Subject: Request for Nassau New York Client Pension Plan Account Statements Dear [Client's Name], I hope this letter finds you in good health. I am writing to kindly request your cooperation in providing us with the necessary account statements for your Nassau New York pension plan. As your trusted financial advisor, it is crucial for us to maintain accurate and up-to-date records of your retirement investments. Our firm understands the significance of comprehensive financial planning, which includes monitoring your pension plan's performance regularly. By assessing the statements, we can evaluate the health of your retirement savings and make informed decisions to optimize it further. To ensure that we have access to the most recent data regarding your pension account, we kindly urge you to furnish us with the following account statements: 1. Quarterly Statements: These official reports summarize your pension investment activity, including contributions, expenses, gains, and losses over the three-month period. Reviewing these statements will help us identify any irregularities or areas of improvement. 2. Annual Statements: This detailed summary provides a comprehensive overview of your pension plan's performance and contribution history throughout the year. By analyzing these reports, we can assess the long-term progress of your retirement funds and offer tailored advice accordingly. 3. Transaction Statements: These statements entail a record of specific transactions within your pension plan. It includes details such as deposits, withdrawals, trades, and any change in beneficiary information. Examining these documents is crucial for ensuring accurate tracking and tax reporting. We kindly request that you gather the aforementioned account statements from your Nassau New York pension plan provider. Once you have them in hand, please provide us with copies or electronic versions as per your convenience. You may choose to send the documents via email to [your email address] or mail them directly to [your business address]. Rest assured that all the provided information will be treated with the utmost confidentiality and will be used solely for the purpose of enhancing our financial planning services for your benefit. Should you have any questions or require assistance in obtaining these statements, please do not hesitate to contact our office at [your contact number] or via email. We are here to help you and guide you towards a secure financial future. Thank you for your attention to this matter. We greatly appreciate your prompt response and cooperation. Sincerely, [Your Name] [Your Position] [Your Firm's Name] [Contact Information]

Nassau New York Sample Letter Requesting Client Pension Plan Account Statements

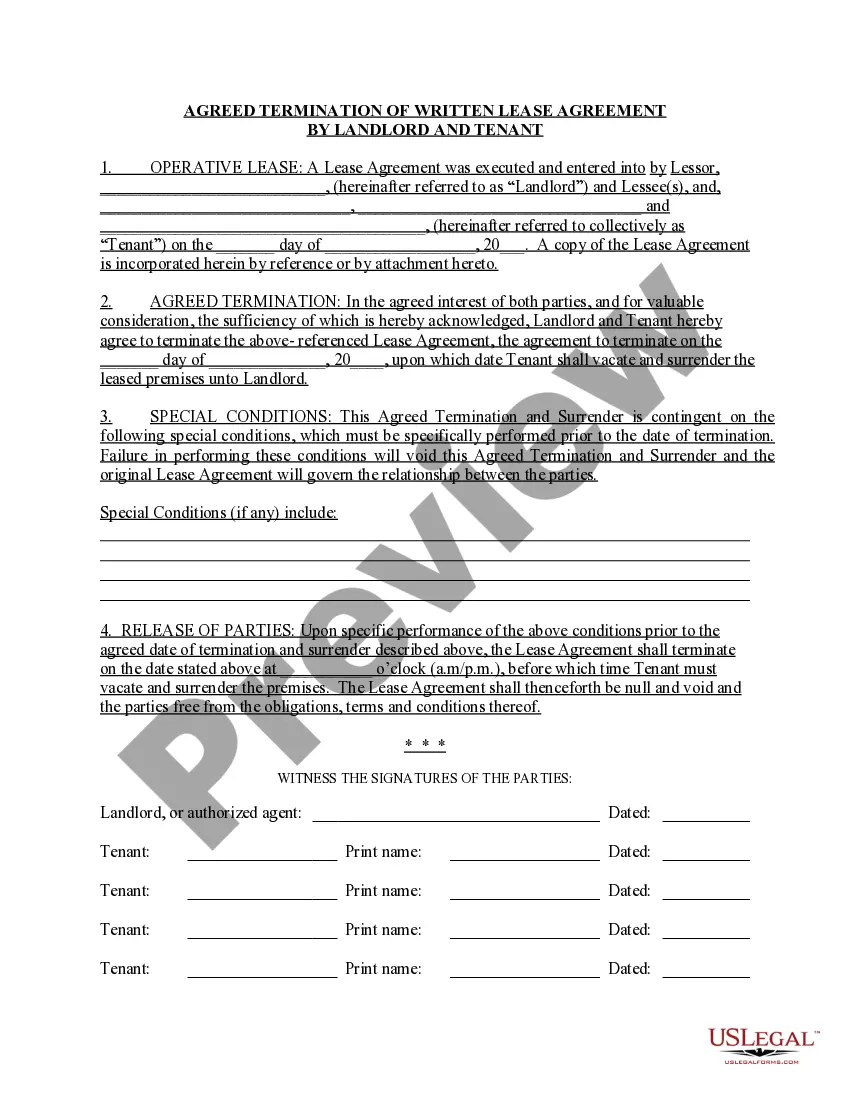

Description

How to fill out Nassau New York Sample Letter Requesting Client Pension Plan Account Statements?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Nassau Sample Letter Requesting Client Pension Plan Account Statements meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Nassau Sample Letter Requesting Client Pension Plan Account Statements, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Nassau Sample Letter Requesting Client Pension Plan Account Statements:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Nassau Sample Letter Requesting Client Pension Plan Account Statements.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Here's how to track down a pension from a former employer: Contact your former employer. Consider financial and insurance companies. Search at the Pension Benefit Guaranty Corporation. Collect the paperwork. Look into spousal payments. Make sure you are vested.

To request a new copy of Your Federal Retirement Benefits, or to receive a verification of your annuity, contact OPM's Retirement Office at 1-888-767-6738 or retire@opm.gov. The phone lines are open from am to pm (Eastern Standard Time).

If your pension is a defined contribution scheme, your provider must send you a statement telling you about your pot once a year. This will usually include the following information: the value of your pension pot at the start and end of the statement year.

Pension Paperwork If you have a pension at work, the details of the plan will be spelled out in the plan's Summary Plan Description. In addition, you should receive an Individual Benefit Statement that details the specific benefits that you have earned and are eligible for.

Your Annual Member Statement shows an accounting of your retirement-related work history as reported by your employer. Statements are typically available in late August. You should keep your statement with your personal records for future financial planning purposes.

A pension statement is an annual summary sent to you by your pension provider. It shows you how much money or benefits you have in your pension and, if your money is invested, how your investments are performing.

Sir, I request to state that I am due to retire from service wef202620262026202620262026my date of birth being2026202620262026.. I therefore request that steps may kindly be taken with a view to sanction pension and gratuity as admissible under CCS Rules. I desire to draw my pension from the office of DPDO2026202620262026202620262026 or20262026202620262026202620262026202620262026202620262026

The Pension Tracing Service is a free government service. It searches a database of more than 200,000 workplace and personal pension schemes to try to find the contact details you need.

If you need to replace your original award letter, you can request a copy by calling Social Security at 800-772-1213 or visiting your local SSA office.

A pension award letter is issued annually by the state or government agency detailing the pension benefits earned by an individual. Pension award letters are commonly used in the mortgage industry, especially for income verification.