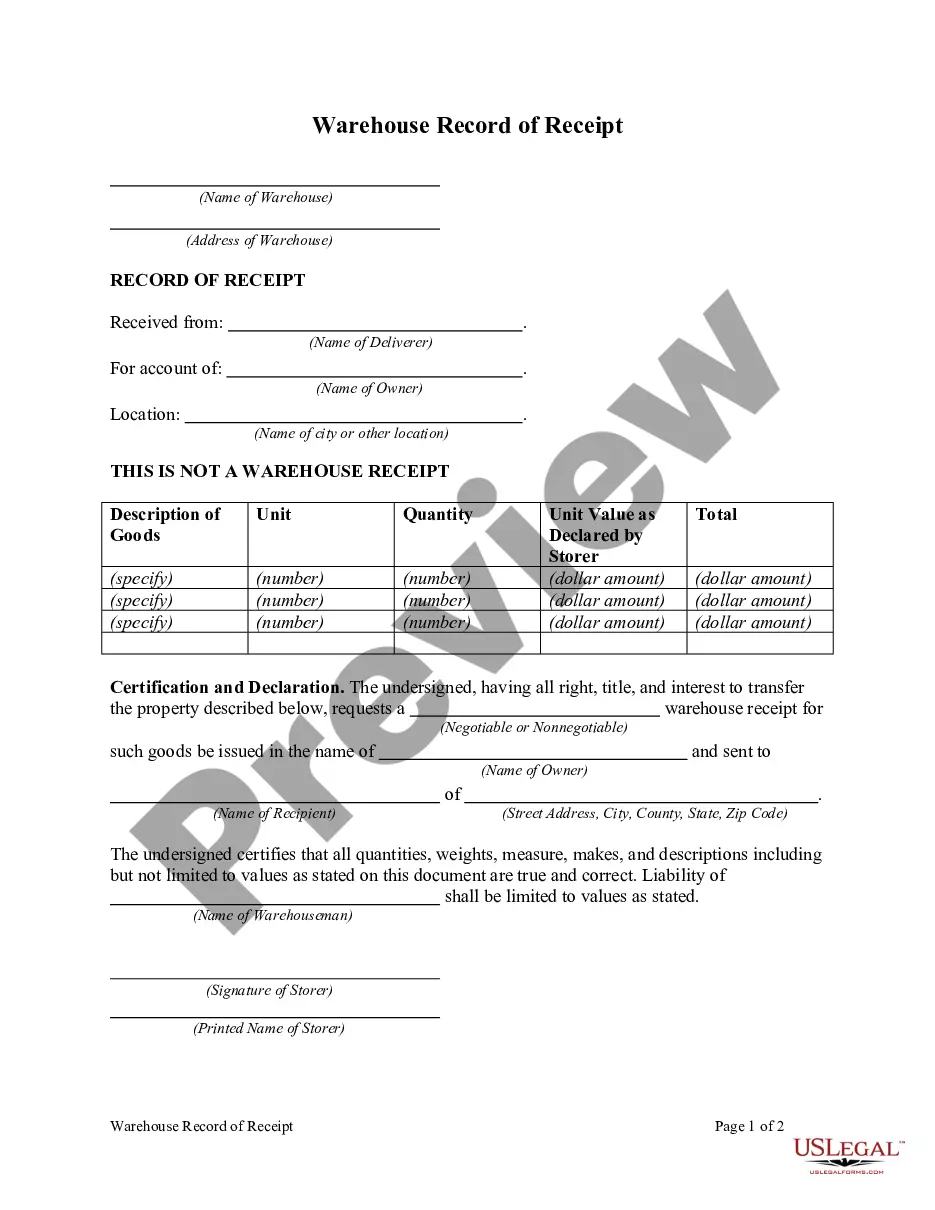

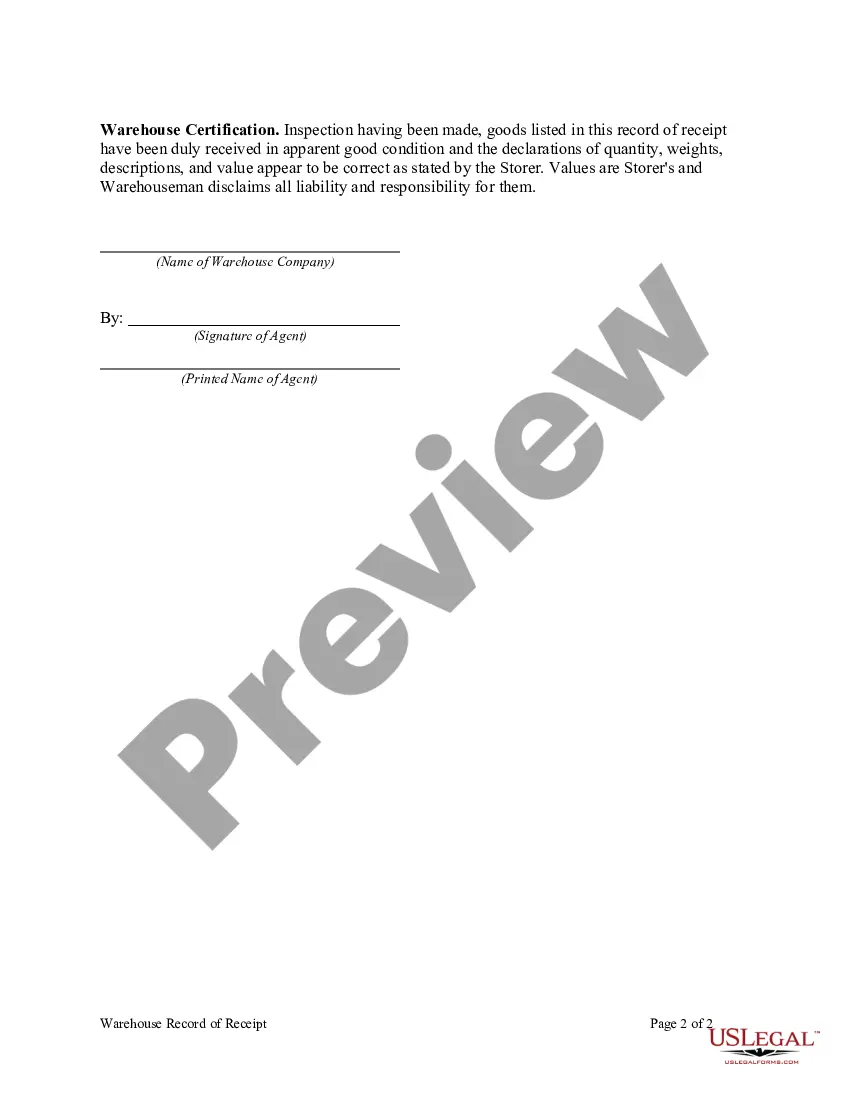

Hillsborough Florida Warehouse Record of Receipt

Description

How to fill out Warehouse Record Of Receipt?

Drafting legal documents is essential in the contemporary era.

However, seeking professional help to create some documents from the ground up, including the Hillsborough Warehouse Record of Receipt, isn't always required when utilizing a service like US Legal Forms.

US Legal Forms offers more than 85,000 documents to select from across various categories, ranging from living wills to real estate documents to divorce agreements.

Choose the pricing {plan, followed by the desired payment method, and purchase the Hillsborough Warehouse Record of Receipt.

Opt to save the document template in any available format. Visit the My documents section to re-download the file.

- All documents are categorized by their applicable state, simplifying the search process.

- You can also access comprehensive resources and guides on the site to facilitate any tasks related to document creation.

- Here’s how to acquire and download the Hillsborough Warehouse Record of Receipt.

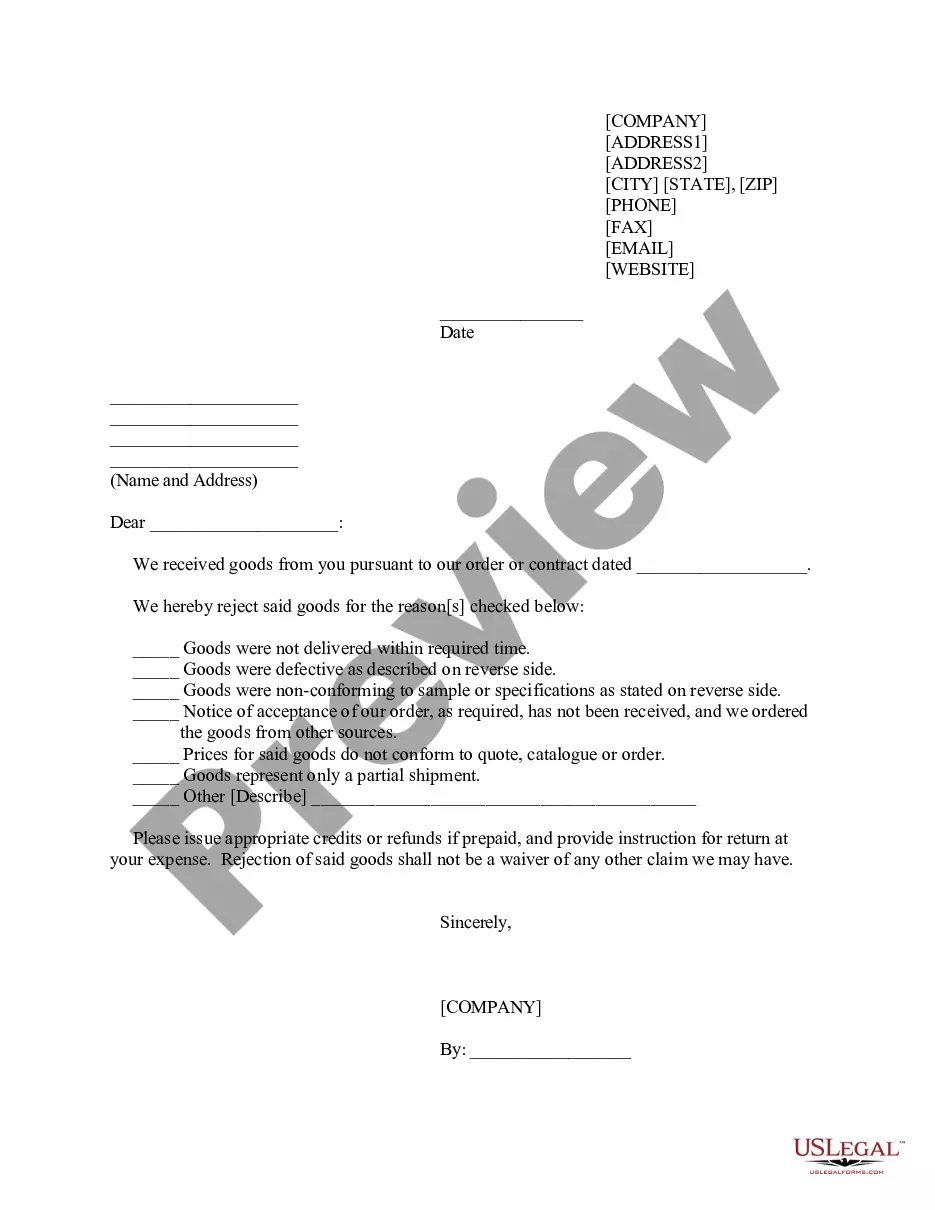

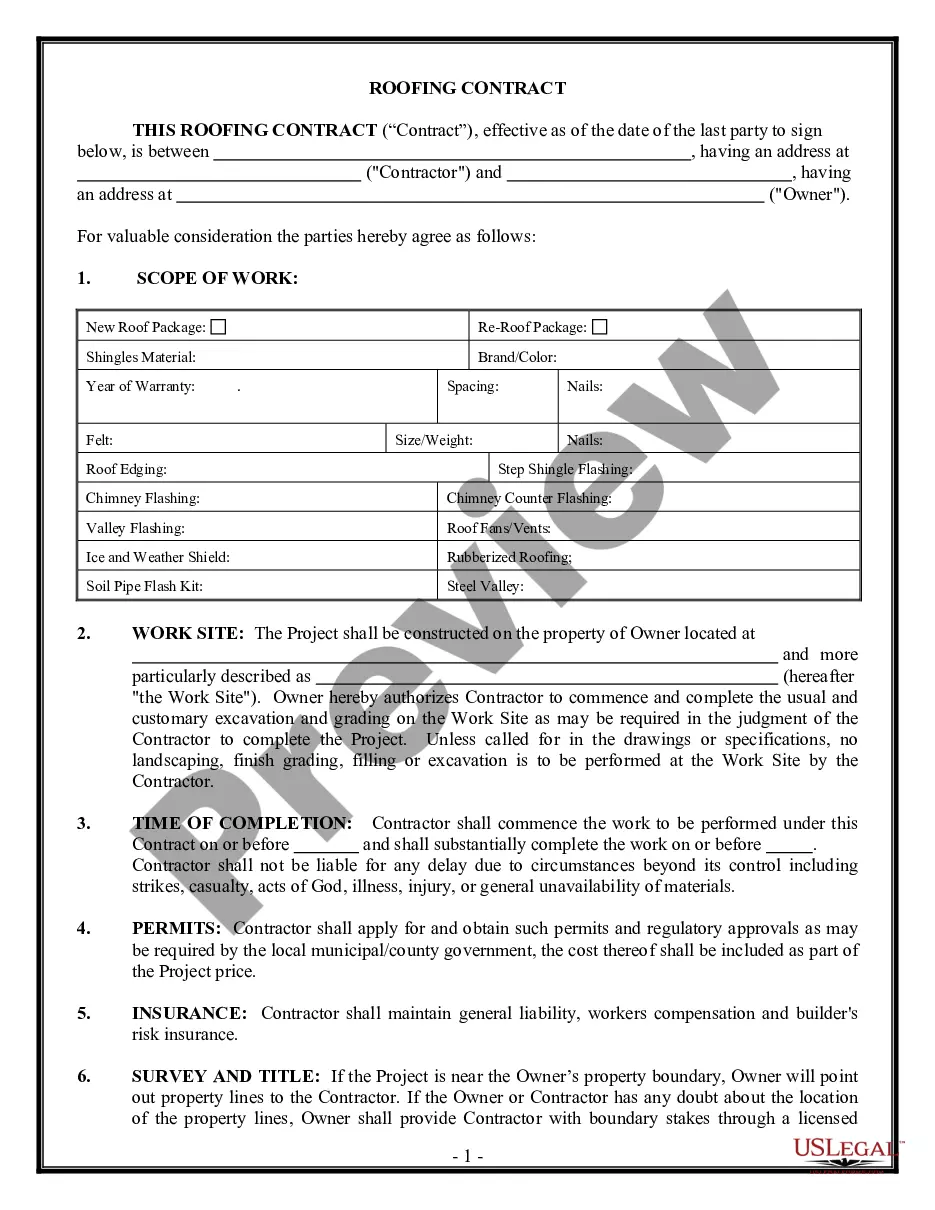

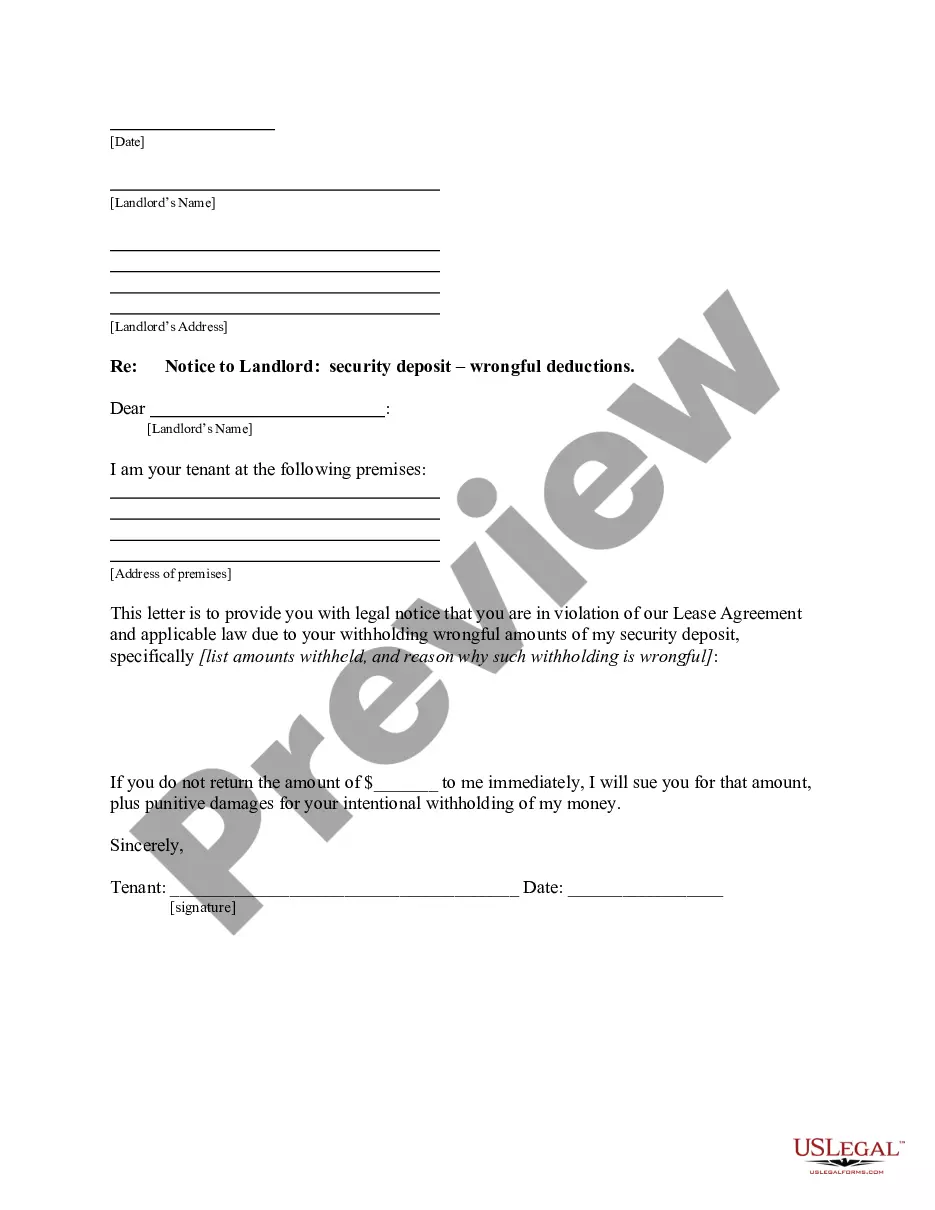

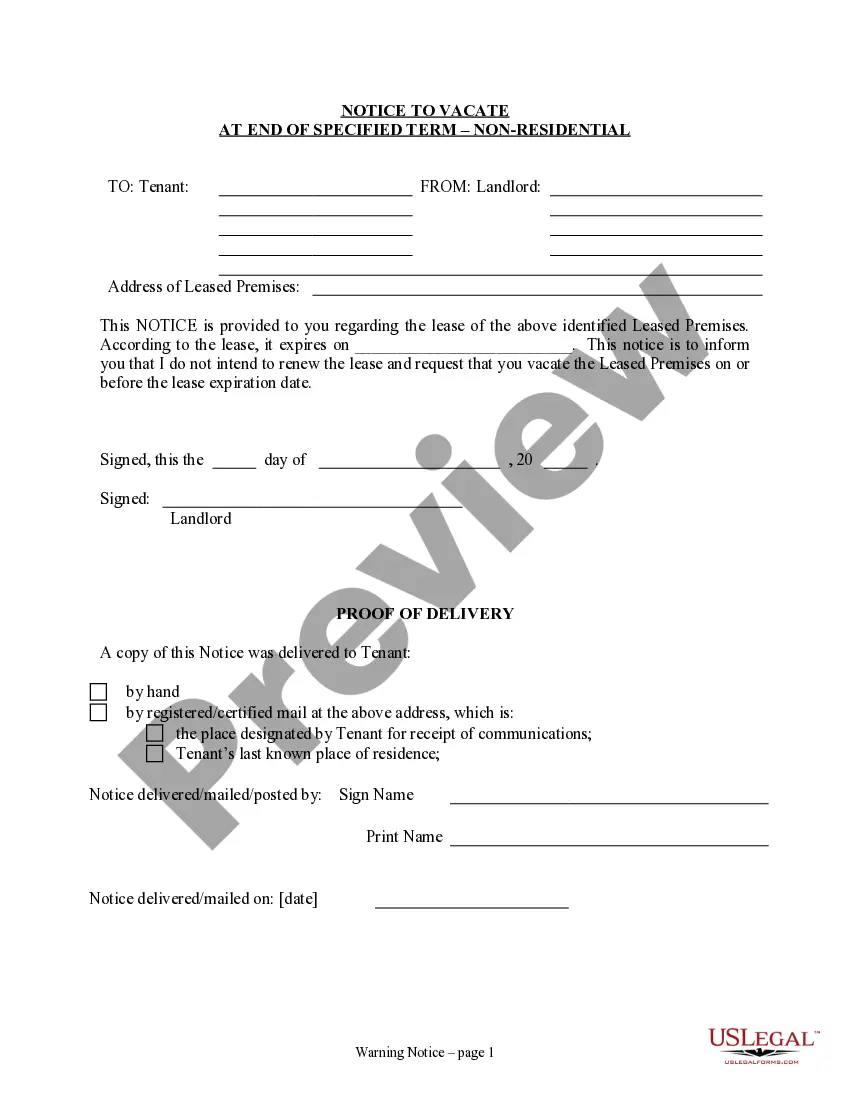

- Review the preview and outline of the document (if present) to understand what you'll receive after obtaining the form.

- Ensure that the document you select is tailored to your specific state/county/area, as state laws can influence the legitimacy of certain records.

- Look over related document templates or redo your search to locate the correct file.

- Click Buy now and create your account. If you already possess one, choose to sign in.

Form popularity

FAQ

(b) Any person who conducts more than two garage sales in a six-month period shall secure a business tax receipt from the Tax Collector of Hillsborough County in the manner prescribed in Section 46-163 and shall pay to the Tax Collector a business tax of $30.00.

The above documents and payment can be electronically recorded using an e-Recording vendor (see e-Recording Services FAQ above), mailed to Hillsborough County Clerk of Court Official Records, PO Box 3249, Tampa FL 33602-3249, or recorded in person at our Official Records service locations.

Obtaining General Business Licenses. In Florida, you will need a general business license, called a business tax receipt, if you provide goods and/or services to the general public whether you are operating your new business at home or in a separate commercial location.

(b) Any person who conducts more than two garage sales in a six-month period shall secure a business tax receipt from the Tax Collector of Hillsborough County in the manner prescribed in Section 46-163 and shall pay to the Tax Collector a business tax of $30.00.

Download the Declaration of Domicile form, which must be submitted to the Clerk for recording, along with a check for the recording fee of $10 made payable to "Clerk of the Circuit Court" and either mailed to Clerk of Court & Comptroller, PO Box 3249, Tampa FL 33601-3249 or submitted in person at Room 140, 401 Pierce

The Clerk of Court is responsible for recording and maintaining real property records in Hillsborough County.

Recording fees are $10.00 for the first page and $8.50 for each additional page of the document. The first four names are free; any additional names are $1.00 per name. If you are unsure if documentary stamp taxes are due, please contact the Florida Department of Revenue at (850) 488-6800 for assistance.

How much does a Local Business Tax Receipt cost? Fees are based on your type of business, and range from $27 to $150. Some categories determine the fee by the number of employees, number of seats, number of merchandise machines, rooms, units, etc.

70 per $100 (or portion thereof) on documents that transfer interest in Florida real property, such as warranty deeds and quit claim deeds. This tax is based on the sale, consideration or transfer amount and is usually paid to the Clerk of Court when the document is recorded.

The cost of a business tax is $190.30 for each type of business....Business Tax Receipt Fees. ClassificationFeesPeddlers of Merchandise - Not otherwise enumerated specifically herein$30.8218 more rows