand letter, a follow-up letter may be sent to emphasize the seriousness of the situation and the potential legal actions that may be taken. 3. Final Demand Letter: In some cases, a final demand letter may be sent as a last attempt to resolve the issue before pursuing legal action. This letter typically includes a final deadline for repayment and warns the borrower of the impending legal consequences. It is advisable to consult with a legal professional or an attorney experienced in debt collection and contract law to ensure compliance with California laws and to handle the process effectively.

Los Angeles California Demand Letter - Repayment of Promissory Note

Description

How to fill out Los Angeles California Demand Letter - Repayment Of Promissory Note?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life sphere, finding a Los Angeles Demand Letter - Repayment of Promissory Note suiting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. In addition to the Los Angeles Demand Letter - Repayment of Promissory Note, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Los Angeles Demand Letter - Repayment of Promissory Note:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Los Angeles Demand Letter - Repayment of Promissory Note.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Promissory notes have a statute of limitations. Depending on which U.S. state you live in, a written loan agreement may expire 315 years after creation.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Circumstances for Release of a Promissory Note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

There are two types of promissory notes often used to evidence a loan or debt. One type is referred to as demand promissory note because the note is payable at any time on demand by the lender.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

If you have an issue with a personal promissory note being unpaid and cannot come to an alternate agreement with your friend or family member that borrowed the money, legal intervention may be the only option. A local collection lawyer can help you attempt debt collection and file a lawsuit, if necessary.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.